You might be surprised to hear that carbon is one of the best performing commodities of the last two years.

Carbon futures rallied 375% between July 2017 and July 2019, according to data from WisdomTree, and the continuing push to reduce carbon emissions may mean there is further upside left.

Nitesh Shah, head of research at WisdomTree, said: "Given that the European Union (EU) has signed up to the Paris Accord [the agreement that promises to limit global temperature gains to 2 degrees Celsius], we believe that it will have to double down on its efforts to thwart rising green-house gas emissions and to tighten carbon allowance availability.

"Carbon future prices could thus continue to rise as the EU strives to do its part in keeping global temperature gains in check."

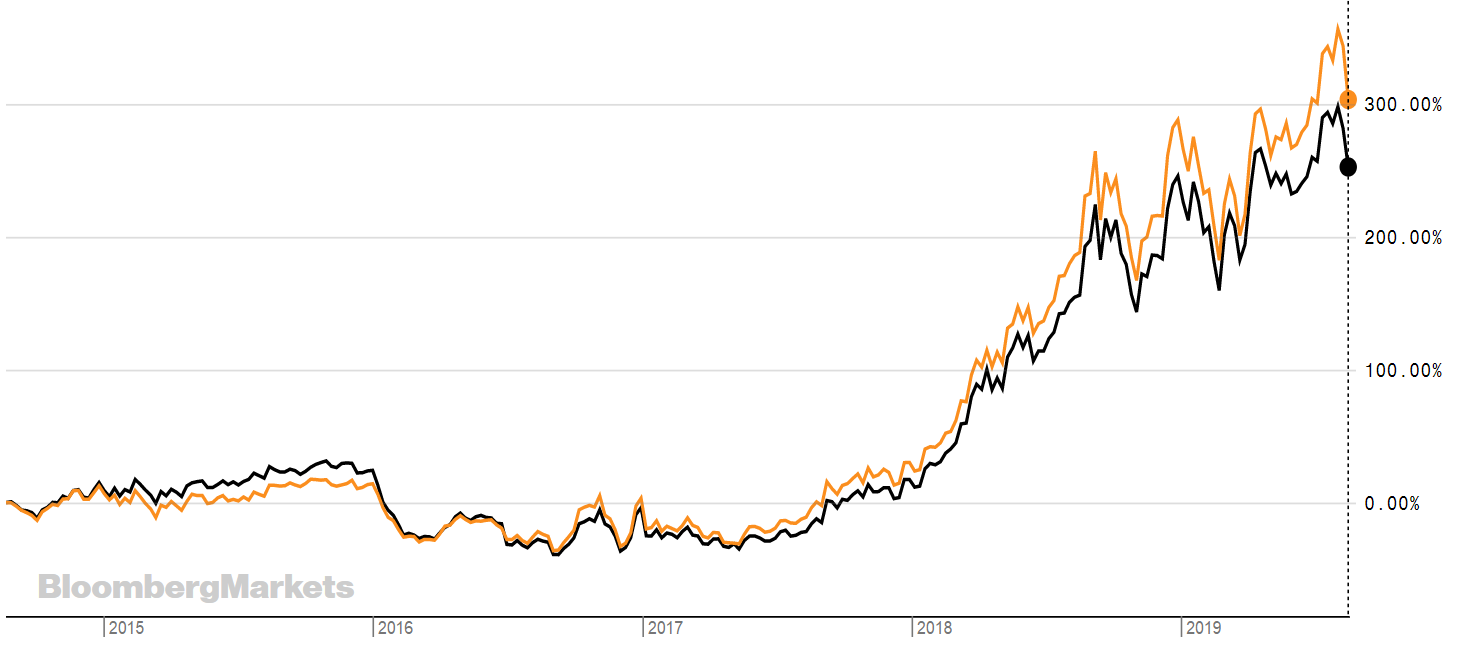

Figure 1: Historical Performance of Carbon Futures

Source: Bloomberg, WisdomTree, data available as of close 09 August 2019.

The lesser known commodity has beaten rallies in palladium, oil and gold which have grabbed the headlines of late.

But there are several factors to take into consideration when looking at carbon, which has recovered from a low base in 2013 when the carbon price crashed to €5/tonne.

Since the European Union’s Emissions Trading System (EU ETS) was launched in 2005, the number of permits for polluting activity (allowances) has been reducing.

According to WisdomTree data, the EU has been cutting the supply of allowances by 1.74% each year since Phase 3 of the programme began in 2013. As the EU ETS enters Phase 4 of the programme in 2021, allowances will be reduced by 2.2% until 2030.

If you want access to the rising value of carbon there is only one ETF (available in euro and sterling) on the London Stock Exchange - Wisdom Tree’s ETFS Carbon (CARB/CARP), which has returned over 70% in the past three years. The graph below shows CARB in black (€) and CARP in orange (£), they cost 0.49% and track the ICE Futures ECX CFI EUA less fees.

Source: Bloomberg

Despite this CARP has returned only 5% YTD. This may be down to issues surrounding Brexit – the EU ETS currently relies on the UK’s participation – although Shah points out that "the UK government claims it is firmly committed to its international climate change agreements and thus is unlikely to exit in a manner that will undermine the EU ETS system".

This may only be a blip. There is also likely to be more upside because as politicians look to reduce carbon emissions the supply of carbon credits to carbon markets are likely to become more restricted.

Shah explains: "The European Commission (EC) will not be loosening policy in the near future – because the target itself is likely to get more aggressive unlike the inflation target which has not changed since it became a concept.

"We see policy tightening in the EU ETS for the foreseeable future. With the EC under new leadership, the market is convinced the administrative institution will maintain policy stability to continue with its emissions tightening programme."

There are also certain factors which will play into the hands of a rising carbon price. The Paris Agreement’s central aim is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees.

Saying all this – and if your conscience is getting the better of you – then there are also clean energy ETFs now on the market and even a carbon impact ETF.

First Trust recently launched its actively managed carbon impact ETF in the US. The aim of the fund is to provide exposure to firms that are reducing, or planning to reduce, their carbon footprint, but it comes with a hefty price tag of 0.95%, and – as above – is available on NYSE Arca.

Available on the LSE are funds such as iShares global clean energy ETF, which has a very respectable 38.26% YTD return. The price tag is 0.65% and it tracks the S&P Global Clean Energy Index. The index offers exposure to the 30 largest and most liquid listed companies globally that are involved in clean energy related businesses.

In the table below is the carbon ETF on the London market plus another environmental ETF.

CARP (£)

CARB

INRG

ETFYTD RTNTERINDEXETFS Carbon5.13%0.49%ICE Futures ECX CFI EUAETFS Carbon (€)3.21%0.49%ICE Futures ECX CFI EUAiShares Global Clean Energy UCITS ETF (£)38.31%0.65%S&P Global Clean Energy Index. The index offers exposure to the 30 largest and most liquid listed companies globally that are involved in clean energy related businesses.