Though broadly diversified emerging market ETFs get the lion’s share of the assets, investors also have options that are focused on one country – or even a specific sector in a country – if they would like to take a tactical tilt in an effort to generate alpha.

India is a potential opportunity in this regard for investors who want to drill down further as the country could see brighter days ahead.

It also could be just the solution investors need to respond to China’s outsized weighting in the most prominent cap-weighted emerging market indices.

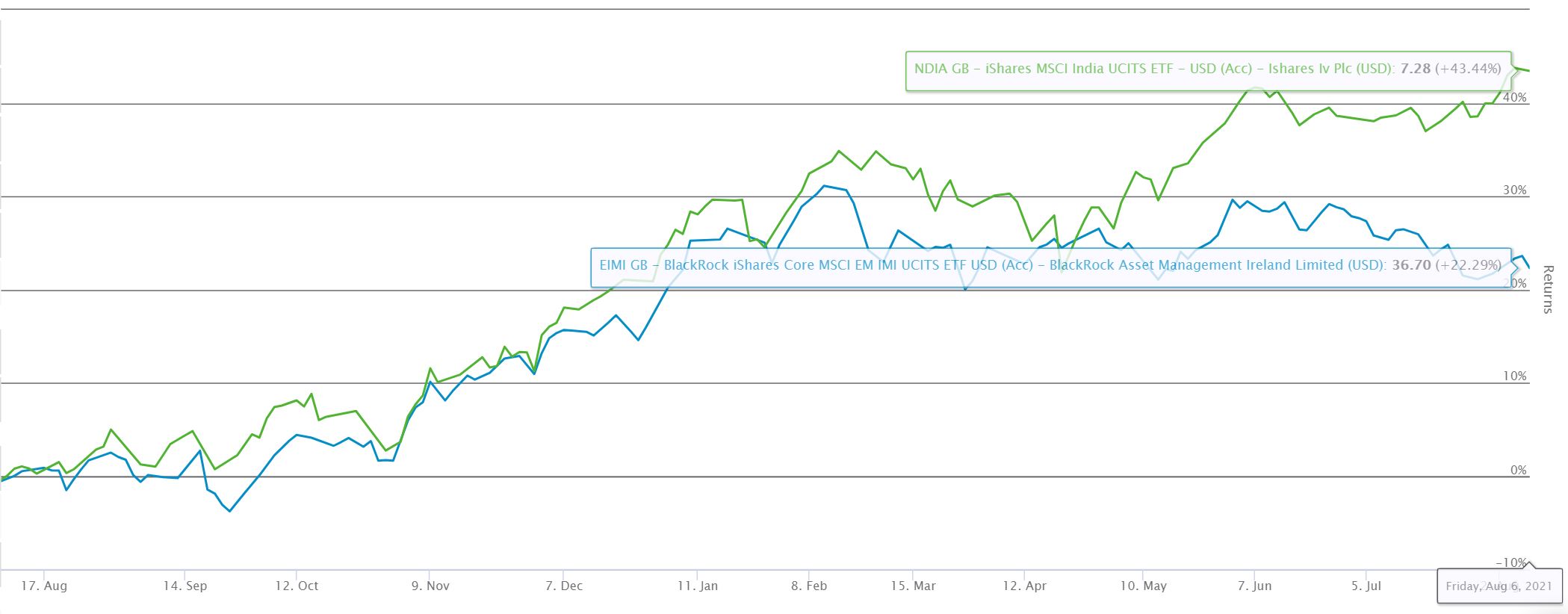

While India was ravaged in the spring by a second wave of COVID-19, India equities have roared back over the last few months. Over the trailing year, Europe’s largest India ETF, the iShares MSCI India UCITS ETF (NDIA) has almost doubled the performance of the iShares Core MSCI EM IMI UCITS ETF (EIMI) returning 43.4% versus 22.3%, as at 9 August.

Chart 1: One-year returns for NDIA and EIMI (9 August 2020-9 August 2021)

Source: ETFLogic

More than market-cap weighted

NDIA tracks a market-cap-weighted index of the top 85% of firms in India’s securities market. However, other ETFs provide a different way of looking at India equities.

One such option is the US-listed Nifty India Financials ETF (INDF). This ETF tracks an index of India’s top 20 financial services companies. This is a sector of the market that could be well-positioned for growth going forward.

Unlike Chinese internet stocks that have been hit hard by the government crackdown, government action in India has been beneficial for the banking sector in particular.

Due to the pandemic, the government instituted a moratorium allowing borrowers to defer payments until economic conditions normalised. This has enabled banks to continue lending without the risk of losses.

In addition, the government also provided a credit guarantee that enables banks to lend to small and midsize businesses at attractive yields. As a result, private sector banks in the country have reported double-digit loan growth over the past year.

Aside from loans, much of the population does not yet have access to banking products such as mortgages, credit cards or life insurance. This means that as the economy matures and GDP per capita increases, there is significant room for growth as more citizens begin to make use of these products.

The cheapest ETF available on the European market is the Franklin FTSE India UCITS ETF (FLXI) which is a massive 46 basis points less expensive than its nearest rival at 0.19%.

FLXI tracks the FTSE India 30/18 Capped index which offers exposure to 173 Indian companies versus 101 stocks for the MSCI India, the index that all other ETFs in Europe track.

Keep risk management in mind

When considering these ETFs for your portfolio, it is important to remember that these strategies are exposed to unsystematic risk by being invested in only one country. And an ETF like INDF, with exposure to only one sector and 20 holdings, has not only country risk but sector risk.

These ETFs should be viewed as tactical tools to be used as a portion of the allocation, rather than as funds that could comprise the entire emerging market allocation of a portfolio.

This story was originally published on ETF.com