New regulation is needed to counter the system change which has seen asset managers move from ‘liquidity takers’ to ‘liquidity makers’, according to a report Redlap Consulting.

The research, titled Turning the Tables on Liquidity Provision, revealed the COVID-19 pandemic has prompted an increased use of electronic liquidity providers (ELPs). With this shift to automated trading, the buy-side has improved access to new trading partners which helps improve the efficiency and diversity of trading options.

In the context of fixed income, the buy-side’s need for access to balance sheet risk capital strengthened banks’ role as intermediary between the wholesale interdealer and asset managers. The loss of this balance sheet during the pandemic has prompted the buy-side to take more agency in liquidity creation, the report said.

Filling the gap left in the market by the sell-side, ELPs are more able to warehouse risk across a broader pool of assets, widening the inventory the buy-side are able to engage with.

“This, in turn, is moving buy-side dealing desks away from being the passive recipients of sell-side liquidity,” the research continued. “Instead, they are increasingly becoming active participants themselves in sourcing and building latent liquidity.

“Greater use of automated workflows among a wider group of trading counterparties is placing asset managers in the driving seat to select not only what liquidity is available to them and where – but also, what assets to trade and how.”

This innovation is helping the buy-side to take greater ownership of execution, which impacts who they choose as liquidity provider and also the services they require more generally.

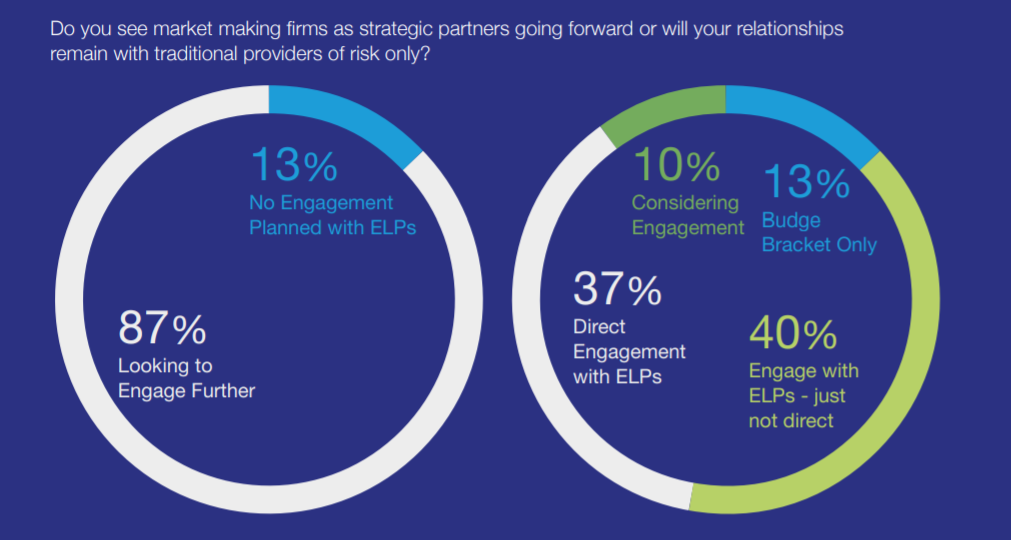

Of the 30 head of trading at asset managers interviewed by Redlap Consulting, 87% said they plan to increase their engagement with ELPs, while 37% said they plan to increase their direct engagement with alternative liquidity providers.

However, while ELPs are very active in the ETF space, 73% still choose to trade over the counter (OTC) derivatives with banks, given the breadth of services they provide.

Source: Redlap Consulting

Another key finding is the transparency of accurate post-trade data remains a priority for the buy-side, with respondents saying they want to understand whether their order flow has taken or provided liquidity, which affects who they choose as a trading counterparty.

Initiatives such as improved FIX Protocol tagging are benefitting asset managers, but other developments such as a consolidated tape in Europe remain essential for further progress.

Crucially, the evolution of ELP usage and what it means for asset managers as potential drivers of liquidity is an ongoing and fundamental shift in the European trading landscape.

The impact of this shift should prompt regulators to keep pace or risk falling behind, the report said.

Agreeing, Piebe Teebom, secretary general of FIA EPTA, the European industry body for market making firms, said: “The trends identified in this report are significant as they signal a clear shift in the balance of liquidity provision in European markets.

“It is a fundamental realignment which policy-makers should consider as they update the regulatory rulebooks in both the EU and UK.”