ETF liquidity has shown resilience amid a sharp rise in redemptions following market volatility caused by the dramatic spread of the coronavirus, according to research conducted by Société Générale.

The research note, entitled ETF liquidity in the market crash, studied the strength of the ETF market in order to see how liquidity is affected during periods of market stress.

This was done by analysing ETF traded volumes and redemptions between 24 February and 11 March when global markets were spooked by the long-term impact of the coronavirus.

In particular, the SocGen analysts looked at the most vulnerable area of the market, US high yield, as it has significant exposure to oil companies which were impacted by the 30% plummet in oil prices on 9 March.

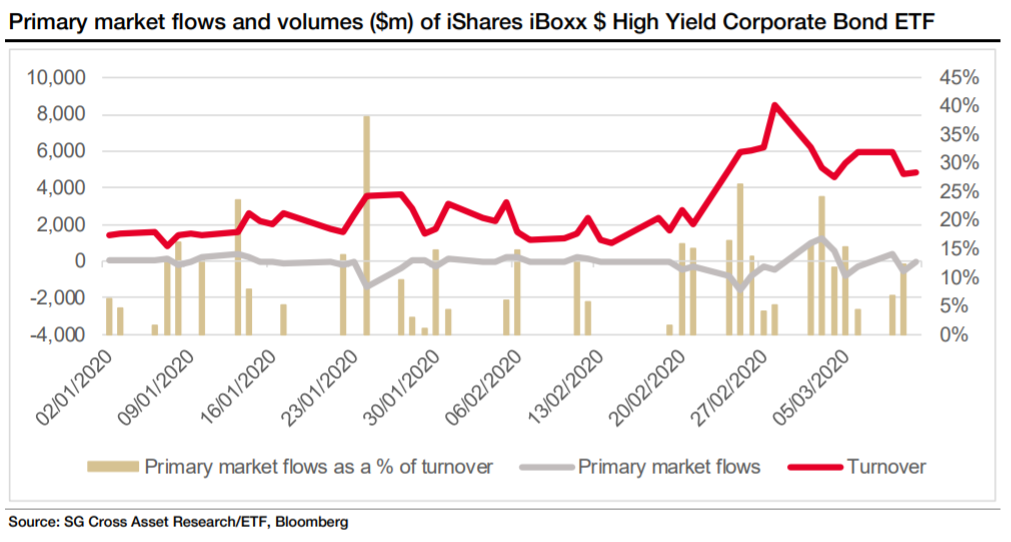

The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) saw record high trading volumes of $8.5bn and record net outflows of $1.6bn on 28 February.

Jane Street hits back at claims ETFs could cause systemic risk

However, the analysts found ETF primary market flows only accounted for a limited amount of the ETF volumes in the secondary market meaning market makers were not forced to facilitate liquidity through redemptions in the primary market which impacts the liquidity of the underlying holdings.

“The data suggests the ETF has continued to rely more on its intrinsic liquidity than on the liquidity of the underlying bonds.

“This tells us that the secondary market of this ETF has not been one-way and that buyers have stepped in to provide liquidity in the secondary market,” Sébastien Lemaire, head of ETF research at SocGen, continued. “This proves the liquidity of this ETF has been relatively resilient.”

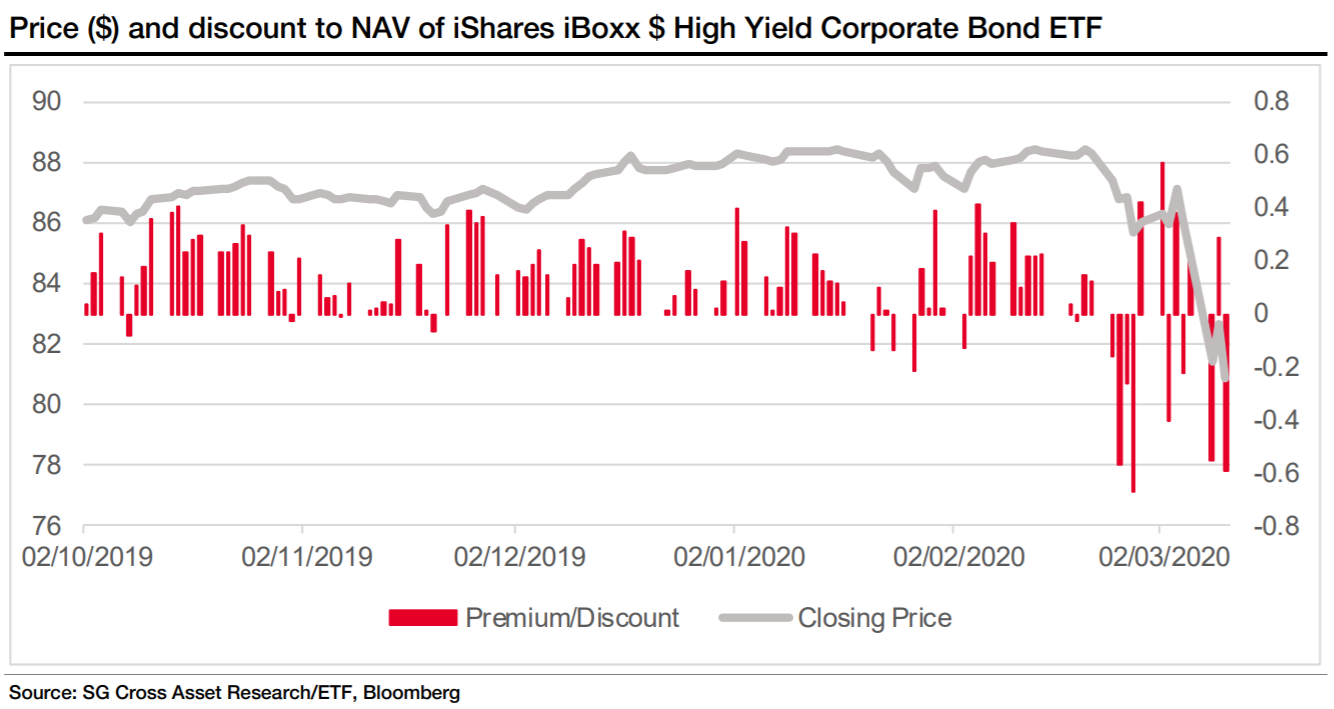

Furthermore, the analysts found when HYG’s price fell, in response to the surge in high yield bond spreads, it traded at a significant discount to net asset value (NAV) which can be explained as the cost of the immediate liquidity an ETF delivers while the underlying bonds became illiquid.

“ETF prices were the effective benchmark prices of the underlying market,” the report explained. “The discounts tended to reflect the lack of liquidity in the underlying bond market.

“In that sense, the ETF played its price discovery role very well.”

Liquidity concerns

However, there were a number of instances where redemptions on corporate bond ETFs were significantly larger relative to the underlying market liquidity.

This can magnify the underlying market impact which was most seen in euro-denominated investment-grade bonds and US dollar-denominated high yield investment grade bonds.

Panic sell-off shows limitations of junk bond ETFs

“The size of ETFs in some market segments has become a source of concern,” Lemaire warned. “In the relatively illiquid corporate bond space, ETFs have become rather big relative to the underlying liquidity.

“The risk is that ETF liquidity might be only facilitated through redemptions in the primary market, with adverse impacts on the underlying markets proportionate to the size of ETF redemptions relative to the liquidity in the underlying markets.”