A common theme we see among the UK adviser community is a preference for physically-backed ETFs over synthetic ETFs that use swaps and derivatives.

This is driven by a scepticism that derivative-based products may contain hidden fees or carry excessive risk. A penchant for ETFs that buy the underlying securities in an index has developed, as it feels the most similar to purchasing an active open-ended fund – it is perceived as both simple and transparent.

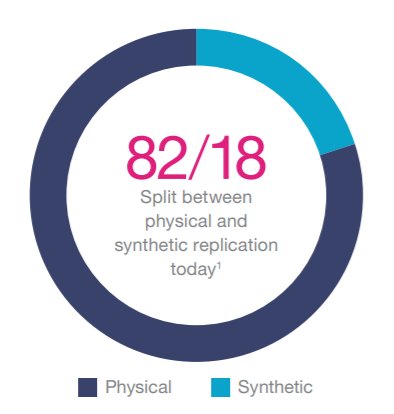

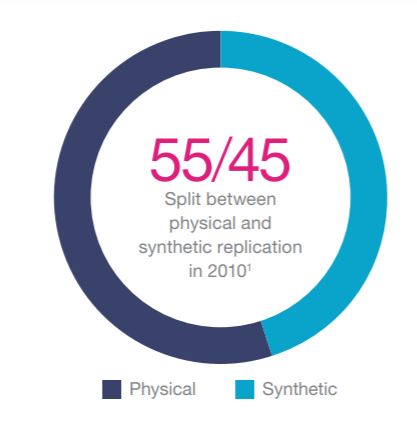

According to a report from Lyxor in 2019, 82% of European ETFs are now physically backed, up from 55% in 2010.

2019 2010

Source: Lyxor, May 2019

The pros and cons of synthetic ETFs

There are situations where using a synthetic ETF can lead to superior returns compared to its physical equivalent.

For example, in the US, swap contracts are currently exempt from dividend-withholding taxes, avoiding the 15% rate suffered by Irish physical ETFs, or 30% by Luxembourg physical ETFs.

Alongside tax treatment, synthetic ETFs can sometimes present a better option in areas such as emerging markets. This could be because physical custody of assets is avoided (which can carry high costs) or because the swap can deliver a return above the index due to market regulation: for example, in China – where short-selling is banned for many stocks – a swap agreement allows a bank to go ‘short’ without having to physically short the securities, and investors are willing to pay a premium above the index to do this. For instance, the CSI 300 swap product from Xtrackers currently states that it expects the ETF to outperform the index by nearly 6% per annum, even after fees.

On the other hand, achieving this additional return comes with risks.

Until recently, Lyxor products operated with a single swap party for several of its synthetic products – its parent company Societe Generale. These products are usually fully (and sometimes over) collateralised, meaning if Societe Generale ran into issues, an investor would have comfort that a pool of assets is available to them in lieu of Societe Generale defaulting on its obligations.

However, a default by Societe Generale could occur as part of a general market sell-off, meaning the pool of assets received by the investor may be less than the value of the index. It is this sort of scenario, however unlikely, that appears to push people towards physically-backed ETFs where, in the event of failure of the ETF, the assets designed to track the index become the property of the investor.

It is also worth noting that some swaps have embedded fees that are not necessarily included as part of the ongoing charge of the ETF; this could be rebalance fees or swap origination fees, for example. As such, understanding the true cost of a synthetic ETF can take additional research.

In defence of synthetic ETFs, the majority of products use a panel of counterparties, spreading the risk, meaning that if one counterparty was to default, the impact would be smaller; it is also an increasing trend to disclose an ‘all-in’ fee, including any costs that form part of the swap.

The hidden risk in physical ETFs

Perhaps what is most surprising to us, given the aversion to counterparty risk within synthetic ETFs, is the lack of adviser engagement with regards to security lending within physically-backed ETFs.

In essence, a physical ETF engaging in securities lending faces a very similar counterparty risk to a synthetic ETF with a well-diversified panel of counterparties and a prudent approach to collateralisation.

In a similar way to using synthetic ETFs, security lending offers both risks and returns.

Securities lending is the process of lending out positions, usually to allow the other party to cover a short position. In return, the counterparty will post collateral, and pay an agreed rate. The rate received for each security varies, and is linked to both supply and demand. For example, a thinly-traded small capitalisation stock may demand a higher rate. Rates are also linked to general interest rates, and as such have fallen significantly since the financial crisis as central bank rates have fallen. Putting together a large blue-chip stock may only earn a rate of a few basis points, whereas a high-yield bond may earn something closer to 1%.

Although securities lending returns per security vary, the counterparty risk is independent of the securities on loan – rather, it is linked to who they are lent to. A judgement call is required to understand if the extra return received is worth the (albeit marginal) counterparty risk.

As part of our due diligence process for deciding which ETF providers to use, an important pillar is understanding the approach to securities lending.

The key areas we look at include:

Security lending policy and philosophy

Fees taken by the ETF manager

Indemnities

ETF tracking difference

Varying approach

Different providers take differing approaches to securities lending. For example, Blackrock uses its scale and technology to generate security lending returns for its products, while being conscious of risk, using its Aladdin technology across the entire portfolio. Vanguard describes its approach as ‘value-based’, focusing on lending securities that earn high returns due to demand, often known as specials. At the other end of the scale, Lyxor does not engage in securities lending within its physical ETFs.

If an investor is genuinely concerned with counterparty risk, and wants to avoid this at all costs, then the Lyxor policy is the only one that does this fully.

Understanding fees

For providers that do engage in lending, understanding how fees work is also a minefield. Sticking with Blackrock and Vanguard: Blackrock keeps 37.5% of the gross proceeds generated, paying the remaining 62.5% into the funds. On the other hand, Vanguard states that it does not keep any of the revenue for itself, however a fee is paid to its lending agent, typically up to around 10%.

On the surface, it appears the Vanguard policy is much more investor friendly. This is why it is important to also consider indemnities and the actual return uplift to the fund.

An indemnity is an agreement from the lending agent to cover any losses from counterparty default. This is a complex legal arrangement and, much like in a synthetic ETF, it is impossible to reduce the risk to zero, as there is an extremely unlikely hypothetical situation where the indemnity may not protect an investor. However, different providers offer different levels of protection, and this may come with a higher fee.

90% of 1% is less than 62.5% of 2%. This is why it is important not just to consider the percentage of fees taken, but the level of gross revenue generated in the first place. If the provider is able to use its scale and technology to generate higher gross returns, even after higher fees, this could lead to a higher net return for investors.

A focus on transparency

That being said, we feel it is important that scrutiny is placed on managers who are taking a fee from securities lending, to ensure it represents good value for investors, and call for benefits of scale to be passed onto investors, through lower fee shares or lower ongoing fees.

There is no right or wrong approach to securities lending within the European market. However, we feel there is a lack of transparency at the moment, making it hard for investors to understand the impact their approach has on both the return and risk of the ETF investments, especially retail investors who may not have the resources to undertake this level of due diligence.

We continue to campaign for consistent reporting from ETF managers with regards to security lending, including the disclosure of gross returns, net returns, fees kept by the provider and counterparty exposure.

ETF due diligence

When selecting an ETF, a topic such as security lending is a stark reminder that looking at metrics such as ongoing charges, spreads or even tracking error are not enough to understand future risk within each product, and that a due diligence process similar to selecting an active fund is required. Purchasing physical ETFs rather than synthetic ETFs does not necessarily lower counterparty risk, despite the common perception, and it is important to consider stock lending practices as part of the selection process.

Morningstar: Synthetic ETFs still have role to play despite 'negative connotations'

Despite some of the advantages to synthetic ETFs, at AJ Bell we still have a preference for physically-backed ETFs due largely to their simplicity – when investing in trackers, the mind set of most investors is to receive the return of the market after (reasonable) fees, with as little additional risk as possible.

Matt Brennan is head of passive portfolios at AJ Bell and was named in ETF Stream's Industry 30 in 2019 and 2020