No crystal ball is needed to realise markets face many of the same inflation-based risks in 2023 as they did this year, however, investors will question whether asset valuations now look more attractive and whether we will ever return to pre-pandemic financial conditions.

The answers provided in asset manager and investment banks outlooks are predictably mixed, but all helpfully agree that most outcomes in 2023 are uncertain. They also virtually unilaterally declared the end of the 40-year ‘great moderation’ of low inflation and with it, the past decade-long regime of ‘free money’ that lifted all boats.

Now, standing at the end of a year where investors saw four-decade-high inflation and the worst returns for a US 60/40 portfolio in over half a century, the key debate is to what extent future risks have already been priced in by equities and bonds.

There is some room for optimism as investors have derated the price-earnings ratio of the S&P 500 by as much as seven times and speculative growth sentiments crashed up to 80% from highs, according to JP Morgan, showing some of the excesses of 2021 have washed away.

But some, including the world’s largest asset manager, are not convinced a sustained hand-in-hand rally across the board is on the way any time soon and in fact, such events may be the stuff of regimes gone by.

In its 2023 outlook, BlackRock said: “The new regime of greater macro and market volatility is playing out. A recession is foretold. Central banks are on course to overtighten policy as they seek to tame inflation.

“We expect to turn more positive on risk assets at some point in 2023 – but we are not there yet. And when we get there, we do not see the sustained bull markets of the past.”

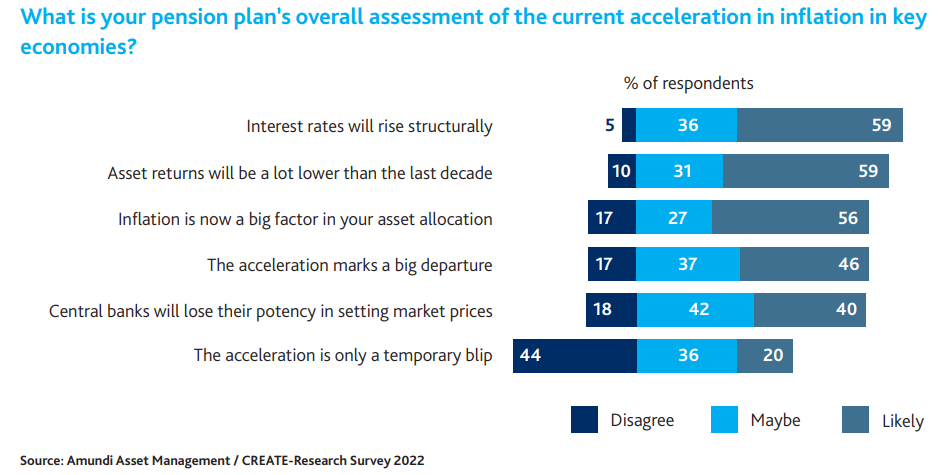

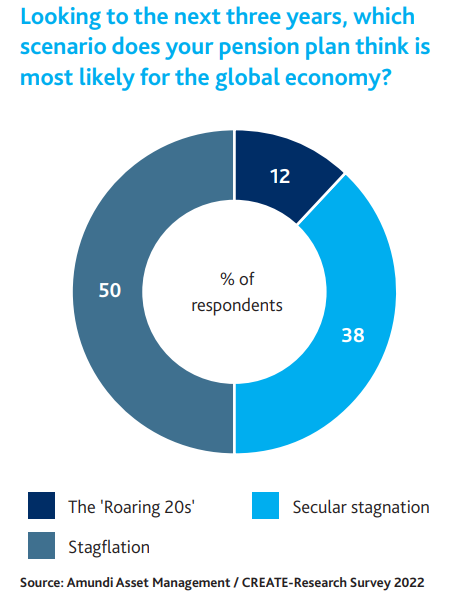

Findings from CREATE Research and Amundi’s annual survey of more than 150 pension funds show these sentiments are echoed among institutional investors.

Inflation

Starting with the headline story of the year soon to end, a second consecutive US Consumer Price Index (CPI) reading below consensus targets supports the view ‘peak inflation’ has been come and gone.

What comes now are questions about how long it will take for the recent year-on-year headline reading of 7.1% to move towards target levels of 2% and where this inflation is happening both geographically and within the inflation basket.

On the latter, PIMCO said on last month’s CPI reading that “moderation in good categories is underway”, but “stickier categories remained sticky”, showing the inflation equation is not being solved evenly.

The UK, for instance, has an unclear inflation pathway, according to Thomas Becket, CIO at Punter Southall Wealth, who added this question will only be answered when the government’s support for household bills is set out.

“Indeed, energy and oil are the greatest unknown factors in the likely path of inflation rates, and while the prices of many commodities have moderated in recent months, various structural factors could ensure that they remain elevated or move higher once again,” Becket added.

In its 2023 outlook, Deutsche Bank said inflation is its “key concern in the euro area” and it expects “stagflation to define 2023 even more than it did 2022”. Even so, it expects eurozone headline inflation to fall slightly below 9% by the end of Q1 2023, down from its recent high of 10.6% in October.

It too expressed concerns about imbalances in the inflation basket including “methodological issues” compromising the passthrough of wholesale gas prices to the European Central Bank’s key inflation index. It added food prices continue displaying “historically fast” 1% month-on-month inflation.

As for tackling inflation, the CREATE Research-Amundi survey painted a bleak picture for the agency of central banks, identifying supply chain bottlenecks and the Russia-Ukraine conflict as the two main key drivers – both of which are out of policymakers’ control.

Interest rates

Though events such as Federal Open Market Committee (FOMC) meetings are closely watched by markets and the general public alike, asset managers and wealth managers agree central banks will continue hiking rates into the new year with no guarantee of getting inflation down to target levels in the near-term.

BlackRock said central banks must choose between “crushing demand” down to levels economies can comfortably cater to or accept high inflation as a structural fixture.

“For now, they are all in on the first option. So a recession is foretold. Signs of a slowdown are emerging. But as the damage becomes real, we believe they will stop their hikes even though inflation will not be on track to get all the way down to 2%,” BlackRock argued.

JP Morgan agreed, stating central banks in the US and Europe are unlikely to pause hikes until labour markets loosen and wage cost pressures ease from current levels.

Overall, BlackRock, PIMCO and JP Morgan agreed the Federal Reserve’s terminal rate would be on or just shy of 5% in 2023 while JP Morgan and Deutsche Bank said the ECB’s terminal rate would be 2.5% or 3%, respectively, by the end of Q2.

Becket remarked: “These monetary heroes are looking to slay the inflationary dragon, which they themselves were at least partly responsible for unleashing on the world.

“Yes, the irony that we are letting those same arsonists who started this fire be responsible for extinguishing the flames has not escaped us.”

Recession

Amid punitive monetary policy, an unexpected rise in unemployment and lingering supply constraints, a slump in economic growth is forecast. The question is how deep this contraction will be.

On one side, JP Morgan argues a global recession could take hold by the end of 2024 but think it is unlikely for one to take hold in early 2023 as declining inflation and moderating Fed tightening support US growth.

However, the bank warned there will be a “hard landing” in global manufacturing this quarter, with a 47.8 purchasing managers’ index reading for November, down 1.4% year-on-year while order and inventory component expectations for the coming six months “remain depressed” versus long-term averages.

Less confident about the year ahead is Deutsche Bank, which suggested a recession has already begun in the eurozone – albeit shallower this winter than previously feared – but it is concerned a “double dip” recession could materialise from high energy costs, more monetary tightening and the US entering a recession.

Similarly, it added the UK has “probably” already entered a recession but its timeline to recovery could be extended by a disposable income squeeze pushing down household consumption for “several quarters” while Brexit supply shocks linger. The bank concluded the UK’s GDP would be unlikely to reach pre-pandemic levels until 2025.

Becket said a global recession has been widely forecast but uncertainty remains over whether growth will be negative or marginally positive. His firm predicts low and patchy growth in 2023, with elevated inflation and the post-pandemic promise of a ‘roaring twenties’ a very distant possibility.

As for China, which is on the cusp of its post-pandemic reopening, questions are rightly being asked about how the end of its ‘zero-COVID-19’ policy will be handled in light of the largest protests in the country since the Tiananmen Square crisis.

On this, JP Morgan said surging COVID-19 cases “threaten our already downward-revised outlook” and the success of the zero-COVID-19 loosening. With a lack of effective vaccination roll-out and natural immunity, “a smooth recovery path for China looks very unlikely”, the bank said.

Despite this, Morningstar has upgraded its conviction on emerging markets – which China makes up a third of by market cap – to “medium to high” in light of valuation, fundamental risk and contrarian elements. This shows the picture for China and other emerging markets remains unclear.

Corporate earnings and valuations

As the tepid-at-best outlook unfolds and consumers and companies continue to be pressured by rising borrowing costs, it naturally follows corporate earnings will begin reflecting these challenges after showing resilience in 2022.

Becket said company revenues are still rising due to price rises but such trends are likely to unfold as consumers stop being able to absorb large price increases and earnings are hampered by continued wage growth.

BlackRock added earnings expectations do not price in “even a mild recession” but it could turn more positive as valuations move closer to reflecting the economic damage that could unfold.

It added: “It is not just about pricing the damage: We could see markets look through the damage and market risk sentiment improve in a way that would prod us to dial up our risk appetite. But we are not there yet.”

Becket noted some non-US equity exposures are already “not expensive” including those in Europe, the UK, Japan and even China, however, there are some nuances to consider regarding the end of the ‘cheap debt’ era.

First, cheap debt allowed companies, especially in the US, to perform stock buy-backs that support their share prices and inflation ‘earnings per share’. He said this will likely be “greatly reduced”.

Second, a high rates environment will mean the difference in outcomes for poorly and well-run companies will be more apparent, with more structural volatility meaning investors might have to become more agile in their positioning.

Despite these considerations, Morningstar said “valuations are significantly better now than late-2021”. A year ago, no developed market equities were undervalued according to its models, whereas almost 30% are “cheap” versus long-term expectations, as at the end of October.

Key takeaways

Considering the correlated downturn of equity and fixed-income assets this year, Morningstar expects the 60/40 portfolio could deliver a return after inflation of 3.6% over the next two decades, up from 2% a year ago.

However, underlining the shift to greater volatility, BlackRock said a diversified ‘fire and forget’ approach to asset allocation may not be the optimal approach.

“The new regime requires a new investment playbook. It involves more frequent portfolio changes by balancing views on risk appetite with estimates of how markets are pricing in economic damage. It also calls for taking more granular views by focusing on sectors, regions and sub-asset classes, rather than on broad exposures.”

Echoing BlackRock’s thoughts, Becket said the US market “remains dear” but specific opportunities are in healthcare and renewable technologies. Going forward, a broader growth to value shift could be underway alongside a shift to non-US exposures after more than a decade out in the cold.

Deutsche Bank noted there is a ‘polycrisis’ of macro and geopolitical events for investors to be wary of including Russia escalating tensions, cost-of-living crises triggering social unrest and both industrial action and political instability.

With this largely undecided but grey-skies outlook, the conventional wisdom remains – to not chase returns but position appropriately for as many of the likely outcomes as possible.

Related articles