A new wave of fintechs, including robo-advisors and zero fee brokers, show ETFs can be used for buy and hold investment strategies

At its most extreme, ETFs can be used by buy-and-hold investors in place of multi-fund managers

These developments suggest Bogle was wrong to worry about ETFs being mostly the tool of technical traders

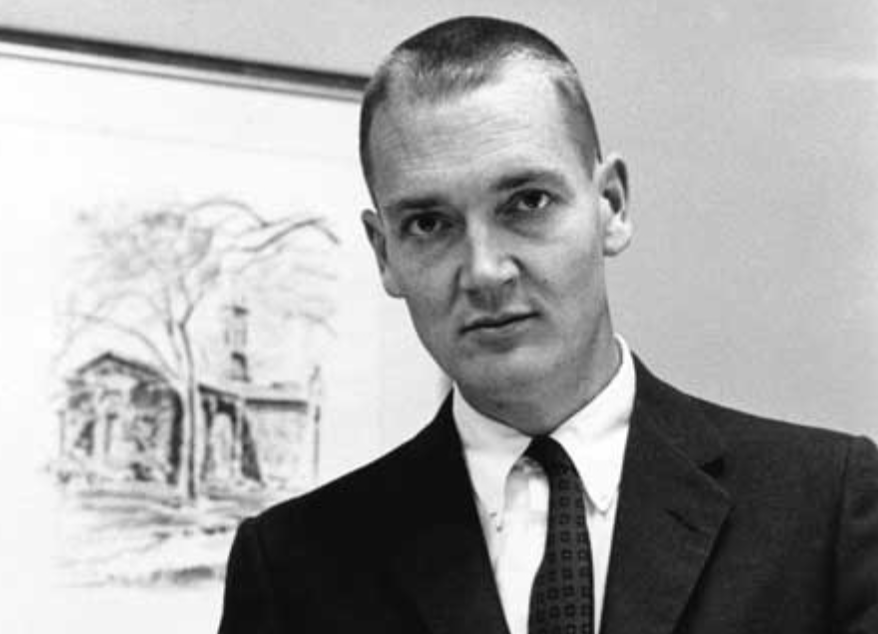

Jack Bogle - who I had the privilege of meeting and interviewing - famously disliked ETFs. He did so for several reasons: they're often tactical; they charge spreads and brokerage; and they encouraged ETF providers to build silly products. He thought that everything an ETF could do, an open ended mutual fund could do better.

But was he right? For my part, I'm not so sure.

For one, we're increasingly seeing ETFs getting used by long-term investors. The growing proliferation of low-cost robo advisors, who make portfolios from ETFs, is one place to see this. ETFs increasing uptake in Europe by multi-fund managers is another place to see this.

As for the costs of entering and exiting, new zero-fee brokerage platforms, like Freetrade in the UK and Robinhood in the US, show these costs are coming down.

Replacing multi-fund managers

Freetrade for example has a short but promising list of ETFs which can be bought with zero brokerage fees on its platform. For long term investors this a manna from heaven. One could easily construct a simple portfolio of cheap ETFs, say 4 to 6, and then buy them through Freetrade and keep the overall portfolio cost below 25 basis points (including the fund TER and possible bid offer spreads). This is exactly what Bogle would have loved.

Back in the mainstream where Vanguard increasingly dominates, we've seen intense competition in the multi funds passive space.

The choice of multi-managers is growing all the time. But with ETFs and free brokerage tools, adventurous private investors could simply track the biggest and best players in this space and then work out what's inside each of their portfolios. Average out the variations in asset classes, and then build a sensible asset class list and build your own ETF portfolio using a service like Freetrade.

Indexes are crucial for picking ETFs

But one issue immediately presents itself. Once one has decided on the broad asset class building blocks (say 20% in US equities, 30% in emerging markets), which ETF to use? The lazy answer is to choose the biggest by AuM or the cheapest by TCO/TER. This is not a bad first step, but I think the selection process needs to be a bit more rigorous than that. When I talked to Matt Brennan at AJ Bell. He suggested that investors should also look at the following list of variables:

Does the ETF physically replicate the index or is it using swaps and derivatives

Does the ETF undertake stock lending

How big is the ETF

How well has the ETF tracked its index over time

How diversified is the underlying index

Trading costs such as bid/ask spreads

How often it rebalances

If the ETF is trading at a premium or discount

And then there's the tricky issue of the index itself. As Brennan at AJ Bell reminds us, not all indices covering the same asset class, are alike. According to Brennan "in reality, the index providers themselves such as FTSE or MSCI make discretionary decisions as to which countries count as emerging markets or not. MSCI include South Korea as an Emerging Market, whereas FTSE counts it is a Developed market. This means that the iShares ETF, tracking the MSCI product has a 3% weight to Samsung, and the Vanguard product (tracking FTSE) has a 0% weight". Quite.

Which brings nicely back to Jack Bogle. My sense is that he'd have been deeply worried by the profusion of indices and the accompanying new-fangled strategies. He was already deeply sceptical of stuff like smart beta - or dumb beta as he once called it. I think he'd have also told investors to really get under the skin of the index they are tracking. Download the fact sheet and compare it with other providers and then work out which index is right for you. Indices really, really matter.