Two recent news snippets about where new ETF flows have been heading in recent months suggest the enthusiasm for smart beta products is on the rise.

Indeed it might be argued that smart beta is proving its worth as a technology, particularly for investors seeking a defensive posture in a time of increasing nervousness.

First, during a recent mid-year review hosted by State Street Global Advsers (SSGA), the head of research for SPDR ETFs in the EMEA region Antoine Lesné showed how in terms of equities it was smart beta that was attracting investor money.

Within that, it was the defensive factors of low volatility, quality and dividend which had proved most popular.

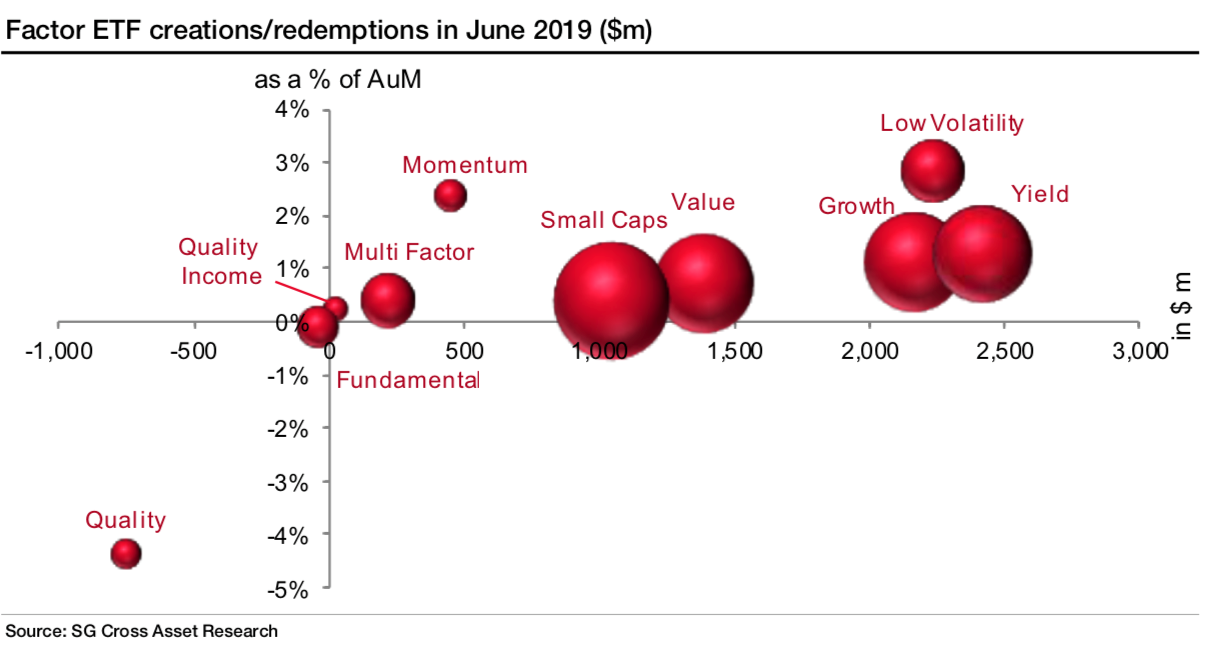

Hot on the heels of the SSGA data came the latest market analysis from the team at SG which pointed out that in June more than 50% of creations came via factor and style investment ETFs with value and low volatility being among the most popular.

To confuse matters slightly, the growth factor was also popular while the SG team found that quality “posted the worst month ever”.

Chart: Factor ETF creations/redemptions in June 2019 ($m)

Defensive posturing

“Investors indeed look to smart beta for capital protection, which was apparent in the first quarter 2019 as they positioned themselves defensively after having lost money in 2018 across asset classes,” says Nicolas Rabener, managing director at FactorResearch.

“The most popular smart beta categories were quality and low volatility ETFs, which experienced significant inflows.”

However, there is a fly in this particular ointment. Smart beta ETFs are, of course, simply indices with factor tilts. “They do not provide any meaningful capital protection,” says Rabener. “If markets decline significantly, so do these strategies.”

Moreover, in particular with low volatility ETFs and quality there are certain scenarios where they underperform markets.

“Quality is typically defined as companies that are highly profitable and lowly levered, which currently results in a large bias towards technology stocks as they feature these characteristics,” says Rabener. “If the tech sector corrects, then quality stocks will likely underperform the market.”

Similarly, he says, low volatility stocks are typically derived from more unexciting sectors such as real estate and utilities which are both very sensitive to interest rate changes due to the leverage involved in each.

“If bond and equity markets correct simultaneously, then low volatility ETFs might not provide the capital protection that investors associate them with.”

Similarly making the point about low volatility, James McManus, investment manager and head of ETF research at Nutmeg, points to a study from 2016 by Driessen, Kuiper and Beilo which found that interest rate moves explain up to 80% of unexplained excess return for low volatility. “In a stressed market environment, understanding this relationship may be crucial,” says McManus.

“Investors should not be of the view that these strategies provide a guaranteed solution to a complex problem – volatility dynamics in markets change over time, and it is important to understand the strategies are weighted based on past volatility behaviour.”

Focus on factors

Complexity abounds, of course. McManus says that most single-factor ETF products do not offer a pure factor exposure. “They also contain underweights and overweights to other factors,” he points out. “For example, US quality contains an overweight to momentum factor, whilst being underweight low volatility, size and value.”

“Before utilising factors, investors should seek to understand their existing factor exposure,” he adds. “UK equity investors are typically exposed to higher low volatility factor than they might expect for example. Understanding your existing factor exposure is critical to effectively introducing factor strategies to your portfolio.”

Then there is the issue of market timing. “Factor investing requires a longer-term time frame, and most experts agree that timing factors in the short-term is incredibly difficult,” says McManus.

ETF providers in smart beta catch 22

Peter Sleep, senior portfolio manager at 7IM, meanwhile, says that smart beta “can be good in soft markets” but you need to do your homework before you take a plunge.

“Trying to predict how smart beta strategies will behave can be trying to predict the outcome of the Eurovision song contest,” he adds. “It is anyone’s guess who will win but you know that Cyprus will give Greece a dozen points.”

As Sleep points out, factors such as low-beta and quality are “designed” to outperform in nervous markets. “Also low correlation or maximum diversification strategies will also probably do well,” he adds. “What you save on the downside though you may well lose relatively on any bounce back, but over the cycle you will hope for a better Sharpe ratio than the market.”

But do they provide certainty of protection even when markets are tumbling? He says not, adding that if the ETF sector is to provide products along these lines then there is work to do.

“From our perspective, the ETF market lacks strategies that offer capital protection via short positions in the portfolio,” he says. “Further product innovation is required.” More time spent working the spreadsheets then.

ETF Insight is a new series brought to you by ETF Stream. Each week, we shine a light on the key issues from across the European ETF industry, analysing and interpreting the latest trends in the space. For last week’s insight, click here.