Last year saw a big sector shake-up by S&P and MSCI. The biggest change came from S&P Global - moving companies such as Facebook, Twitter and Alphabet (Google) from the IT sector to a new communications sector. But despite the changes, the technology sector has continued to perform well.

In fact, the technology space is one of the best performing year to date and there are a number of ETFs that can give you exposure.

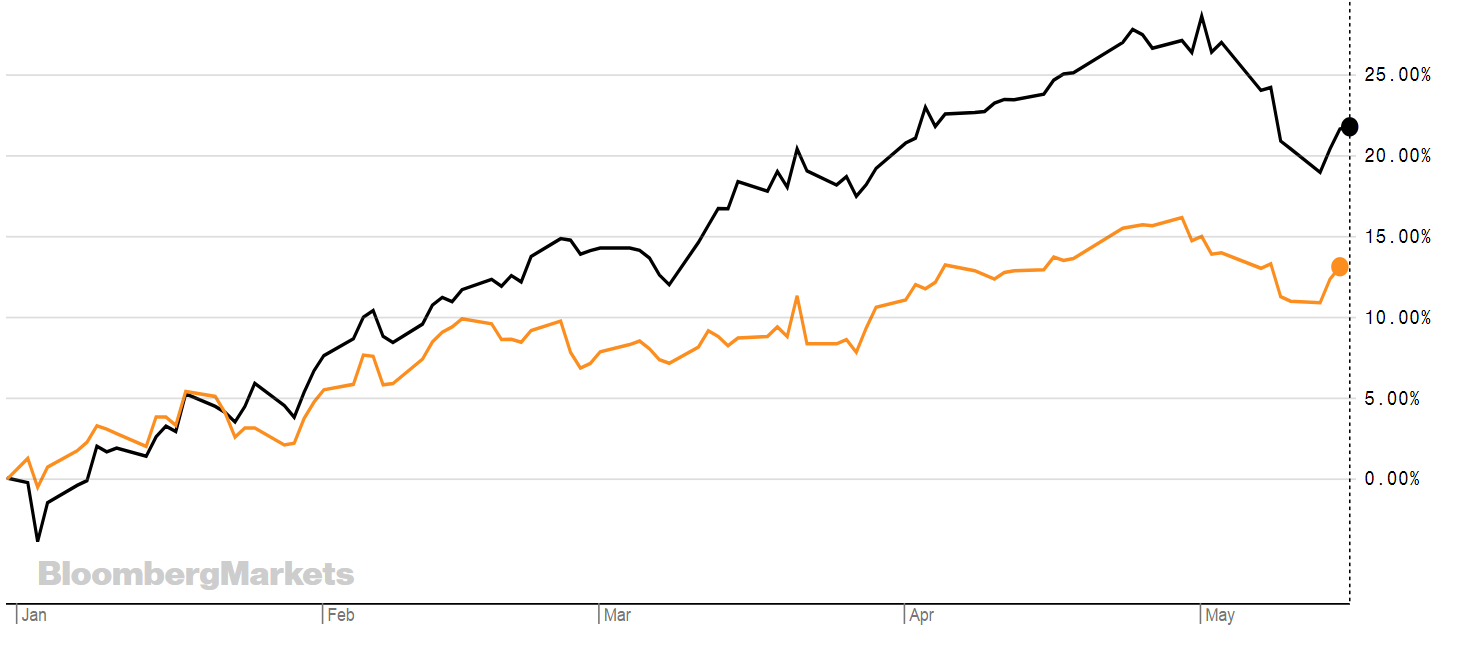

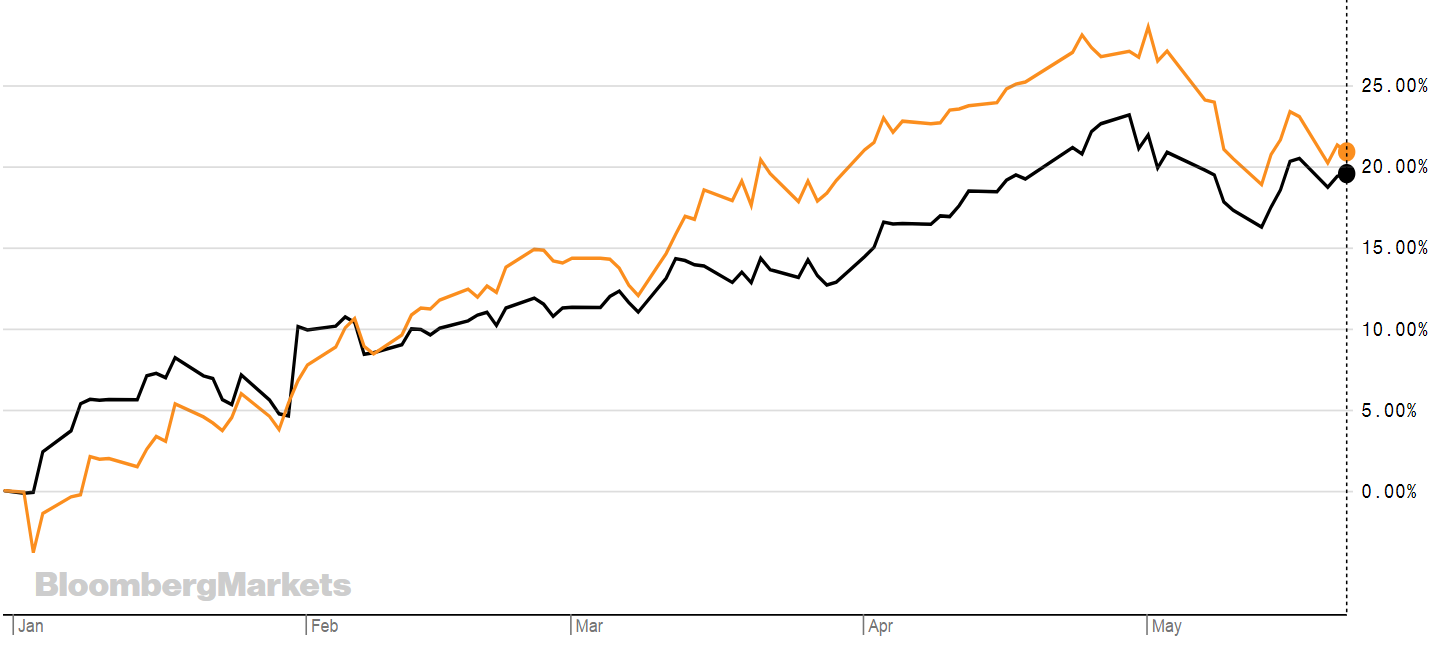

The chart below shows Invesco’s US technology S&P US Select Sector UCITS ETF (XLKS) which has returned 21.75% year-to-date (in black) and costs 0.14%, and Invesco’s S&P 500 ETF (SPXS) (in orange), which has returned 14.53% and has a TER of 0.05%.

Source: Bloomberg

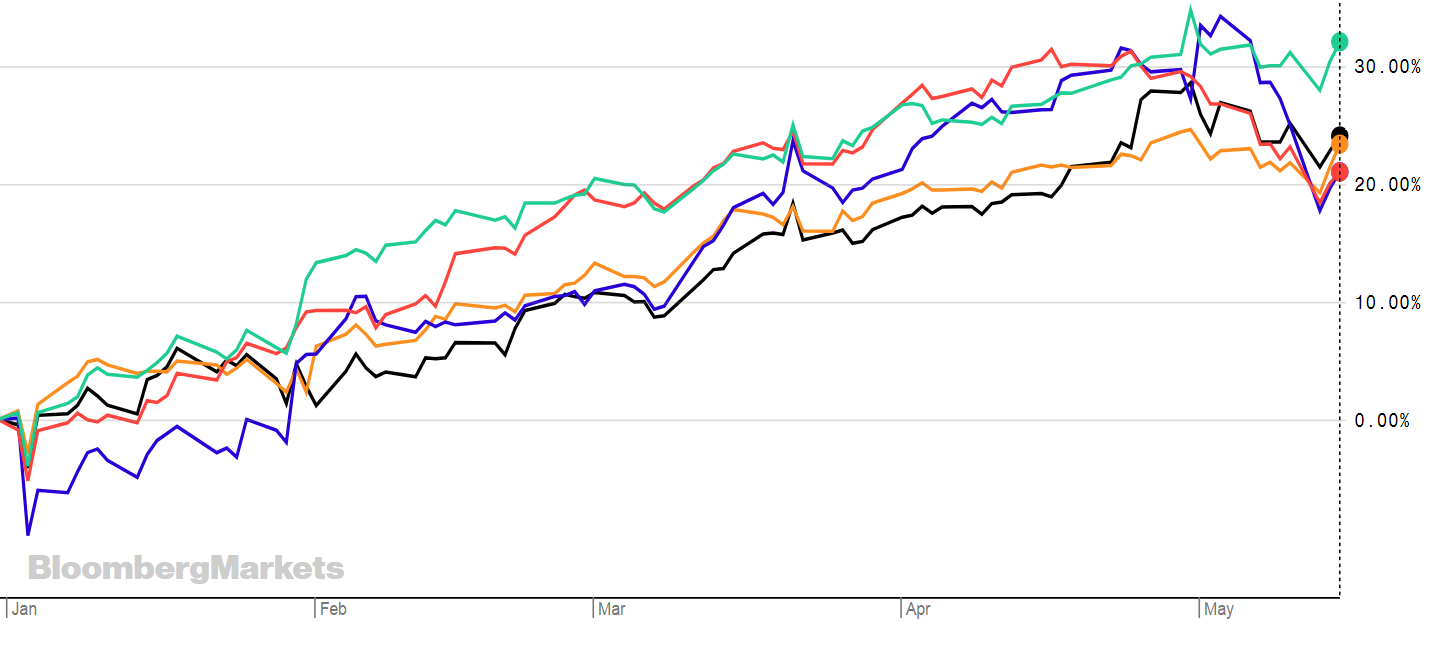

Invesco’s XLKS top ten constituents are still some of the industry giants: Microsoft, Apple, Visa, Cisco, Mastercard, Intel, Oracle, Adobe, Paypal Holdings and Salesforce. Individually these stocks have performed well with the top five stocks shown below.

Source: Bloomberg

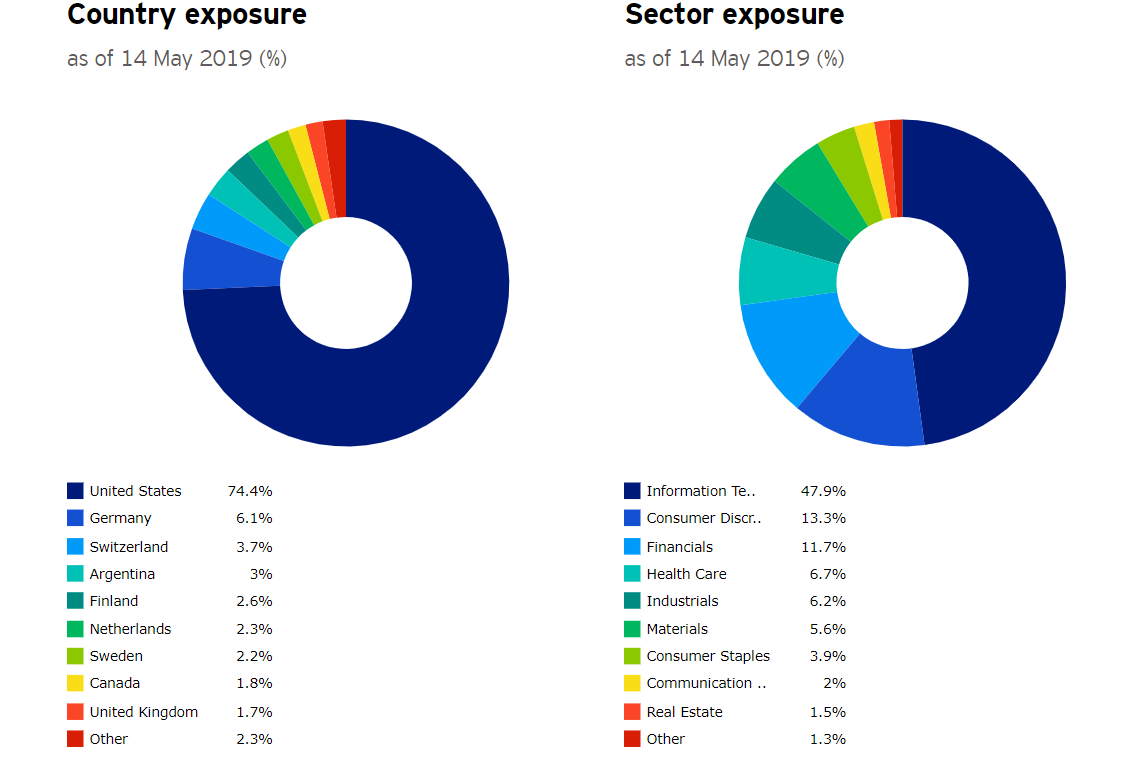

The below chart from Invesco also shows the breakdown of exposures.

Source: Invesco

While the performance of the technology sector is one thing, it has also outperformed the newly created communications sector.

Below is iShares S&P 500 Information Technology Sector UCITS ETF (IUIT), which costs 0.15% and tracks the S&P 500 Information Technology Sector (it has the same top ten holdings as Invesco’s XLKS) in orange. And Invesco’s Communications S&P US Select Sector UCITS ETF (XLCS) in black, which costs 0.14% and tracks the S&P Select Sector Capped 20% (Communications) Net Total Return Index.

XLCS has a YTD return of 19.61% and its top five holdings are Facebook, Verizon Communications, AT&T, Alphabet and Alphabet. Even with these heavyweights accounting for the largest holdings it still hasn’t performed as well as technology.

But, will the trend continue?

According to a note from BlackRock reported in ETF Trends. Most probably.

“We remain overweight U.S. equities, and one of our favoured sectors is technology. Even with strong performance this year, we believe the sector remains appealing,” according to BlackRock. “Technology firms tend to have strong balance sheets and healthy earnings trends, as well as enjoying support from longer-term trends. These are all attractive qualities in a late economic cycle. Furthermore, tech stocks have historically fared well through various yield curve regimes.”

While these ETFs focus on the US tech sector, around the world there is a similar story.

SPDR’s MSCI World Technology UCITS ETF has returned 21.65% YTD. It tracks the MSCI World Technology Index. This has similar holdings to the iShares and Invesco ETFs, but with a few exceptions such as German software corporation SAP and American software solution provider Broadcom.

In Europe there have also been good returns. SPDR’s MSCI Europe Technology UCITS ETF has returned 20.79% YTD and tracks the MSCI Europe Information Technology Index.

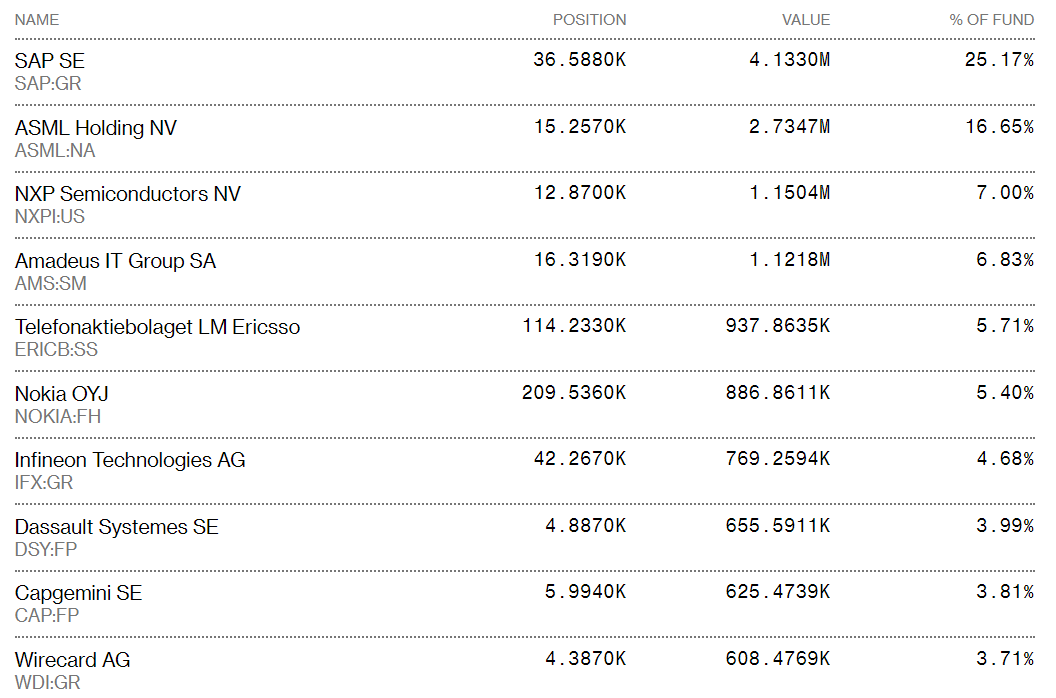

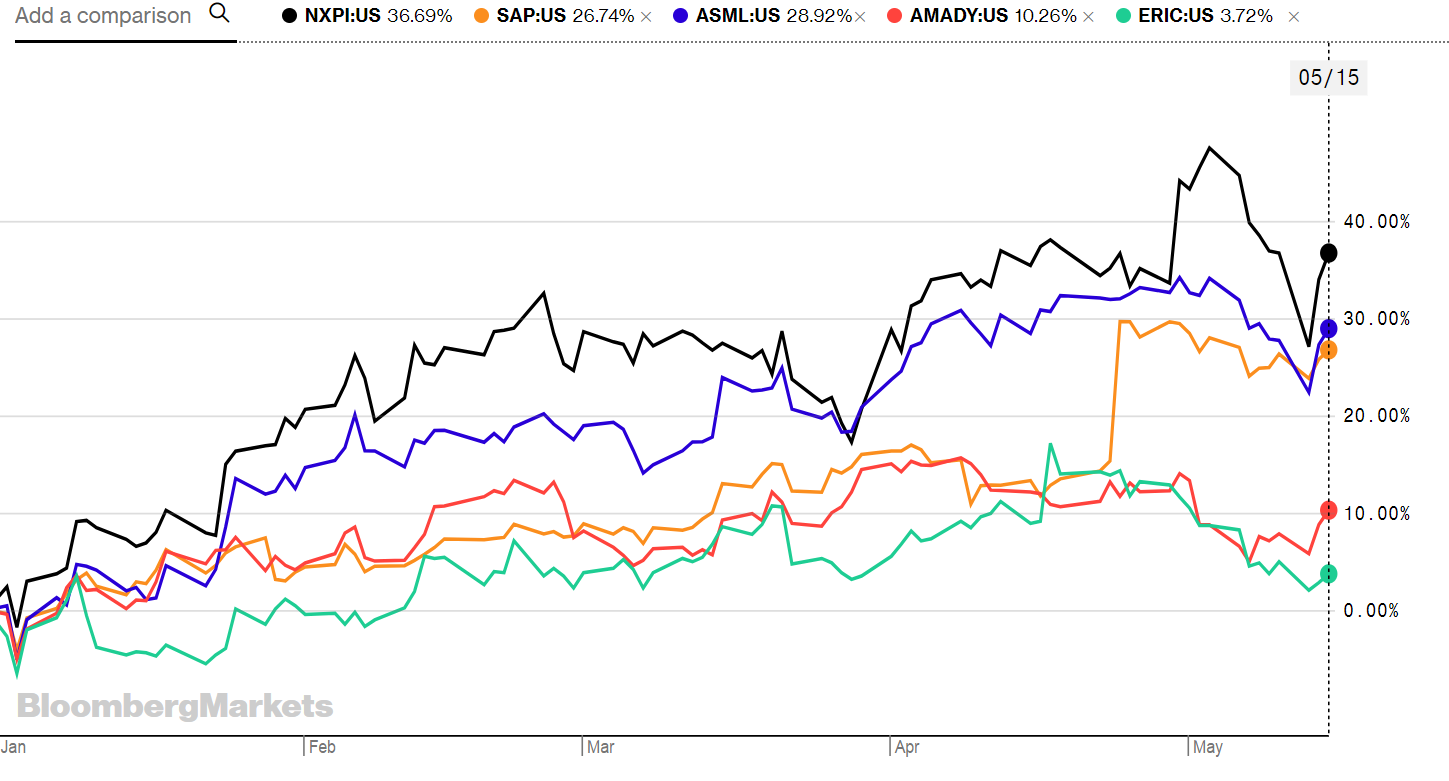

The holdings are completely different to that seen in the US and World ETFs. See the table below.

The top five holdings – shown below – have more erratic performance than that seen in the World and US tech indices.

And despite the positive outlook for tech stocks, there are some things worth noting.

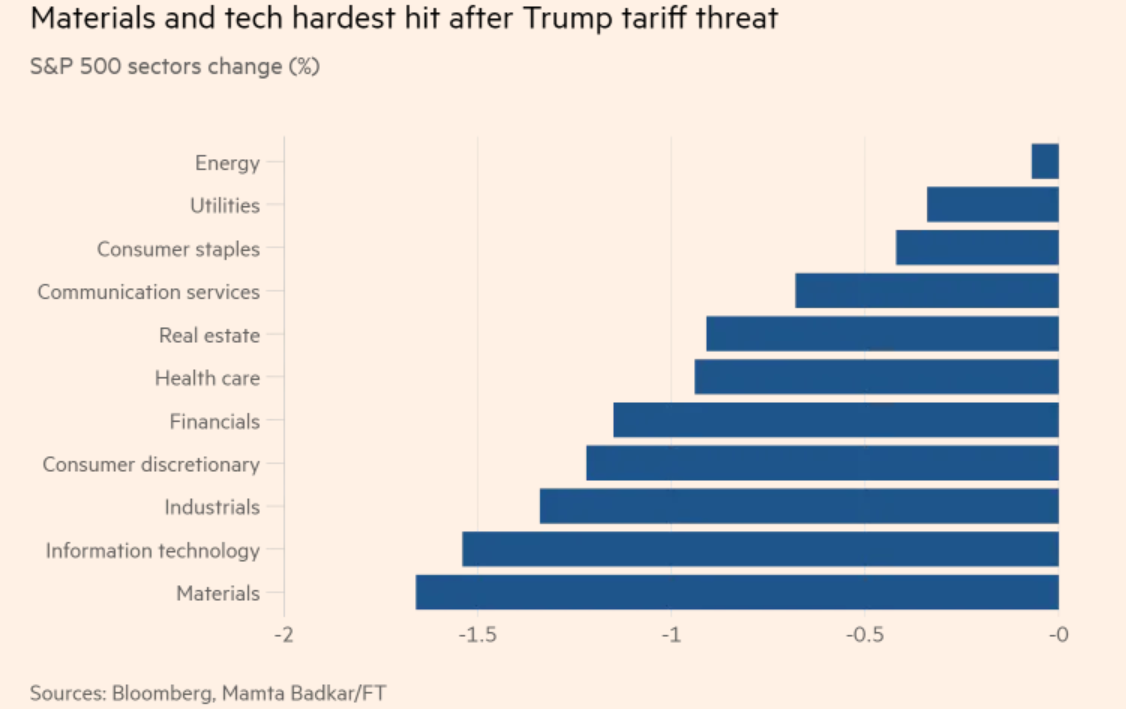

The FT reported earlier this month that information technology was likely to be one of the hardest hit from Trump’s tariff threats. The chart below from the FT highlights this.

Source: The FT

If you still want access, there are a number of ETFs on the London Stock Exchange offering it. We list a number of these below with their performance YTD.

RTN

XLKS

XDWT

Expense Ratio: 0.3%

IITU

IUIT

SXLK

XLKQ

WTEC

ITEC

TNOW

TNOG

ETFYTD TERINDEXInvesco Technology S&P US Select Sector UCITS ETF21.75%0.14%S&P Select Sector Capped 20% (Technology) Net Total Return IndexXtrackers MSCI World Information Technology UCITS ETF22.18%M/ment fee: 0.15%MSCI World Information Technology Net Total Return IndexiShares S&P 500 Information Technology Sector UCITS ETF22.04%0.15%S&P 500 Information Technology IndexiShares S&P 500 Information Technology Sector UCITS ETF22.35%0.15%S&P 500 Information Technology IndexSPDR S&P U.S. Technology Select Sector UCITS ETF21.89%0.15%The fund's objective is to track the performance of large sized U.S. tinformation technology and telecommunication services companies in the S&P 500 IndexInvesco Technology S&P US Select Sector UCITS ETF20.96%0.14% S&P Select Sector Capped 20% (Technology) Net Total Return IndexSPDR MSCI World Technology UCITS ETF21.65%0.30%MSCI World TechnologySPDR MSCI Europe Technology UCITS ETF20.79%0.30%MSCI Europe Information Technology Index.Lyxor MSCI World Information Technology TR UCITS ETF21.44%0.30%MSCI World Information Technology TRN index.Lyxor MSCI World Information Technology TR UCITS ETF20.73%0.30%MSCI World Information Technology TRN index.