ETF Stream's deputy editor Tom Eckett shows why incorporating ESG factors in emerging markets should be high on investors’ agendas when searching for a better risk-return profile.

Introduction

Analysing emerging markets through an environmental, social and governance (ESG) lens is still in its early stages considering the poor data available and the limited track records of ESG products. Despite this, a consensus is beginning to emerge that incorporating ESG factors into an emerging markets portfolio can produce even stronger results than in developed markets.

ESG investing has come a long way since the launch of the first ETF with an ESG tilt, the iShares MSCI USA ESG Select ETF, in 2002. Today, ESG ETFs represent $50bn of the $6trn ETF market, according to data from ETFGI, with 74% of investors planning to increase their allocations over the next year, according to a Brown Brothers Harriman survey.

Emerging market ESG ETFs only account for a small part of these assets, however, investors are starting to pour money into these products. For example, the Xtrackers ESG MSCI Emerging Markets UCITS ETF already has $297m assets under management (AUM) having just launched last October while Europe’s largest ETF of this kind, the iShares MSCI EM IMI ESG Screened UCITS ETF (SAEM) has $494m AUM.

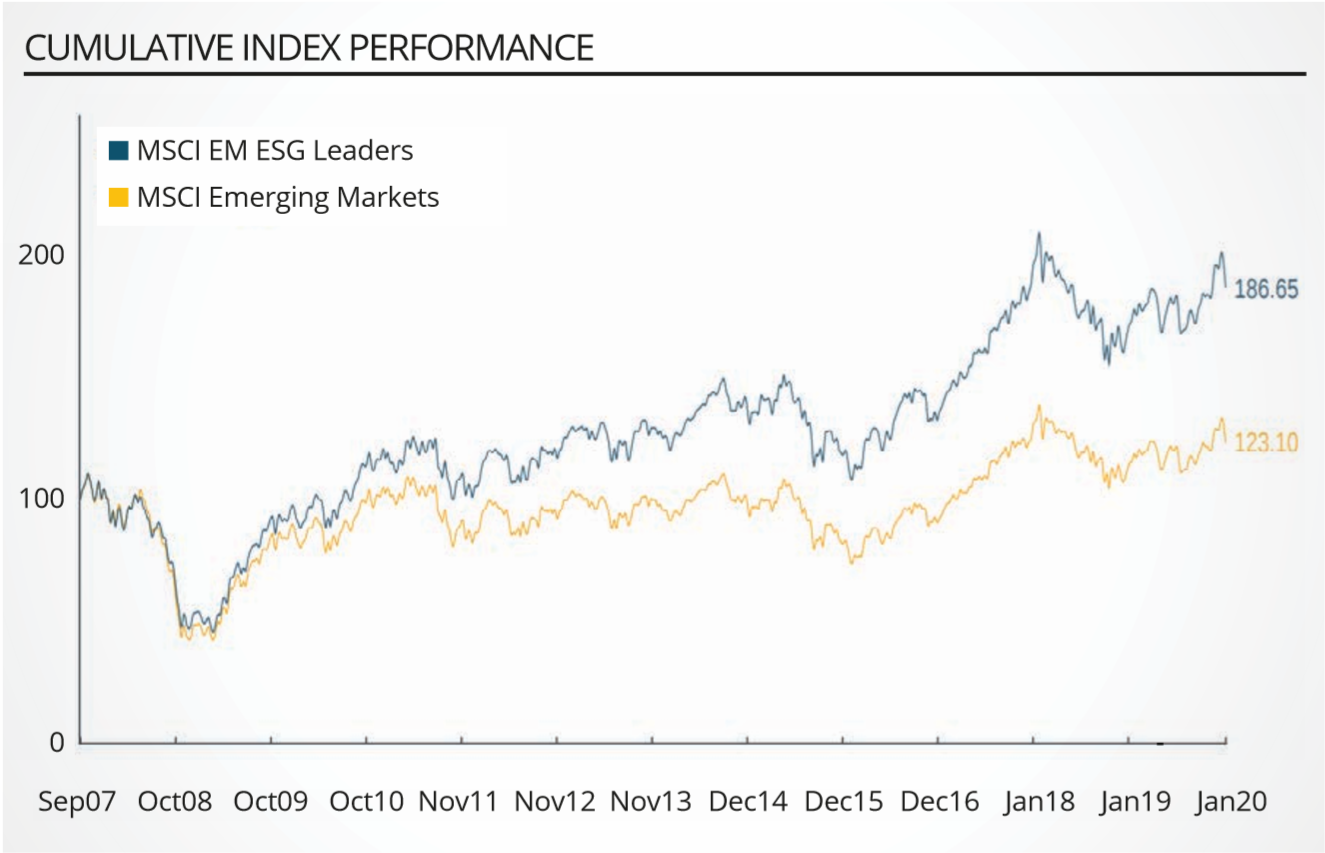

Recent inflows will partly be due to the strong performance emerging market ESG ETFs have exhibited over their parent counterparts. Over the past decade, the MSCI EM ESG Leaders index has delivered annualised returns of 7.5% versus 4.1% for the regular MSCI Emerging Markets index. If one compares this to developed markets, the MSCI World ESG Leaders index has returned 10.4% over the past 10 years versus 10.5% for the MSCI World, as at 31 January.

Source: MSCI

While this is just a sample, it does highlight the greater impact incorporating ESG factors has in emerging markets compared to developed markets. The greater average annualised returns of 3.4% over a 10-year period when using an emerging market index with an ESG tilt can be explained by a number of factors.

As well as boosting performance, incorporating ESG factors can reduce the volatility of a portfolio, as Nicolas Rabener, managing director of FactorResearch, notes. “Intuitively applying ESG metrics should be rewarding in emerging markets as there is less regulation than in developed markets,” he says.

Supporting this, research from data provider Sustainalytics finds the FTSE Emerging index had an ESG risk score of 27.4 compared to 24 for the FTSE Developed index, suggesting emerging market investors are exposed to 14.2% more unmanaged ESG risk. “These differentials reflect the prevalence of weaker regulatory systems, poor corporate governance practices and lax disclosure requirements in emerging markets,” the report adds.

State-owned enterprises

One issue which is not prevalent in developed markets is the reality of state and family-owned businesses. Highlighting this, Goldman Sachs found state-owned enterprises (SOEs) represented 28% of the MSCI Emerging Market index in 2016.

The problem with SOEs, as a Cambridge Associates research piece notes, is “SOEs are influenced by interests beyond generating profits for shareholders, which can negatively impact operational aspects of the business”.

Evidence shows SOEs can have a significant impact over performance with those companies lagging private sector stocks by 40% over the five years to June 2016, according to Goldman Sachs.

Where ESG ratings have a positive effect is SOEs often score far lower than private firms due to governance issues. The Cambridge Associates research note adds: “Concerns over SOEs have seemingly been around for so long, one wonders how they could not already be amply discounted by markets, but the ESG ratings process has clearly been effective in identifying underperforming companies here.”

When studying the reasons behind the underperformance in the MSCI World ESG Leaders index, one factor is ESG stocks underperforming in the US. Over the last decade, the MSCI USA has returned 14% per annum versus 13.4% for its ESG counterpart due to the index removing a number of the top performing US mega-caps including Amazon and Home Depot.

The Cambridge Associates report adds: “The data for developed markets have been more mixed, largely due to ESG ratings being a poor indicator of stock performance for US large-cap companies. Consideration of ESG quality can still add value in developed markets with the correct application, which may need to be more nuanced than using ratings in isolation.”

ESG data

Turning back to emerging markets, an area that remains an issue is the lack of ESG data available for providers and investors. Hortense Bioy, director of passive funds and sustainability research for Europe at Morningstar, says this requires more resources and more engagement with companies.

“Poor data quality makes implementing ESG in emerging markets more challenging,” she continues. “However, considering ESG factors when investing in emerging markets makes a lot of sense because ESG standards in these markets are typically lower than in developed markets. Fewer emerging markets companies score well on ESG and focusing on these companies has proven to be a winning strategy.”

ETF Insight: ESG ETFs score major victory during coronavirus turmoil

ESG data for emerging markets is becoming more detailed and comprehensive, according to Cambridge Associates: “ESG data for emerging markets has become more detailed and comprehensive in recent years.

“Investors…may have underestimated the value of now widely available information on the ESG strength of corporates in emerging markets.”

This article first appeared in the Q1 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy, click here.