Institutions hoping to take advantage of an apparent valuation gap between low volatility stocks in emerging markets versus their peers in Europe and the US might struggle to identify the necessary funds set, according to research from Style Analytics.

In research released last week, Bernie Nelson, president of North America at Style Analytics, showed how low volatility stocks in emerging markets were much cheaper compared with their recent history.

In comparison, in both the US and Europe low vol stocks were more expensive than in most of their history. Nelson said that, according to Style Analytics’ historic analysis, this valuation for low vol stocks would point to potential underperformance of around 2% per annum over the next five years.

However, once this gap has been identified Nelson suggested that institutions looking at undertaking their quarterly rebalance to implement a strategy to take advantage of this gap will need to “make sure [they] know what the actual opportunity set of funds is” given some of the funds don’t appear to have either low vol or defensive in their names.

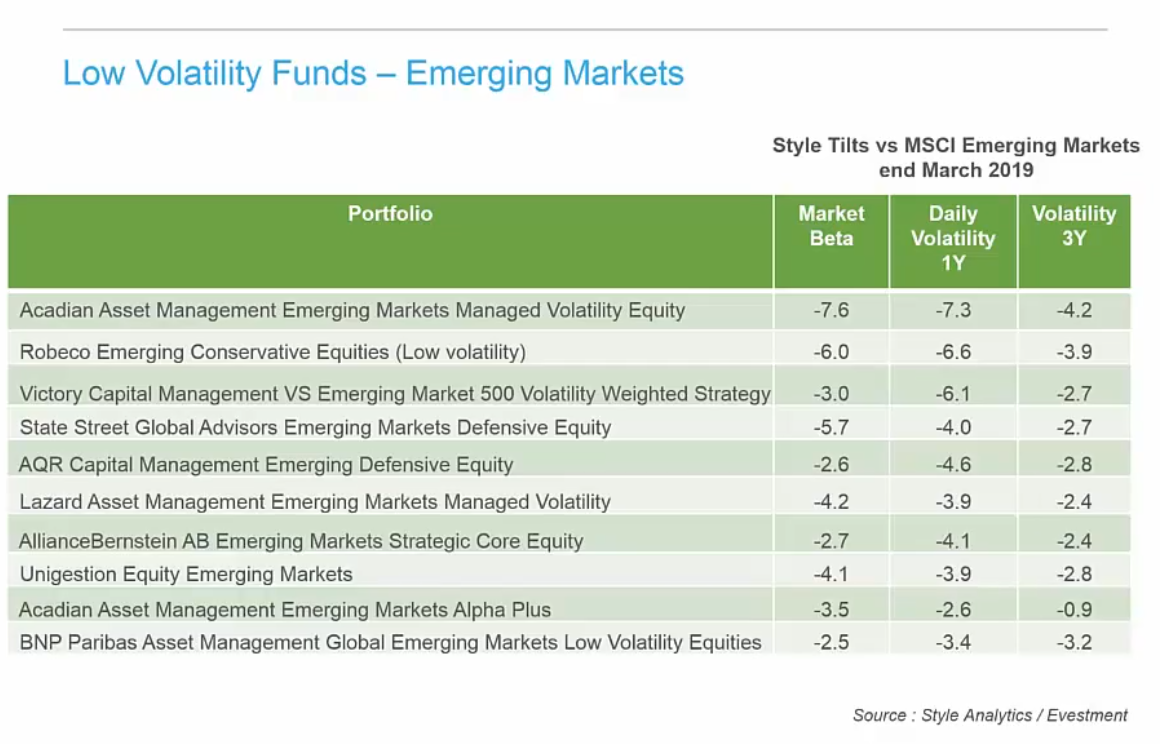

Looking at eVestment's Global Emerging Market universe of funds, Style Analytics identified a top 10 of funds which displayed the strongest style score for low vol from a set of 291 funds.

However, of the 10 only seven had either low vol of defensive in their names.

As can be seen, the Alliance Bernstein AB Emerging Markets Strategic Core Equity, Unigestion Equity Emerging Markets and the Acadian Asset Management Emerging Markets Alpha Plus had either defensive of low vol in their names.

Nelson said this finding was interesting: "Of course you would also want to examine what else you’re getting with these funds in terms of other factor orientations, or sectors, countries, risk, and so on, but the point is that if you want to implement a style or factor-based investment solution you really need to make sure you know what the actual opportunity set of funds is for those styles or factors."

Warning signs

The valuation gap between the US and Europe and emerging markets has opened up has as the market has entered what Nelson called the “late stage of a stretched cycle” with defensive actions on the part of investors coming to the fore.

In the US, while value stocks have continued to underperform, the strength in growth stocks has come mostly from strong dividend growers such as Microsoft, Walt Disney, Visa, and JP Morgan.

“Despite the market strength, there has actually been a defensive undercurrent towards low volatility along with investors seeking reassurance from larger companies with demonstrated evidence of historic dividend growth,” he said.

A similar move towards high-quality stocks has occurred in Europe. “This quality underpinning has been a strong theme year to date now and likely reflects a defensive sentiment as uncertainties continue around Brexit, UK leadership as well as political concerns elsewhere in Europe,” said Nelson.

However, while low vol stocks have become expensive in the US and Europe, in emerging markets a different dynamic is playing out.

“Here we can see that while the same overall relationship has held between valuation and subsequent performance as in Europe and as in the US, in emerging markets the current valuation of low volatility is cheaper than the market, and in fact it has only been cheaper than this 13% of the time over the past 30 years,” he said.

“Again, using this specific period as a guide, this suggests a subsequent outperformance from low vol in emerging markets of over 2% per annum over the next five years.”

In comparison, low volatility in the US is currently more expensive than in 98% of its history. “If we use the past as a guide – which is a big assumption of course - this current valuation would predict a market underperformance of around 2% per annum over the next five years.”

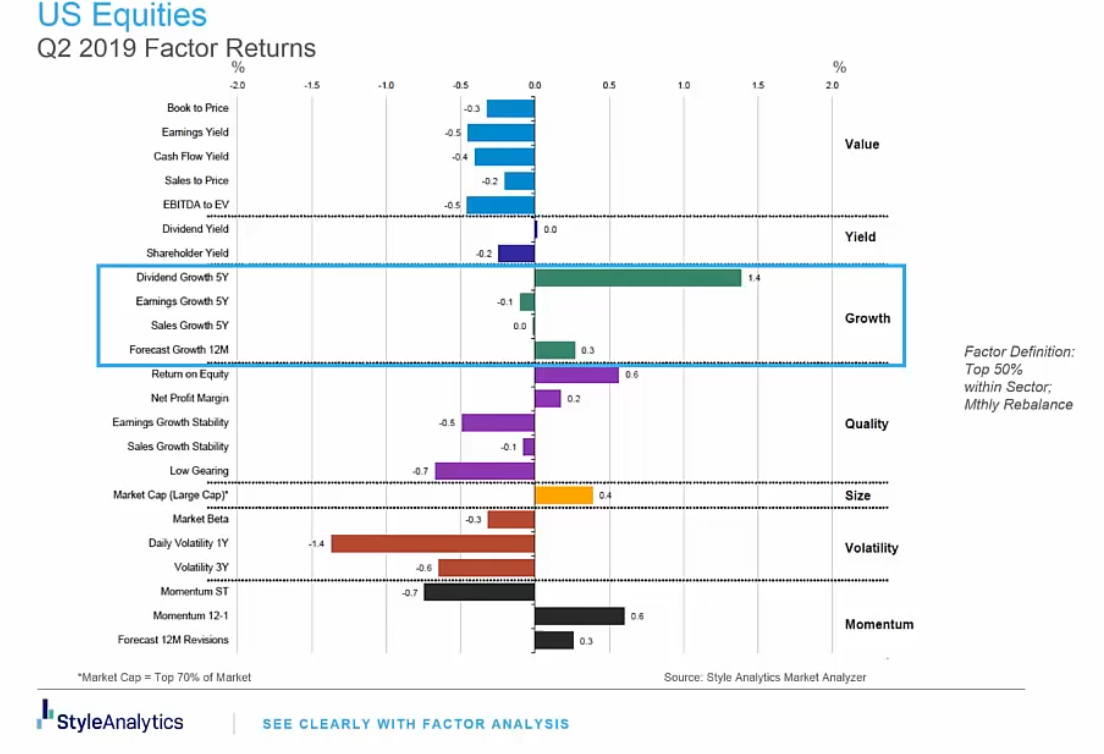

The factor performance in the second quarter is shown in the chart below. We can see here the poor performance of volatility factors and the strong performance of dividend growth and, to a lesser extent, forecast growth. In comparison, all the value factors underperformed.