US mutual fund firms have been put under significant pressure as of late as a result of fee compression, flow of funds falling and the transition from active to passive. Therefore, firms must act today if they are to remain competitive tomorrow, according to PwC.

Passive funds, such as ETFs, have grown massively in popularity in recent years due to their low fees. It is very rare to find a product with fees greater than 1% as most issuers are launching funds which are only three or four basis points.

In the US, rather controversially, US-based ETF issuer SoFi launched a zero-fee ETF as well as another filing with the Securities and Exchange Commission a negative fee ETF, meaning investors would be getting paid to invest.

The impact of the EU Benchmarks Regulation on the ETF industry

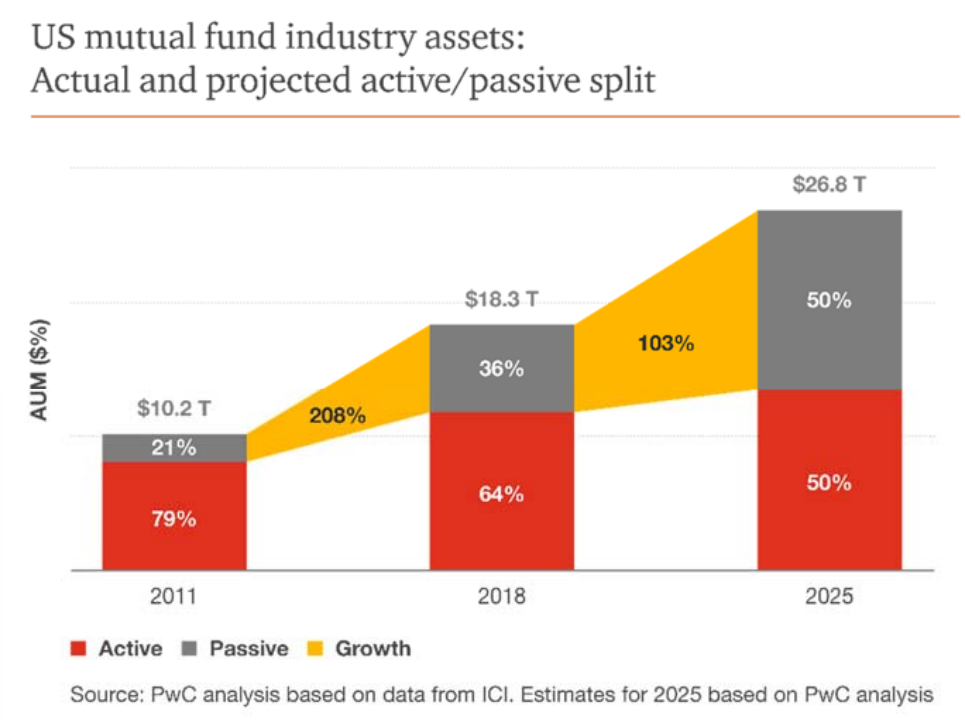

By the end of 2018, assets in US mutual funds reached $18.3tn with the split between active and passive strategies being in favour of the former, accounting for 64% while the latter accounted for 36%.

PwC forecasts the industry to continue growing to $26.8tn by 2025 and for passive strategies to account for 50% of this figure.

To keep up with ETFs’ competitive fees, which many have seen as a marketing trap for investors, the active fund industry has also been reducing its fees.

But times are going to get even harder as PwC expects the combined active and passive fund expense ratios to continue declining by approximately 22% from the already reduced levels in 2018.

As fees are being cut in tandem with assets under management (AUM) increasing, US mutual fund revenue growth is struggling to keep in line with the funds’ inflows.

Their AUM is expected to grow by 46% between 2018 and 2025 whereas total industry revenue is only projected to increase by between 10% and 15% over the same period.