Having left equities and traditional stores of value in the dust during the height of COVID-19 volatility, cryptocurrencies - led by bitcoin - are struggling to prove their ‘safe haven’ use case during the ongoing invasion of Ukraine.

Bitcoin surged 15.8% and ethereum jumped 14.6% between the start of the conflict on 24 February and the beginning of March, however, both coins had virtually undone these gains by 8 March, almost a fortnight after the invasion began.

This volatility raises question marks around crypto’s usefulness as a potential store of value. It is also in stark contrast to gold’s recent form, with the precious metal rising steadliy from $1907 to $2047 an ounce over the past 13 days.

In the exchange-traded product space, there are some signs of crypto’s resilience. According to data from CoinShares, digital asset investment products saw $127m inflows last week, an increase from the previous week, “suggesting investors remain supportive of digital assets despite the recent geopolitical events prompting a sell-off in risk assets”.

Unfortunately, this was not the case across the board. Europe’s largest physical bitcoin and ethereum ETPs, the $600m BTCetc Bitcoin Exchange Traded Cryptocurrency (BTCE) and $324m 21Shares Ethereum ETP (AETH), saw outflows of $15.3m and $1.2m, respectively, in the week to 7 March, according to data from ETFLogic.

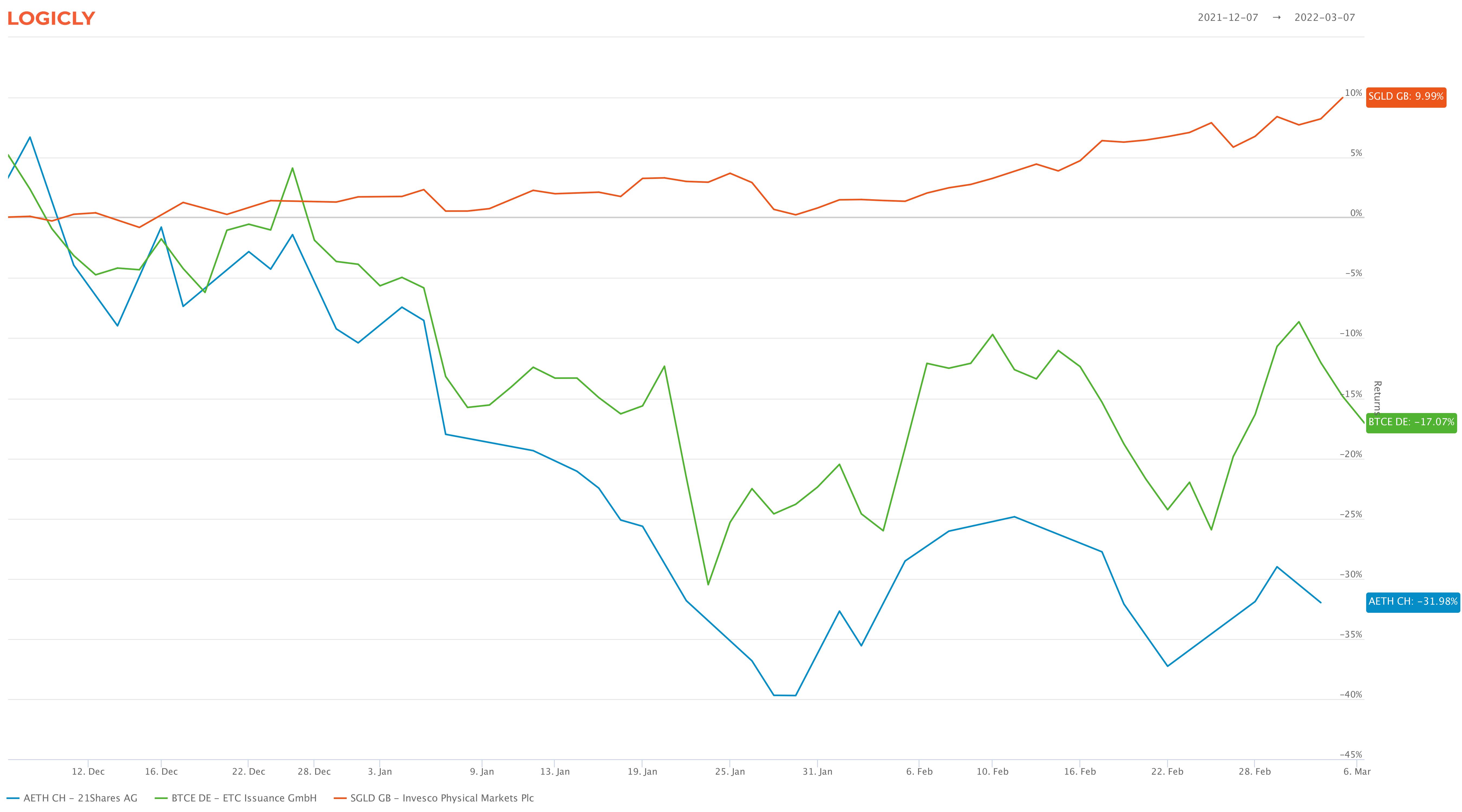

Furthermore, the drawdown in crypto valuations that started last year has continued over the past month. BTCE dropped 5.2% while AETH fell 14.8% in the four weeks to 7 March.

Meanwhile, Europe’s largest gold ETPs, the $15.6bn Invesco Physical Gold ETC (SGLD) and $14.9bn iShares Physical Gold ETC (IGLN), saw $285m and $385m inflows over the past week. Likewise, the two products both booked returns of 8.3% over the trailing month.

Broader view on the old and new asset classes

Zooming out, the current risk-off backdrop likely started in mid-December when central banks began signalling their first interest rate hikes since the start of the pandemic, swiftly bringing 2021 recovery optimism to a halt across most asset classes.

This should have spelled a time to shine for safe havens suited to non-correlation and indeed, the SGLD and IGLN gold trackers returned 10.9% and 10.4%, respectively, over the last three months.

The same cannot be said for products tracking large cap cryptos, with BTCE and AETH falling 19% and 40.7% over the same period.

Source: ETFLogic

Whereas gold behaved like a typical safe haven asset in 2021 – falling after considerable gains the year before – crypto assets of all sizes did the exact opposite.

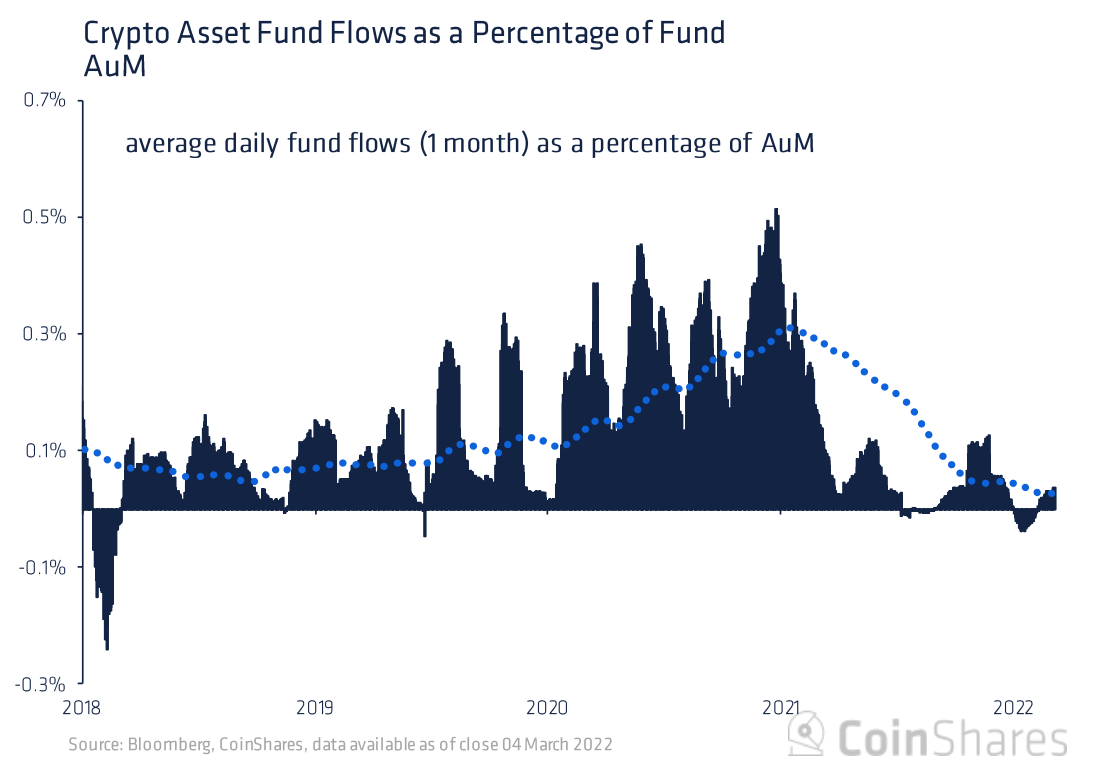

The surge of headlines covering bitcoin’s triple-digit returns in 2020 was followed by a wave of new product launches and trillions of dollars of new money across the asset class. Last year, this frenzy continued across bitcoin, ethereum, mid-caps such as solana and cardano, and meme coins such as dogecoin.

As many cryptos rebounded to hit all-time highs last November, some steam began coming off the speculation surrounding this attention cycle. In a tail-wags-dog scenario, as the volume of new assets pouring into crypto has cooled off, so too have valuations.

Ultimately, while gold is a less exciting ride and lacks the decentralised finance story, it is behaving as one would hope during a time of increasing uncertainty.

Whether crypto assets – name bitcoin – can act as a store of value is currently determined by the frequency and tone of public opinion and news cycle events.

Coming up, it will be interesting to see how bitcoin’s role in financing both sides of the Russia-Ukraine conflict will impact perceptions and valuations.

Part of this will stem from this week’s US executive order, which will outline the government’s regulatory and national security strategy for crypto in light of Russian parties using crypto to sidestep sanctions.

Related articles