Robotics ETFs give investors access to tomorrows technology today, but so far returns have been negative, so is it just a fad?

There is no doubt that the technology sector is evolving to include artificial intelligence, robotics, self-driving cars and quantum computing, among other things. These developments are set to shape how technology advances in the future.

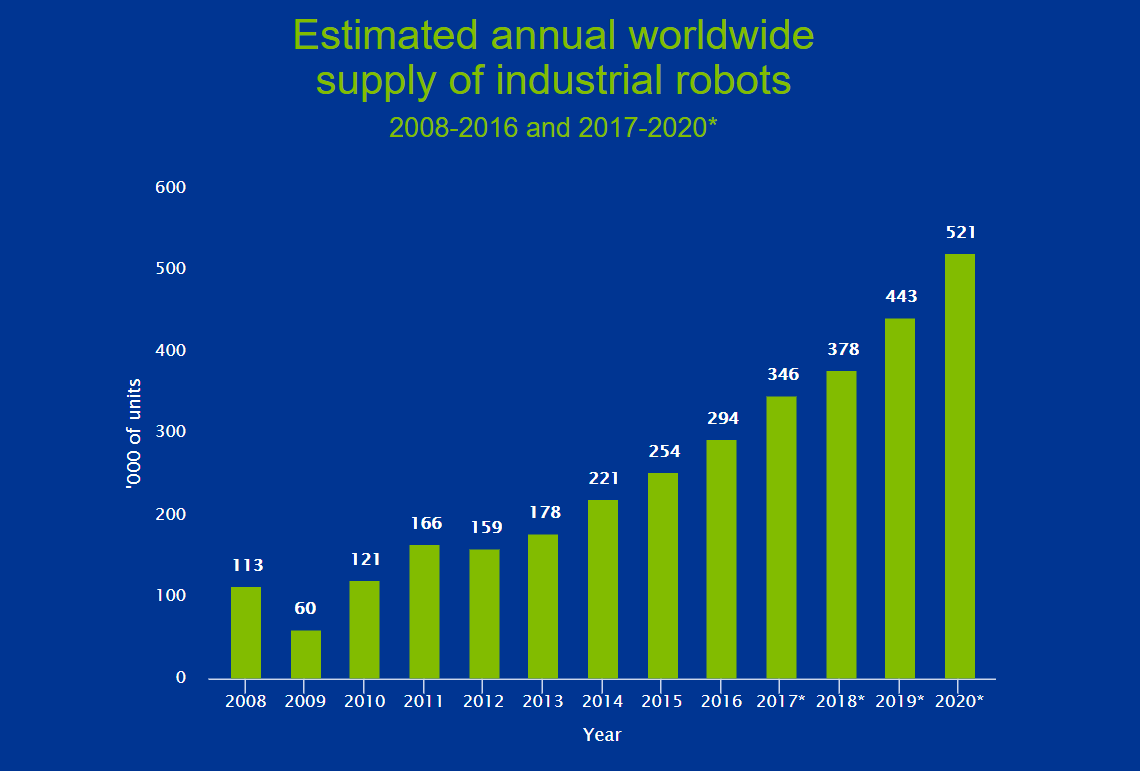

According to a note from the International Federation of Robotics (IFR) in October, global industrial robot sales have double in the past five years.

At the same time the cost of production is going down and expertise in those working in the sector is increasing. It's becoming a more efficient industry.

The report from IFR shows that the sales value of robots increased by 21% compared to 2016 to a new high of $16.2bn in 2017. They also argue that robots are increasingly important in manufacturing.

"Industrial robots are a crucial part of the progress of manufacturing industry," says Junji Tsuda, President of the International Federation of Robotics. "Robots evolve with many cutting-edge technologies. They are vision recognition, skill learning, failure prediction utilizing AI, new concept of man-machine-collaboration plus easy programming and so on. They will help improve productivity of manufacturing and expand the field of robot application. The IFR outlook shows that in 2021 the annual number of robots supplied to factories around the world will reach about 630,000 units.

A report from iShares also shows that robot manufacturing is going to increase.

Source: iShares

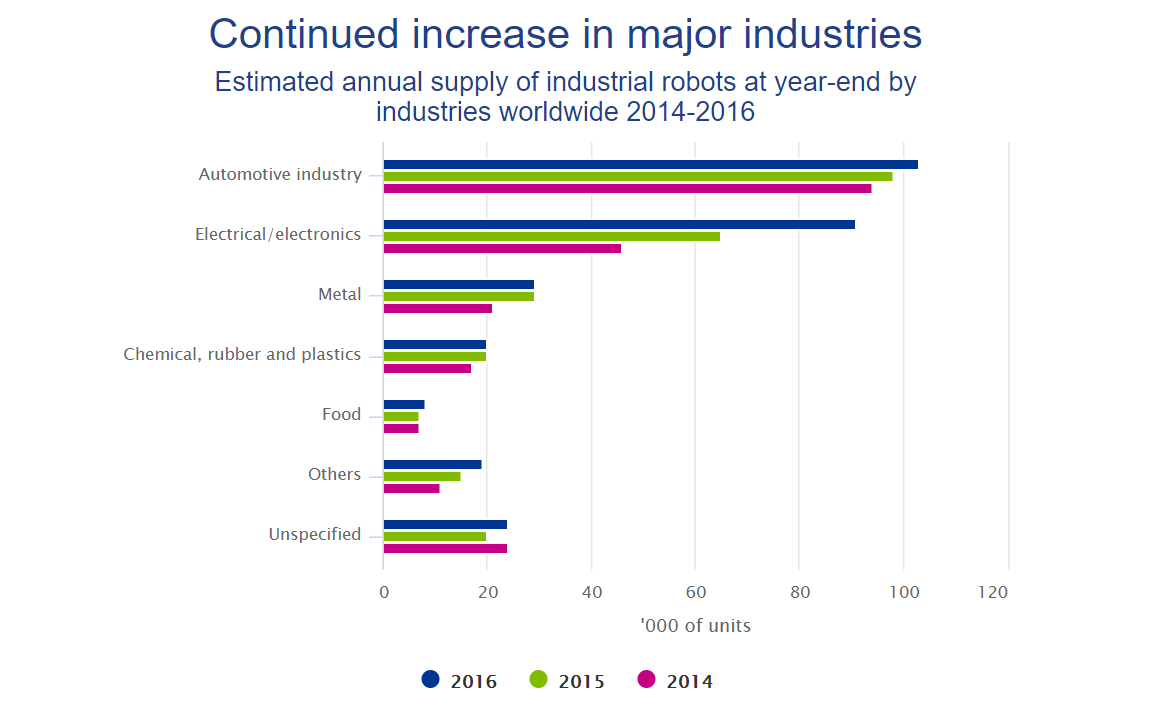

Robots are used in many areas of manufacturing with automobiles leading the way.

Source: iShares

According to IFR the automotive industry remains the largest adopter of robots globally with a share of 33% of the total supply in 2017. The manufacturing of passenger cars has become increasingly complex over the past ten years: a substantial proportion of the production processes nowadays require automation solutions using robots. Manufacturers of hybrid and electric cars are experiencing stronger demand for a wider variety of car models just like the traditional car manufacturers. The increased need to meet 2030 climate targets require a larger proportion of new cars to be low- and zero-emission vehicles.

The electrical/electronics industry is witnessing rising demand for electronic products and the increasing need for batteries, chips, and displays were driving factors for the boost in sales. The need to automate production increases demand: robots can handle very small parts at high speeds, with very high degrees of precision, enabling electronics manufacturers to ensure quality whilst optimising production costs. The expanding range of smart end-effectors and vision technologies extends the range of tasks that robots can perform in the manufacture of electronic products.

The metal industry (including industrial machinery, metal products and basic metals industries) is also on an upswing. Analysts predict an overall growth in demand in 2018 for metals, with ongoing high demand for the cobalt and lithium used in electric car batteries. Large metal and metal product companies are implementing Industry 4.0 automation strategies, including robotics, to reap the benefits of economies of scale and to be able to respond quickly to changes in demand.

The top five countries with the highest robot purchases are China, Japan, Korea, the US and Germany.

Investing in the sector is an attractive prospect, the indexes tracking these companies are also fairly well diversified. The iShares RBTX ETF's largest holding makes up only 1.56% of the index, the next three holdings account for 1.48%, 1.38%, 1.37%, respectively. This compares with other technology indexes, such as the MSCI World Information Technology index, which has Apple accounting for 14.83%, Microsoft at 10.73%, and Facebook at 5%.

Unlike broad technology which includes some big name FANG stocks, the companies included in the Robo and AI indexes have revenues generated from industries associated with the development of automatic and robotic technology.

But access isn't cheap.

The ETFs in the sector have a price tag between 0.4% and 0.8%.

This higher price tag is likely the result of the lack of competition; there are only three ETFs on offer in the UK, one of which only launched in September.

The three ROBO ETFs in the UK have assets between them at around $3.3bn. The oldest of these is L&G's ROBO Global Robotics and Automation UCITS ETF which was launched in 2014 and has $1.09bn in AUM, it's also the priciest at 0.80%.

The iShares ETF is the largest with assets of $2.15bn, it's also on the cheaper side with a fee of 0.40%.

At the end of September Lyxor increased competition in the space with the launch of its Lyxor Robotics & AI UCITS ETF. The ETF costs 0.40% and has attracted $62m in assets so far.

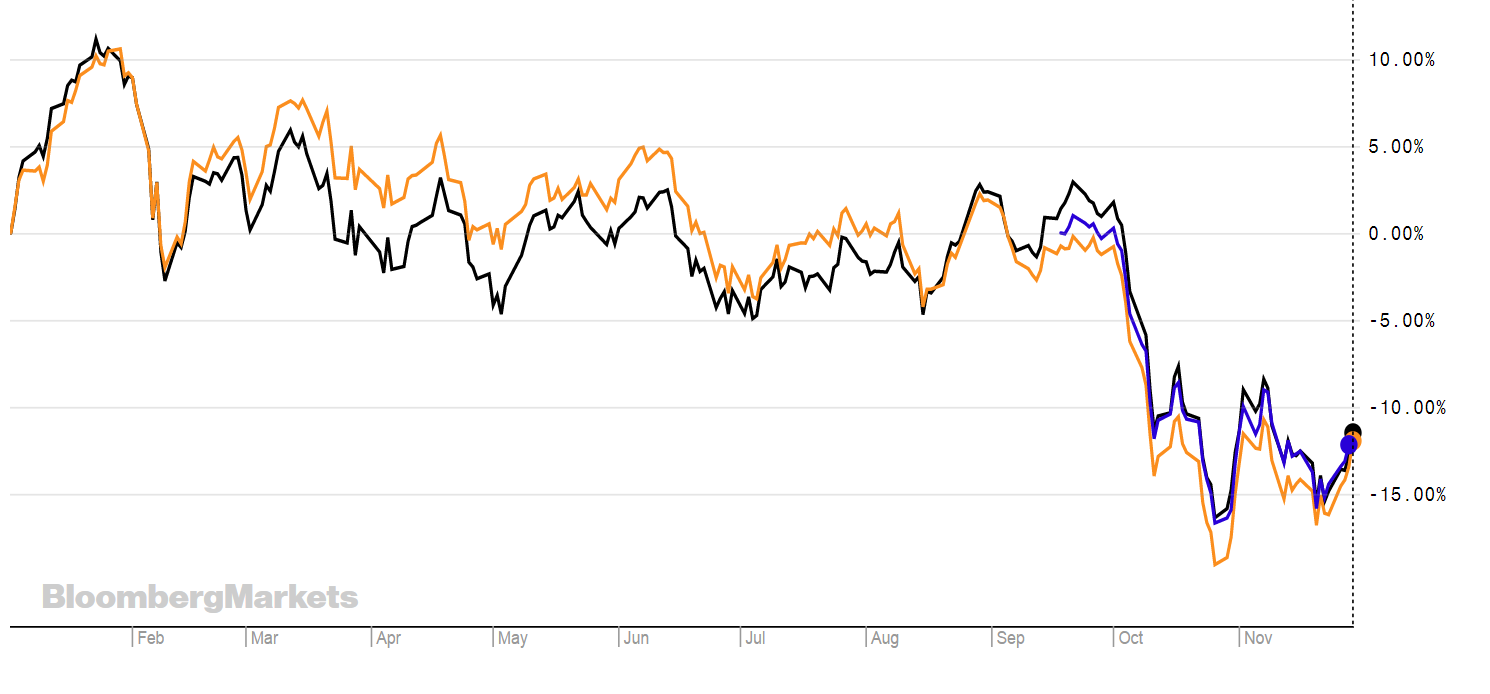

Despite the ETFs attracting assets, performance is an issue; all three ETFs have provided negative returns in the last three years. Which compares to an 8% return from MSCI's World Information Technology Index since the beginning of the year.

The performance of the ETFs is seen below, shown from the beginning of the year. ROBO is in black, RBOT in orange and ROAI in purple.

The sector is a promising one, but the ETFs are pricey, and performance remains an issue. Below are the ETFs listed on the London Stock Exchange.

ROBG

ROBO

ROBE

RBOT

RBTX

ROAI

(Since inception 09/18.

-12%)

ETFYTD RTNTERINDEXL&G ROBO Global Robotics and Automation UCITS ETF-6.22%0.80%ROBO Global Robotics and Automation UCITS IndexL&G ROBO Global Robotics and Automation UCITS ETF-11.94%0.80%ROBO Global Robotics and Automation UCITS IndexL&G ROBO Global Robotics and Automation UCITS ETF-7.29%0.80%ROBO Global Robotics and Automation UCITS IndexiShares Automation & Robotics UCITS ETF-11.74%0.40% iSTOXX® FactSet Automation & Robotics IndexiShares Automation & Robotics UCITS ETF-6.48%0.40% iSTOXX® FactSet Automation & Robotics IndexLyxor Robotics & AI UCITS ETFn/a0.40%Rise of the Robots NTR Index