Analysing ETF transaction costs could provide investors with insights into when an ETF is set to trade at a significant discount to net asset value (NAV), according to research conducted by MSCI.

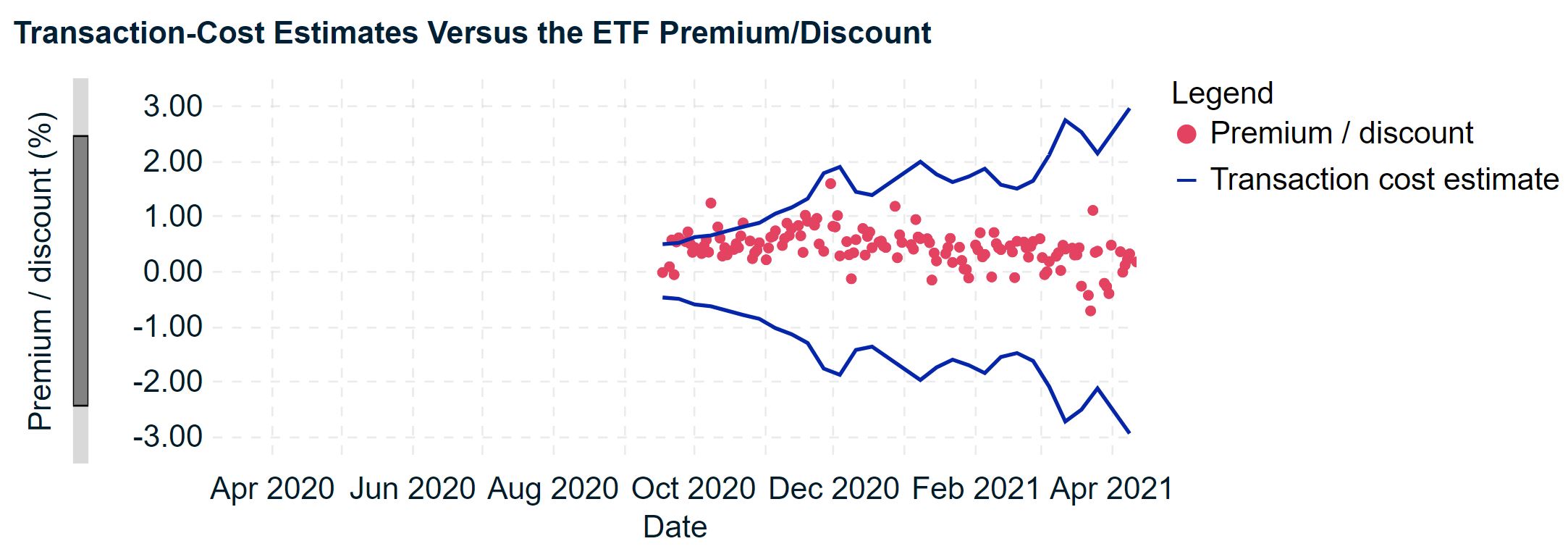

The research, titled What can liquidity tell us about ETF prices?, found transaction cost estimates – as calculated using MSCI’s RiskMetrics and LiquidityMetrics tools and historical flow data – were close to the maximum ETF discount or premium to NAV difference of the ETFs studied.

ETF prices to NAV are an increasingly important source of risk for investors following the all-time high discounts fixed income ETFs blew out to in March 2020.

As liquidity vanished from the opaque underlying bond market, fixed income ETFs traded as much as a 10% discount to NAV, providing investors with real-time pricing on bonds that were infrequently trading.

Furthermore, thematic ETFs have soared in popularity over the past 18 months which has caused liquidity concerns with many offering exposure to small caps and as a result, own a large proportion of their shares.

Amid the potential liquidity issues, Laszio Hollo, vice president, risk management research, at MSCI, analysed nine US-listed thematic ETFs between $1bn and $20bn assets under management (AUM) which have the highest ownership ratio, as calculated by the number of shares in the ETF relative to the total shares outstanding.

When studying the differences between the ETF price and NAV, Hollo found the higher the transaction costs, the bigger the discrepancy. Transaction costs are driven by the liquidity of the underlying shares and the transaction size.

Source: IHS Markit, MSCI

It is worth noting that very rarely did the ETF price-NAV difference fall outside of MSCI’s transaction cost estimates due to the clear arbitrage opportunity this would offer authorised participants (APs).

“A simple model would say that the price-NAV should never be higher than the transaction costs that the AP would incur to eliminate the arbitrage,” Hollo explained.

“For most of the funds studied, these transaction-cost estimates were close to the maximum price-NAV difference during our sample period.”

Overall, with ETF discounts to NAV becoming an area that requires further attention following the liquidity crunch last March, transaction costs could be one way to monitor the risk, the research said.

“Even though the ETF price remains close to the NAV most of the time, the difference between price and NAV is a source of risk for ETF investors, especially when market liquidity dries up,” Hollo concluded. “Transaction costs may provide a forward-looking view of price-NAV risk, which may enable investors to more effectively manage this source of risk.”