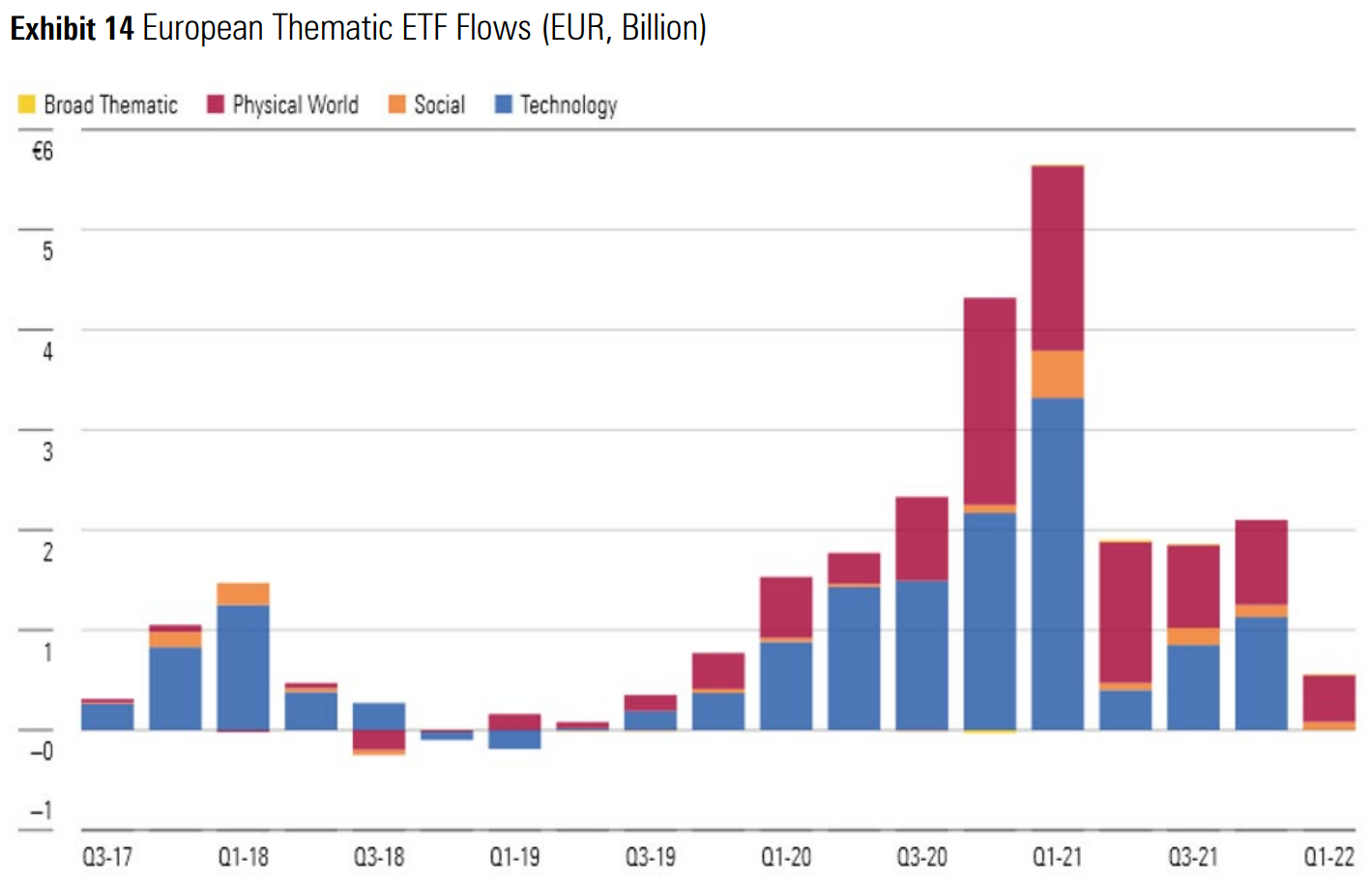

Thematic ETFs face a reality check after booking their worst quarter of flows since 2019 despite new launches continuing at a rapid pace.

Having captivated investors in Europe and quadrupled its assets under management (AUM) in the three years to the end of 2021, the product class saw inflows of just €600m in Q1, down from €2.1bn during the previous quarter according to data from Morningstar.

Not only is this the first time since the fourth quarter of 2019 thatthematicETFs have failed to gather flows of more than €1bn, it is also the first time since peak COVID-19 volatility where assets in the product class actually fell.

At the start of the year, Europe's more than 130thematicETFs had €37.8bn – this fell to €35bn after a challenging first 12 weeks.

Of this, €20.7bn was housed in technology ETFs, €12.8bn in physical world themes and €1.4bn in socialthematics.

Interestingly, European techthematics saw virtually zero new money in Q1, a dramatic change of pace from more than €3bn inflows during their peak popularity in Q1 2021.

Source: Morningstar

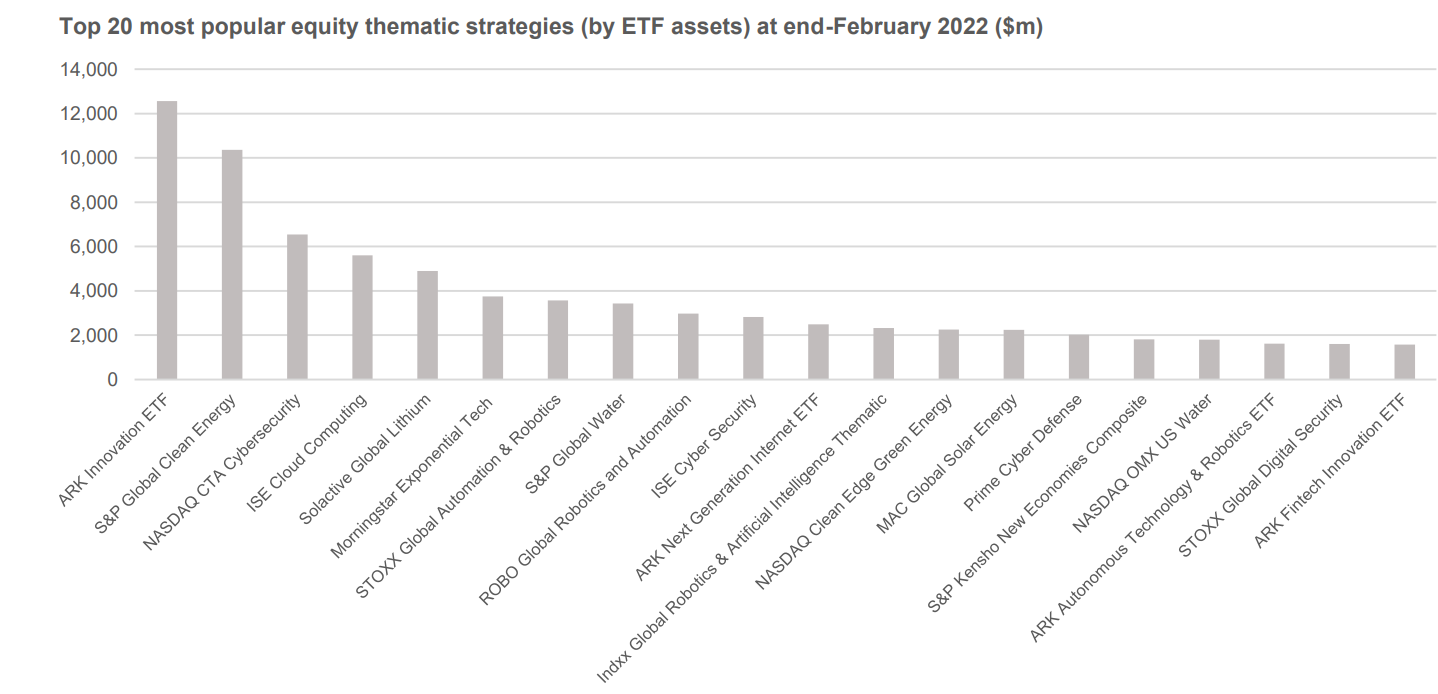

Globally, there are just two equity thematic baskets with more than $10bn AUM, the ARK Innovation ETF (ARKK) and the S&P Global Clean Energy index – with five ETFs using it as their benchmark.

Source: Société Générale

At the start of the month, Morningstar downgraded its stance on ARKK from ‘neutral’ to ‘negative’, with Morningstar analyst Robbie Greengold emphatically describing the approach of its manager, Cathie Wood, a “liability” after she almost halved the size of the ETF’s basket and “doubled down on her perilous approach”.

Over the year to 20 April, ARKK returned -53.4% according to data from ETFLogic. While still up 161.7% since its launch in 2014, Wood’s flagship product was still outperformed by the $183.4bn Invesco QQQ Trust (QQQ) by almost 68% during the same period – before fees and portfolio turnover costs.

Elsewhere, Europe’s largestthematicproduct and the largest tracking S&P’s clean energy index – the $6.1bn iShares Global Clean Energy UCITS ETF (INRG) – positively distortedthematicflows data in a considerable way, with $755m inflows during the year to date to 20 April.

Unfortunately, the product is emblematic not only ofthematicETFs’ tendency for periods of exceptional outperformance in short bursts but also the growing challenges they will face as we move into a phase of higher interest rates. Since launch in 2007, the ETF is down 35%, before fees.

Some of the steam has certainly come off thethematicETF hype train in recent months, the question now is whether new launches will keep positive momentum alive or whether a more cautious economic outlook will lead to more conservative asset allocation.

In January this year, PwC conducted a survey of 60 executives from ETF issuers, service providers, market makers and asset managers. Of this number, 82% expectedthematicETFs to be the biggest growth area over the next 24-36 months. It would be interesting to see if that number has waned after such a challenging start to 2022.

Related articles