One of the first economic bubbles recorded in western Europe was during the 17th Century when tulip mania swept through the Netherlands. During the Dutch Golden Age, tulip prices reached extraordinarily high levels with one tulip being traded for 12 acres of land at one point, according to the British journalist Charles Mackay. The bubble dramatically burst in February 1637, however, when contract prices for the bulbs collapsed overnight.

Could this happen to the concept of smart beta? The answer is a firm no, at least not in such emphatic fashion, however, there are whisperings from corners of the investment landscape that the strong inflows into smart beta products over the past decade will not last forever.

Smart beta products have seen their assets balloon since the Global Financial Crisis in 2008 with investors disillusioned about the state of traditional active management. According to data from Morningstar, smart beta ETP assets under management (AUM) now total around $800bn globally with BlackRock predicting assets in factor strategies will reach $3.4trn by 2022.

It is easy to see why smart beta has grown in popularity. The products incorporate factors that have been ‘empirically’ proven by academic research to deliver outperformance over the long term. Factors such as value have been written about for over 50 years as a way of delivering superior returns to the benchmark. Along with the promise of outperformance, smart beta ETFs come at a cheaper rate when compared to active mutual funds.

Axes to grind

The sharp rise in assets has led to the proliferation of factors with issuers looking to tie themselves to the latest piece of academic research in order to capture investor assets. The problem with this approach from the smart beta issuers, however, is academics have their own axe to grind.

Over the past 50 years, academics have faced increasing pressure to meet funding requirements by being published in top journals. This is evidently not achieved by doing a piece of research and finding a factor that cannot be supported by the evidence. This is not just a problem in finance but is rife across the whole of academia as research departments look to keep their head above water.

As a result of the pressure, a recent academic study conducted by Campbell Harvey, Professor of Finance at Duke University and Yan Liu, Assistant Professor of Finance at Purdue University, found over 400 factors had been published in top journals.

“The rate of factor production in the academic research is out of control,” the paper stressed. “The backtested results published in academic outlets are routinely cited to support commercial products. As a consequence, investors develop exaggerated expectations based on inflated backtested results and are then disappointed by the live trading experience.”

Furthermore, David McLean and Jeffrey Pontiff in a 2015 study analysed the returns of 85 published factors and found they delivered in-sample returns of an annualised 7.2%. However, this number dramatically dropped to 4.9% out-of-sample – typically a 56-month period – and fell even further to 3.2% following publication.

It is certainly fair to say the “factor zoo” as it has come to be known is out of control with academics publishing new findings without regard for the validity of the factor. And with smart beta issuers very quick to tie themselves to academic research when launching a factor-based product, it certainly brings into question the validity of these vehicles, especially when providers do not make money from investing in smart beta themselves.

Academic evidence

As Dylan Grice, co-founder of Calderwood Capital Research, said: “The academic evidence for factors is dubious at best. To the extent there was substance to the [factors], market participants soon eliminated them in their rush to capture them. In other words, there is little merit in this academic literature, and there is commensurately little merit in the vast array of financial products which are largely based upon it.”

The fact there are 400 academically published factors available for issuers to turn into products does highlight an overreach in the space. Value’s underperformance for over a decade now could be viewed as a key signal of the smart beta bubble slowly starting to burst.

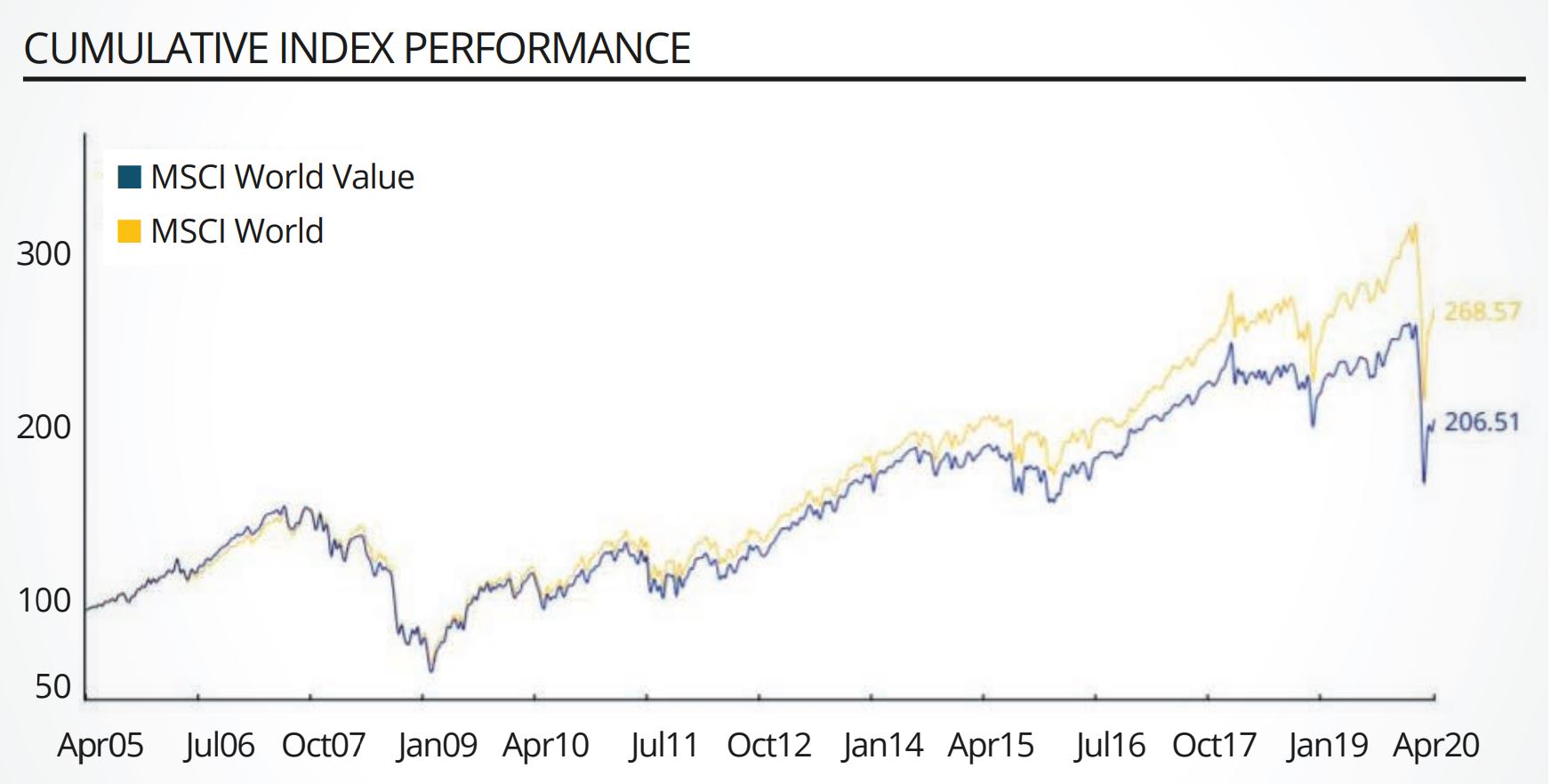

Somewhat worryingly, value has underperformed in both rising and falling markets this year. Highlighting this, the MSCI World Value index returned -29.2% in Q1 versus -23.2% for the MSCI World. When markets started to rally the MSCI World outperformed its value relative by 2.3% in April. Although this is a tiny sample, it does highlight the structural problems facing “value” products.

Source: MSCI

But how will the smart beta bubble burst? Grice shares his predictions: “Probably not in the same dramatic fashion that the sub-prime bubble did. And probably not by being unpicked by the awkward questioning of probing academics. The financial products which are based on [smart beta] will ultimately return negative alpha as today’s army of supposed ‘value investors’ (i.e. those following the value ‘factor’ strategy) have already discovered. It will die a slow death, as the eventual realisation sets in several years hence, that poor performance is intrinsic to its shoddy research approach.”

This article first appeared in the Q2 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy,click here.