The market share of ETFs in Europe significantly lags other continents despite continued innovation, outperformance and record flows in recent years.

According to data from Bloomberg Intelligence, passives have almost doubled from 10% of UCITS investments to little under 20% in less than a decade.

This growth has been led by ETFs, with the wrapper putting pressure on active managers to cut costs while overall passives outperformed all but 16.7% of active managers over the past decade, according to S&P Dow Jones Indices’ SPIVA scorecard.

In a report, titled European ETFs have small bark but bigger bite for fund fees,Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said he expects further growth in ETFs this side of the pond due to “cost pressures and active funds' underperformance”.

“Investors in the region prefer ETFs over index-tracking mutual funds, likely drawn by the introduction of new, innovative strategies such as ESG and themes.”

Despite these seemingly positive trends, ETFs remain a relatively underutilised tool in the arsenal of European investors.

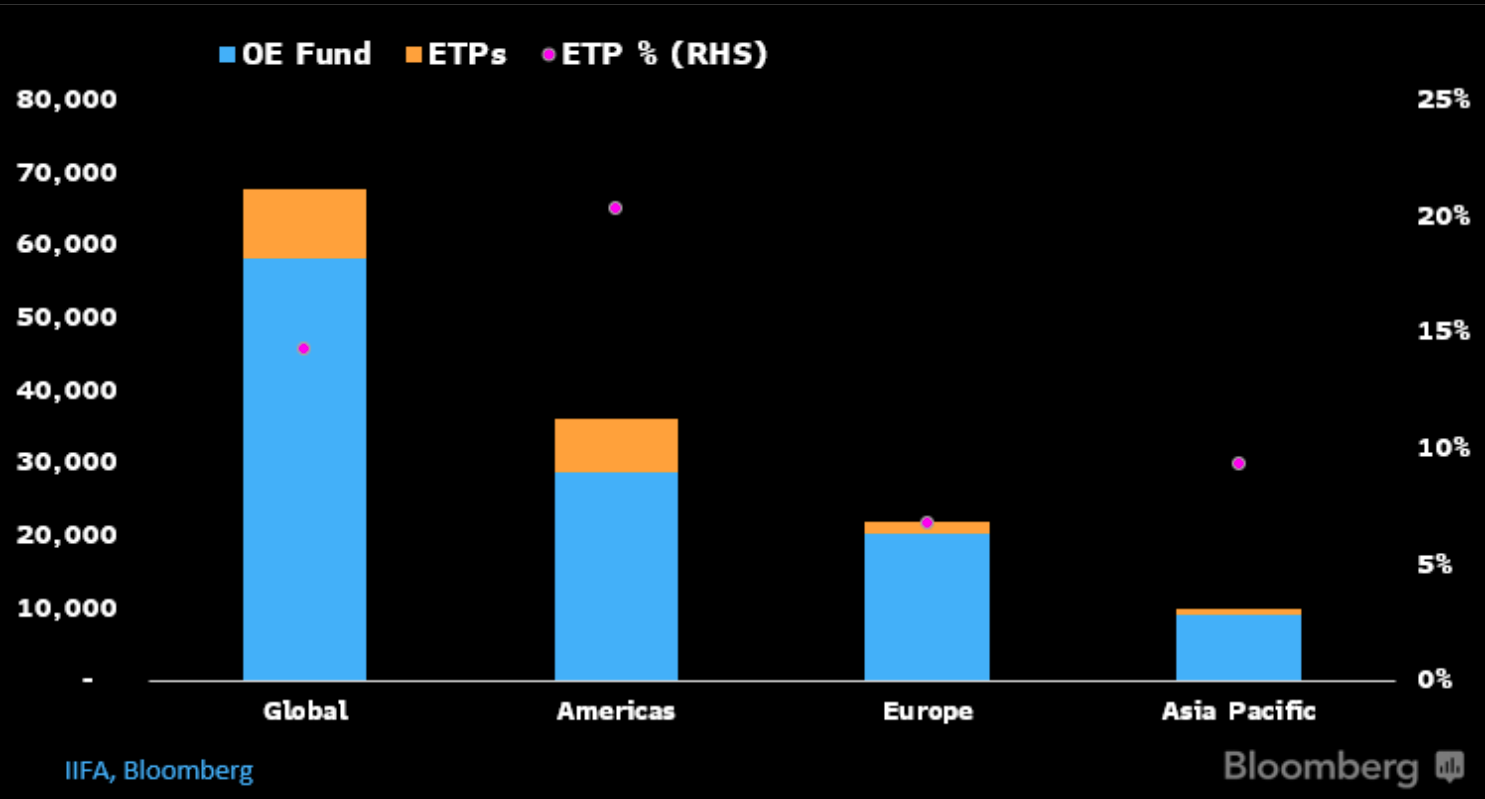

Exchange-traded products (ETPs) claim 20% of the $35trn fund market in the Americas, 14% of fund assets globally, 9% in Asia Pacific but only 7% in Europe, as at 15 July.

Source: Bloomberg Intelligence

Interestingly, this figure remains unchanged from when global ETF assets broke through $10trn last November and owes to the same lingering issues around fragmentation, lack of tax efficiency for the wrapper and distribution models still relying on retrocession fees or commissions, Psarofagis noted.

Retrocession fee models continue to remain in place across many countries on the continent which encourages banks and advisers to push investors towards more expensive funds in return for large fees.

The report also suggested while European passive ownership is currently higher in equities – at 30% of equity securities – the 17% stake currently claimed by passive fixed income products could have greater growth potential in the near future, given the current interest-rate environment and €10trn inflows for bond ETFs as fixed income mutual funds see outflows.

The passive race to the bottom on fees

Another calling card of ETFs is their comparatively low fees, which continue to be cut.

“There were 52 fee cuts in the first five months of this year, averaging 8 basis points, while 2021 saw 135,” Psarofagis said. “As the industry continues to grow, we expect the benefits of scale to open the door to more fee reductions.”

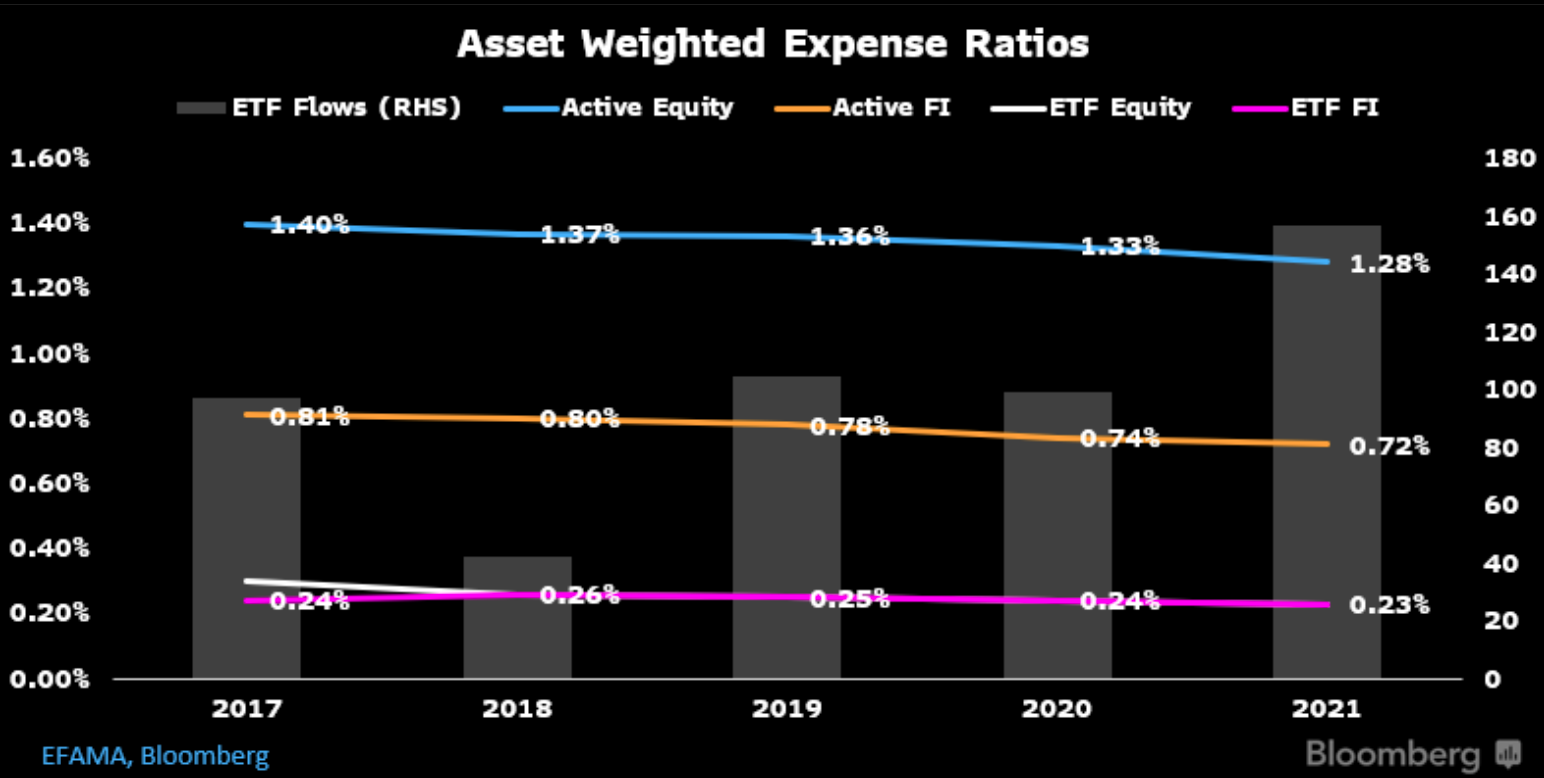

This aggressive race to the bottom will continue to put pressure on active managers. The average asset-weighted fee of an active equity UCITS fund is currently 1.28%, a figure which has fallen from 1.40% since 2017 but remains well short of passive equity and fixed income ETF average fees of 0.23%.

Source: Bloomberg Intelligence

A point worth noting is while the asset-weighted average European ETF charges 0.23%, the equal-weight average is 0.42%, which has climbed slightly following a ramp of launches in non-vanilla exposures such as ESG and thematics.

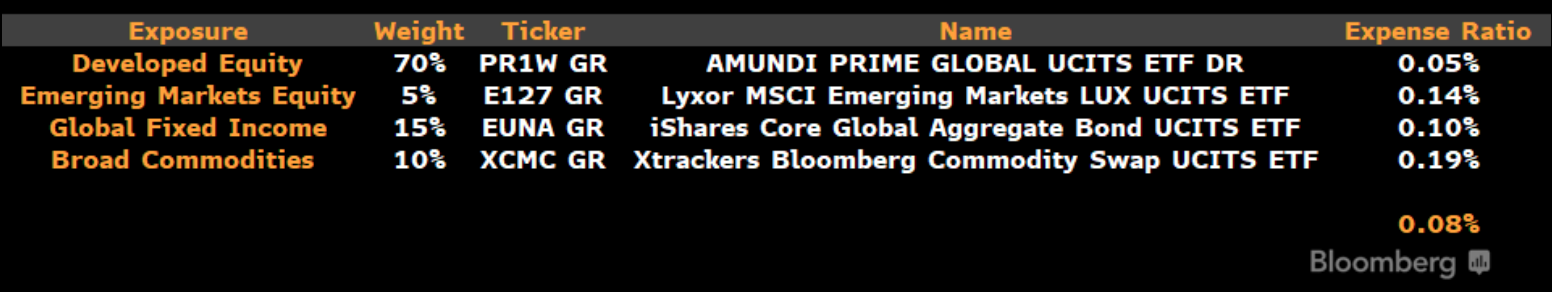

Despite this, Psarofagis said flows still tend to gravitate toward the cheapest ETFs, with a diversified, multi-asset ETF portfolio still possible for a weighted-average fee of just 0.08%.

Source: Bloomberg Intelligence

Related articles