Moody’s Investors Service has warned the rapidly expanding ETF market could be exposed during periods of evaporating liquidity.

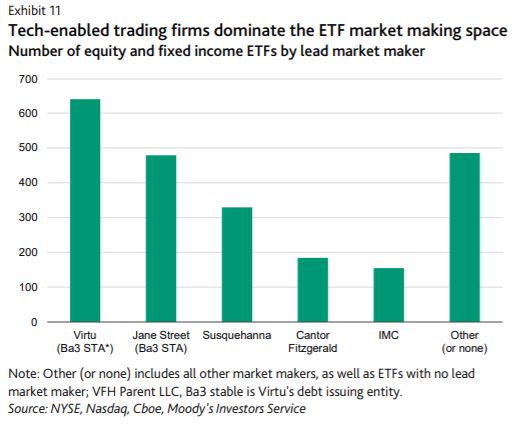

In a report, entitled ETFs track liquidity risk on top of asset performance, Moody’s said the shift in market making practices since the Global Financial Crisis had become a major concern, with banks becoming less involved due to the stricter regulation imposed since the crash.

Instead, the majority of ETF market making, the report said, is being handled by less regulated, technologically advanced trading firms, which continue to disrupt primary and secondary markets by experimenting with new models for liquidity provision.

Therefore, Moody’s warned ETF liquidity risk, especially in less liquid parts of the market, is “heightened” due to the declining inventories at the banks and is further “amplified” by the trading being made by new entrants “with rapidly turning balance sheets”.

The ETF market’s rapid growth from $600bn to over $5trn assets under management globally has been in line with one of the longest bull markets in history and is yet to be tested in a prolonged period of volatility.

Market makers are rewarded through arbitrage but are also exposed to market, liquidity and operational risks. These risks could in turn heighten systemic risk, a credit negative for market participants, Moody’s said.

In the event of a liquidity drought, the report predicted, market makers would likely reflect this risk when providing ETF quotes, meaning “ETFs track not only the performance of their underlying assets, but also the liquidity of these assets”.

Fabi Abdel Massih, assistant vice president analyst at Moody’s and author of the report, commented: “Therefore, ETFs targeting illiquid instruments, such as corporate bonds and leveraged loans, would present greater risks, and investors trading on the premise that ETFs are more liquid than their baskets may find that results fall short of expectations in a stressed environment.”

“Investors may have particular liquidity expectations for their ETF holdings, but not all ETFs have the same liquidity profile,” he continued. “A stress event could diminish the amount of standing orders at various prices and reduce the perceived liquidity of the ETF market, even when ETFs are operating as designed.”

However, the report did add the move from traditional transactions over the phone in the fixed income markets has started to be replaced by electronic trading over the last five, which will improve the liquidity of fixed income markets and the ETF ecosystem as a whole.

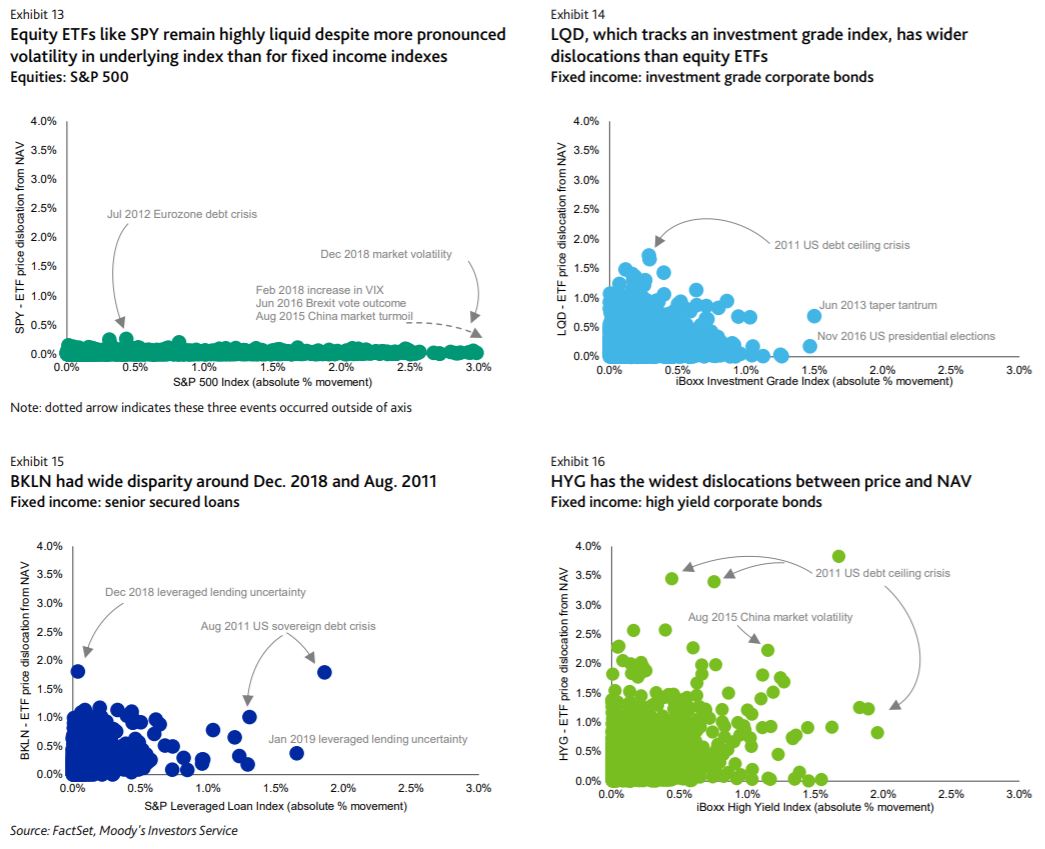

Exhibits 13 to 16 below compare liquidity measures of four ETFs, as represented by their price dislocation from net asset value (NAV), with absolute movement in the underlying index