Kenneth Lamont, senior research analyst, passive strategies, at Morningstar, highlights the major moments from across the smart beta landscape last year, with the slowing number of launches a sign of a maturing market in Europe.

Introduction

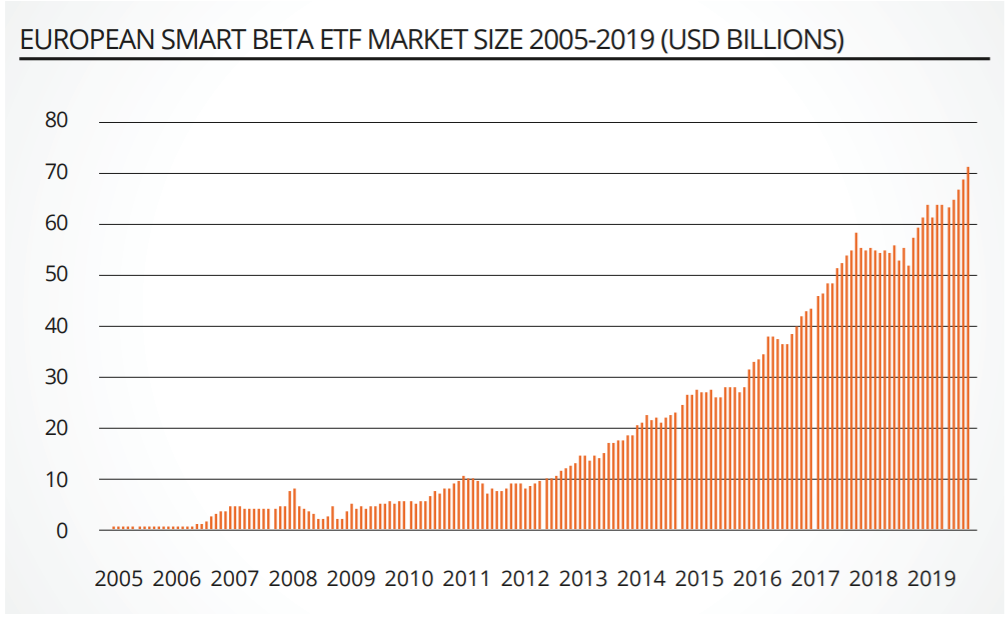

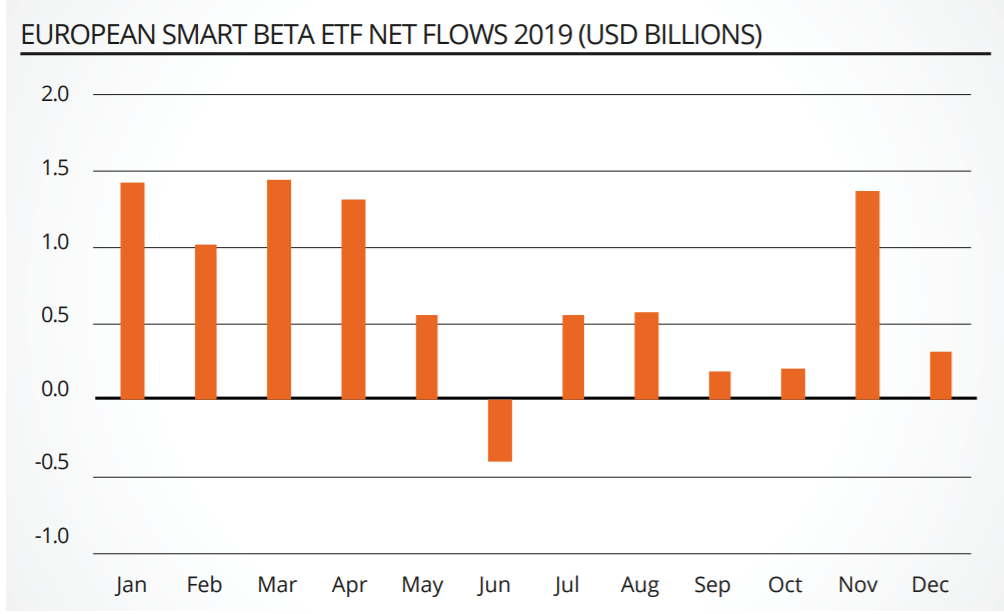

The European strategic beta (also known as smart beta) ETF market grew at a healthy clip in 2019 but the market is showing signs of reaching maturity. Assets in these funds grew by more than a third in size to $71bn over the course of the year. A combination of rising markets and consistently positive monthly net inflows has supported this impressive growth. Over the course of the year, they collectively received $8.5bn in net new money with the share of the total European ETF market holding steady, finishing at 7.2%.

Dividend strategies received almost half of all net inflows in the year and retain the lion’s share of overall assets invested in strategic-beta ETFs. This reflects the demand for income-producing funds among yield-hungry investors.

Risk-orientated and value strategies also benefited from meaningful inflows, with each raking in around $2bn in net new money over the course of the year. On the other hand, commodity strategies were the biggest losers, leaking almost $1.5bn in assets.

Source: Morningstar

Winners and laggards

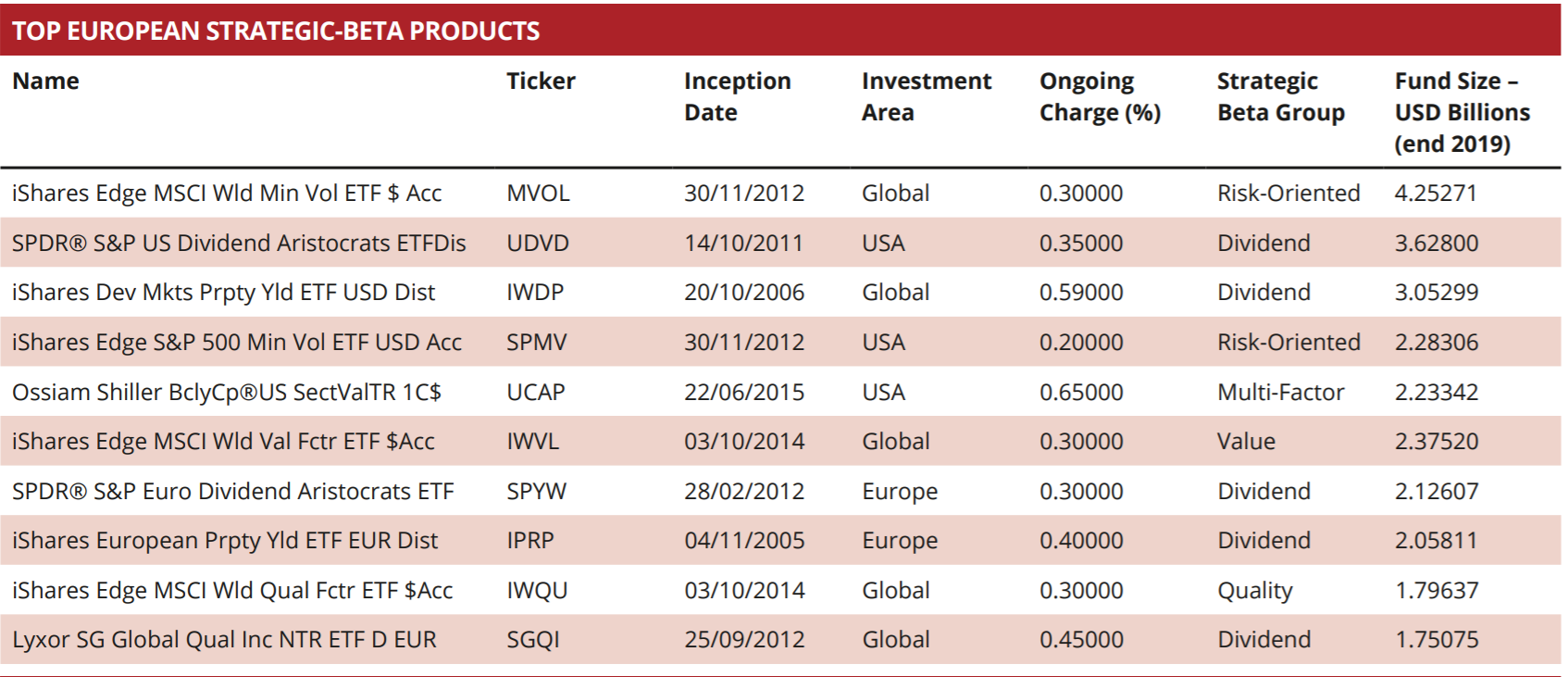

It is no surprise that passive behemoth iShares retained the number-one spot in the European strategic-beta ETP space with a market share of 45% at the end of 2019. Its ‘Edge’-branded suite of ETFs that track factor indexes focused on core global, US, and European exposures has played a key role in cementing iShares’ standing in recent years. Their single factor minimum volatility and value funds were the main recipients of flows in 2019.

One of these funds, the iShares Edge MSCI World Minimum Volatility ETF, is the largest strategic beta fund in Europe with close to $4.4bn in assets at the close of 2019. It attempts to construct the least-volatile portfolio possible with stocks from the flagship MSCI World index under a set of constraints.

ETF providers in smart beta catch 22

These include limiting turnover, exposure to individual names, and sector tilts relative to the index, which improves diversification but also reduces style purity. While pure low-volatility portfolios hold only low volatility stocks, this minimum volatility portfolio may include average- to high-volatility stocks because of the risk-diversification benefits they bring to the overall portfolio and the constraints built into the optimiser.

Source: Morningstar

State Street Global Advisors’ SPDR ETF franchise remained in second place. However, this position belies a dependency on the fortunes of two products from the same stable: the SPDR S&P U.S. Dividend Aristocrats ETF and the SPDR S&P Euro Dividend Aristocrats ETF. These two funds harbour three quarters of SPDR’s assets in strategic-beta ETPs in Europe.

UBS, whose MSCI equity factor suite forms the backbone of its offering, is the third-largest provider in Europe. In particular, the UBS ETF MSCI USA Select Factor Mix ETF has proved to be the most popular multi-factor ETF in Europe, receiving close to $500m in net inflows in the year.

Launches tail-off as market reaches saturation point

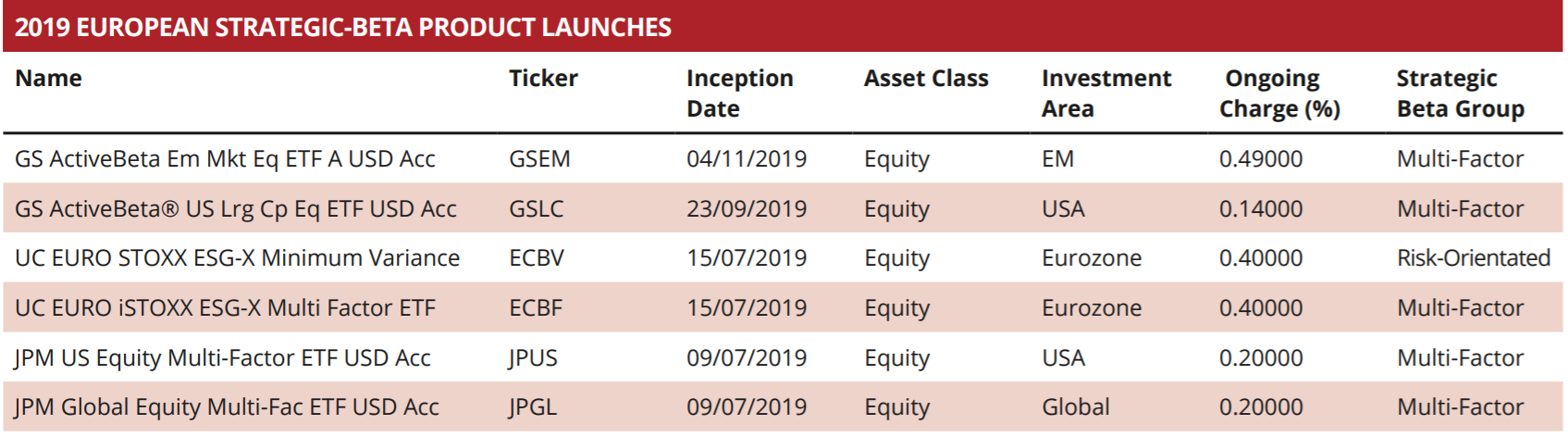

For all the growth in assets, just six new strategic beta products hit the shelves in 2019, the lowest figure for over 15 years. The dwindling number of launches is the natural consequence of the strategic-beta market in Europe reaching maturity. With the market for more vanilla strategic beta all but saturated, providers have moved to develop increasingly complex products in order to stand-out from the competition.

Most new entrants now employ multi-factor equity strategies, which wrap several factor exposures into one strategy.

These funds are routinely marketed as a way of improving the prospective risk-return profile of a market-cap index by diversifying across factors, each of which can suffer long periods of underperformance.

The increased number of variables in these products allow providers more scope to differentiate themselves and often charge a premium for their intellectual property. It is fair to expect that products of this type will continue to come to market. After all, multi-factor ETFs can be churned in many different combinations and cover a number of geographies.

Source: Morningstar

The most high-profile multi-factor launch of 2019 came as part of Goldman Sachs Asset Management’s entrance into the European ETF market. The ActiveBeta US Large Cap Equity ETF shares its approach with a US-listed sister fund, which, listed in 2015 is currently largest multi-factor strategic beta ETF in the world. With an ongoing charge of just 0.14%, the European variant is the cheapest multi-factor ETF in Europe.

This launch was followed by a second fund; the Goldman Sachs ActiveBeta Emerging Market Equity ETF, which applies the same multi-factor approach to emerging market equities. This ActiveBeta strategy offers broad equity exposure, but tilts toward those with low valuations, strong momentum, high profitability, and low volatility.

The simple equal-weighted factor approach employed is transparent, though a more integrated approach would likely lead to stronger style tilts and slightly higher returns.

Source: Morningstar

As competition heated up, we saw JP Morgan also pursue a similar strategy. As part of their push into the European ETF market, they also borrowed two existing multi-factor equity strategies from the US. The JPM Global Equity Multi-Factor and the US Equity Multi-Factor ETFs select stocks based on momentum, quality and value factors while controlling for sector and regional biases.

The short live track records for many multi-factor strategies can make due diligence tricky. By ‘porting’ strategies which have already cut their teeth stateside, both providers have given investors the luxury of a longer live track record to examine.

How to evaluate smart beta ETFs

The final multi-factor strategy ETF launched in 2019 was the UniCredit EURO iSTOXX ESG-X Multi Factor ETF. It selects eurozone stocks based on profitability, earnings yield, leverage, value and low volatility before weighting them using a multi-factor optimization process. It also applies exclusionary screens based on ESG criteria.

The only single factor launch of the year was the UniCredit EURO STOXX ESG-X Minimum Variance ETF. The fund attempts to differentiate itself from several cheaper rivals offering similar factor exposures by applying the same ESG screens as its stablemate.

Product development in the fixed-income space remains eerily quiet. The long-predicted flurry of innovation has failed to materialise, and asset levels remain subdued. One reason for this is that there is currently no consensus view on whether the factors recognized in equity investing can be applied to fixed income.

Kenneth Lamont is a senior fund analyst, passive funds research, Europe, at Morningstar

This article first appeared in the Q1 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy, click here.