There are four key areas where ETFs have the potential to cause systemic risk in the global financial system, according to a report by the European Systemic Risk Board (ESRB).

The report, entitled Can ETFs contribute to systemic risk?, warned a number of trends seen across the European ETF market in recent years has the potential to affect the functioning of financial markets and merits a financial stability discussion.

These trends include a growth in popularity among investors, the rise of more complex products such as inverse and leveraged ETFs and a rise of investors moving into more illiquid parts of the market through the ETF wrapper.

The first reason why systemic risk could be caused by ETFs is because the wrapper is encouraging investors to place large short-term bets on entire asset classes which is increasing the volatility and co-movement of underlying securities.

If these positions were to be liquidated, the report said, this could be problematic in times of financial stress, particularly for ETFs traded over-the-counter (OTC) with illiquid underlying holdings.

The report referenced academic evidence, such as Da and Shive (2014), that shows there is increased co-movement in stocks that belong to an index because when an ETF is traded a lot, underlying securities become more responsive to index-related news than to news related to idiosyncratic factors.

Marco Pagano, chair of the ESRB's Advisory Scientific Committee and co-author of the report, said: “An increase in the co-movement of asset prices can make it more likely that investors experience capital losses simultaneously, therefore potentially leading to waves of insolvencies and synchronised fire sales.”

Another systemic risk posed by ETFs, the ESRB highlighted, was if ETF prices decoupled from their underlying securities during times of market stress this could destabilise financial institutions with large exposures to ETFs or rely heavily on ETFs in their liquidity management operations.

The report said this decoupling effect could originate from authorised participants (APs) not having the incentives and capacity to realign them in times of financial stress.

Pagano added: “APs engage in the creation and redemption of ETF shares in pursuit of profit and have no commitment to ETF sponsors or investors. Therefore, in stressed conditions, APs could simply decide not to engage in ETF redemptions.”

In this event, this excess volatility in ETFs compared to their underlying securities will translate to “a more volatile net worth of financial institutions”.

This, in turn, the report warned, may trigger additional selling pressure in ETF positions, therefore exacerbating ETF price drops further.

Because of this, the ESRB said there is a need to establish whether financial intermediaries’ exposure to ETFs is potentially systemic and to investigate whether the decoupling may lead to a broader loss of faith in the functioning of the market.

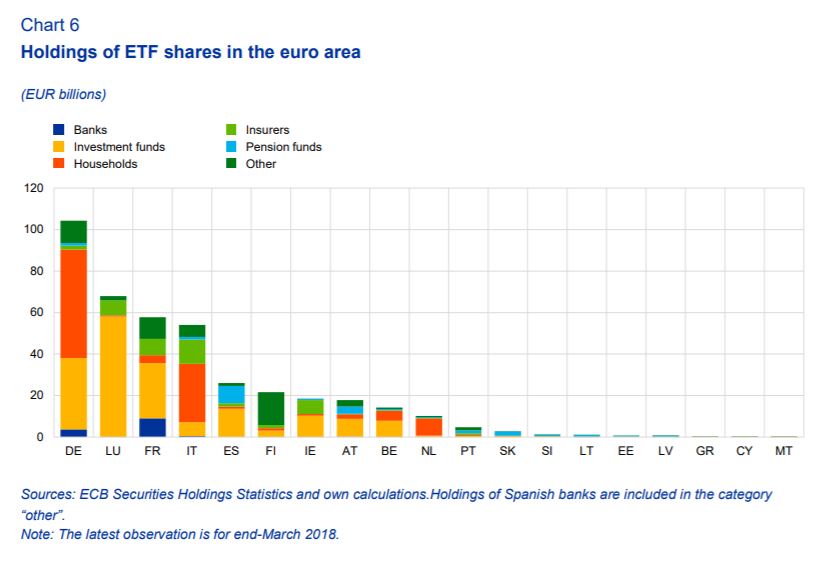

The third systemic risk ETFs could cause, the report said, was the vehicle encouraged large correlation among investors, which could be exposed during a market downturn.

If these positions produced large losses to investors such as banks, they may end up defaulting on other investors sparking a chain reaction. “Through contagion, these losses could thus trigger a chain reaction with systemic risk implications.”

However, the ESRB noted this risk could be said for other financial instruments along with ETFs.

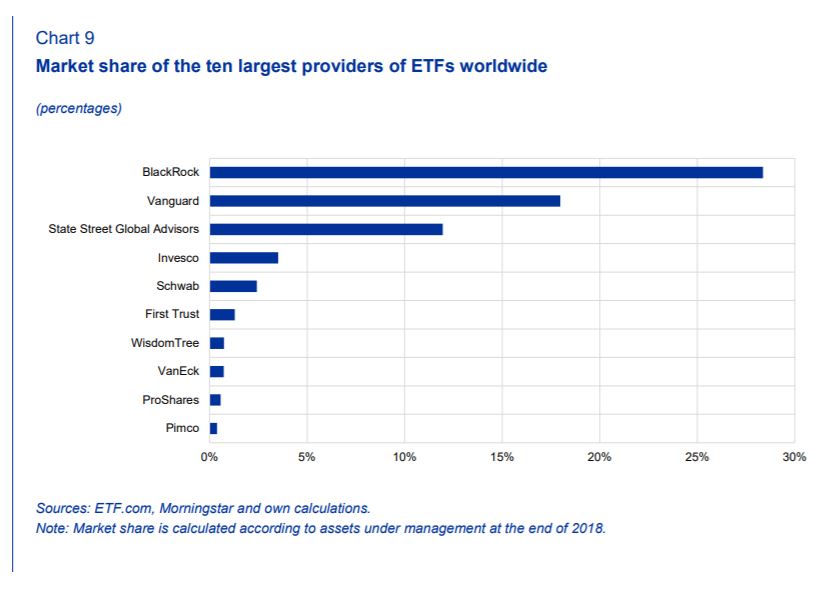

High levels of concentration in the ETF market, the report said, is a key systemic risk as a large event that leads to operational risks in one of the providers may generate “massive fire sales” of ETFs.

The supply of ETFs is highly correlated. In the US, BlackRock, State Street Global Advisors and Vanguard control around 85% of ETF assets while in Europe, BlackRock runs 45% of the market.

“Even though ETF providers have enacted policies to manage operational risk and so far no serious operational risk events have occurred, the materialization of such risks cannot be ruled out completely and can therefore not be ignored from a systemic risk perspective,” he warned.

Furthermore, a European Central Bank analysis of swap counterparties in synthetic ETFs found a concentrated network where just a handful of institutions act as swap counterparties for all synthetic ETFs in the euro area.

While synthetic ETFs are exposed to the risk the swap counterparty cannot fulfil its end of the contract, physical ETFs are exposed to counterparty risk through securities lending transactions, the ESRB added.

Despite this however, Pagano said authorities are no longer concerned about the adverse financial stability effects of synthetic ETFs due to several pieces of regulation on swap counterparties.

“Even though ETF providers have enacted policies to manage operational risk and so far no serious operational risk events have occurred, the materialization of such risks cannot be ruled out completely and can therefore not be ignored from a systemic risk perspective,” he warned.

The ESRB concluded by advising future empirical research to focus on two areas; ETF order flows in periods of stress and the extent to which financial institutions have significant and common exposures to ETFs or rely on them for their liquidity management.