Much has been made of direct indexing over the last few years, with many heralding it as a direct competitor to ETFs. While some assets that will have otherwise gone into ETFs might go the direct indexing route instead, these options should be viewed as two tools in a toolbox.

Rather than being in competition for the same assets, investors should decide whether direct indexing or ETFs is best for their individual situation and needs.

Direct indexing involves purchasing the underlying securities that make up an index rather than buying a pooled investment vehicle such as the iShares Core S&P 500 UCITS ETF (CSPX). The benefit of buying the securities individually is twofold.

It offers a higher degree of customisation and allows for the generation of “tax alpha” by allowing individual securities to be sold at a loss. Tax alpha refers to the ability to achieve additional return on your investments through tax minimising strategies.

For example, consider an investor who works at Apple and receives Apple stock as part of their compensation package. Their overall assets and financial well-being are heavily tied to the stock performance of Apple. To reduce risk, they might not want their large cap portfolio to have exposure to this stock. By buying an ETF like CSPX, they would be unable to avoid having an additional allocation to Apple stock. However, direct indexing would allow her to build an S&P 500 allocation without Apple stock.

Customisation has many uses

This customisation has many practical uses. Along with being able to avoid specific stock for reasons such as those listed above, direct indexing is also compelling for an environmental, social and governance (ESG) perspective.

Many ESG investors want to align their portfolio with their values, but broad ESG ETFs such as the iShares MSCI USA ESG Screened UCITS ETF (SASU), Europe’s largest equity ESG ETF, may not necessarily align with everyone’s philosophy. Direct indexing would allow for true customisation, screening out specific stocks or entire industries and sectors.

Investors could also tilt the portfolio toward companies that have high ESG ratings or other desirable characteristics. As an example, SASU maintains an energy allocation that is larger to that of CSPX, including ESG-risk-laden names Exxon and Chevron. In fact, Sustainalytics gives Chevron a “severe” ESG risk rating.

An investor might use direct indexing to screen out all companies that are affiliated with fossil fuels or any other factor that does not align with their values.

When an ETF might be better

As is almost always the case, this higher level of customisation comes at a cost. The management fee for direct indexing could cost as much as 0.30% or higher. Compare this to CSPX and SASU, which both have total expense ratios (TERs) of 0.07%. And while the tax alpha generated might make up for the expense ratio, strong up-markets where most securities have appreciated over the tax year minimise the opportunity to harvest enough losses to offset gains within the portfolio.

Higher levels of customisation also mean a higher level of tracking error. This tracking error might mean that the customisation adds alpha over the broad index but it could just as likely result in underperformance. Those who opt for direct indexing will need to find the balance between customisation and tracking error.

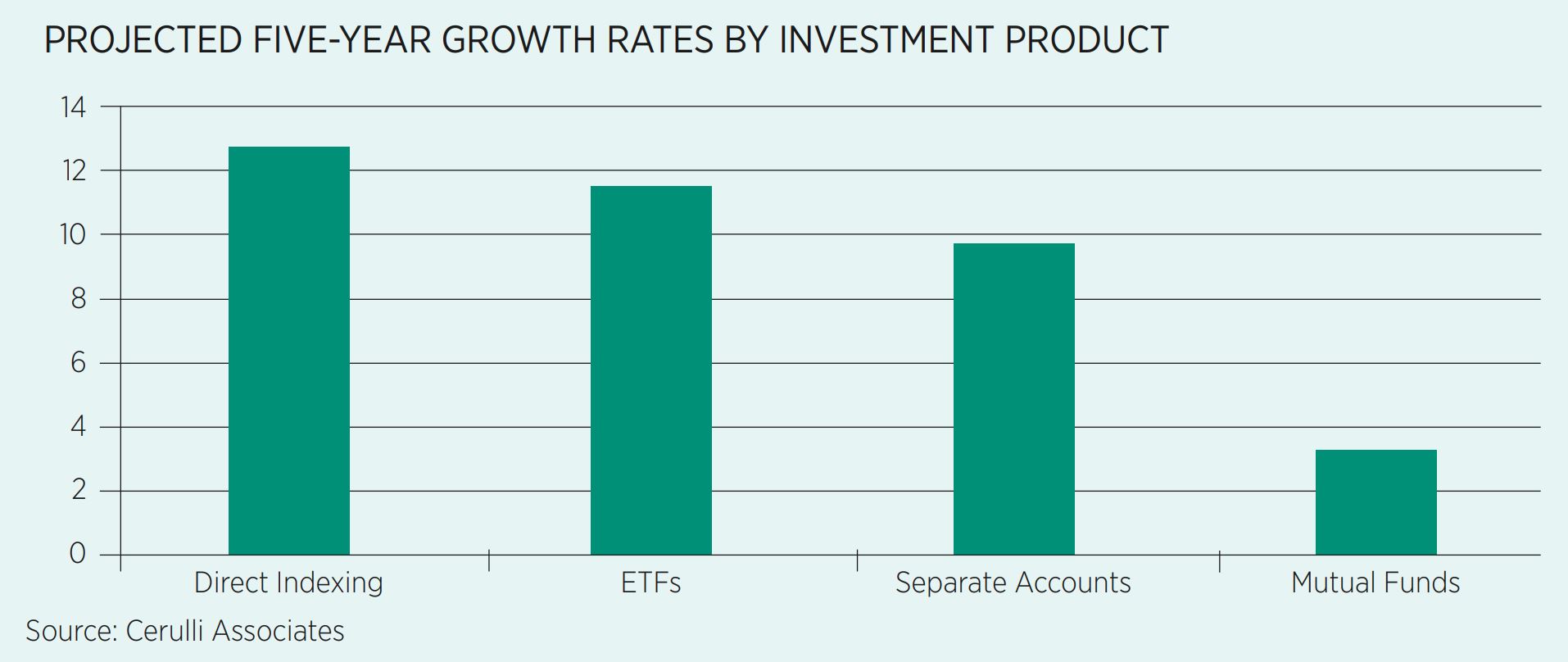

Looking ahead Cerulli Associates forecasts that direct indexing will grow at an annual rate of over 12% during the next five years outpacing the projected growth for ETFs and other investment vehicles.

An important consideration when analysing these growth rates is the total level of assets. According to Cerulli’s data, direct indexing had $362bn in assets at the end of last year. This means projected growth for 2021 is $45bn.

Compare this to the $5.5trn ETFs had at the end of December with an 11.3% growth rate, suggesting the vehicle could grow by $617bn this year. In fact, total ETF assets under management are already nearly 25% higher from the beginning of the year. ETF issuers seem to be betting that direct indexing will continue to gather assets.

Last November, BlackRock announced the purchase of direct indexing firm Aperio Group while Vanguard entered into a definitive agreement to acquire Just Invest in July. Index providers are also getting in on the action. Last month, Indxx announced a partnership with C8 that would provide customisable access to seven of their index strategies.

While many in the ETF ecosystem are preparing for the growth of this type of investment, ETFs still have strengths that will make them a popular choice for many investors in the years to come.

This story was originally published onETF.com