It is fair to say that ‘greater awareness among millennial investors’ and different thinking unleashed by the COVID-19 global crisis has certainly contributed to the drive towards ESG investing.

Research by Morgan Stanley shows that 84% of Millennials cite investing with a focus on ESG impact as a “central goal”. Other data shows that interest in ESG investing is not a perception but a reality as evidenced by Google Trends data showing searches for the term “ESG” have increased threefold from January 2016 to June 2020.

Many advisers are also reporting an increasing number of clients wanting to invest in a way that reflects their growing ethical and environmental concerns. A growing investor mindset that making returns will not matter if there is not a sustainable, stable world to live in.

Historically there was a concern that positively discriminating against ‘sin stocks’ and certain companies when investing ethically meant sacrificing performance.

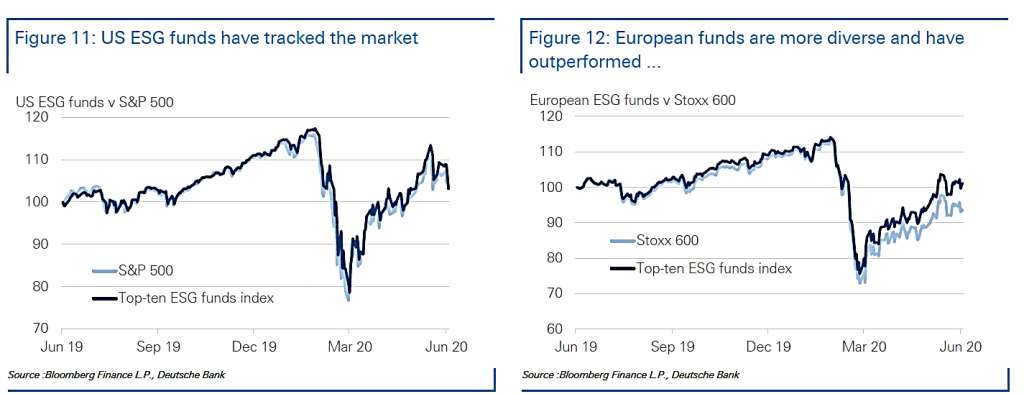

But this is not the case today as the ESG sector has increased in product numbers and sophistication; SCM Direct’s recent analysis of performance during the 2020 bull and bear markets found that ESG funds produced performance close to the market, when the bull and bear markets of 2020 were combined.

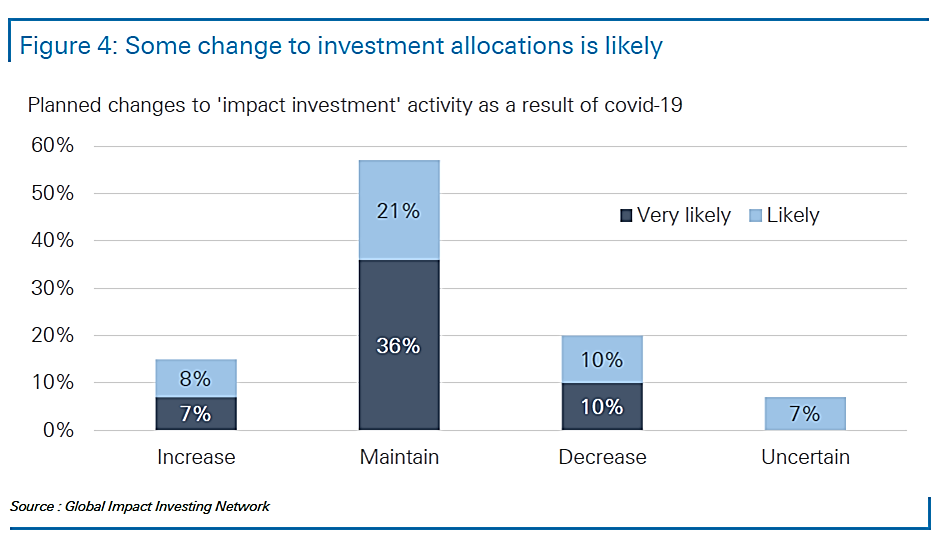

While the flurry of ESG articles would appear to illustrate that during the pandemic there has been accelerated interest in an already growing ESG trend pre-COVID, the data is mixed on how significant the size of this accelerated investor interest really is.

On one hand, nine out of ten wealth managers think COVID-19 has increased investor interest in ESG investing according to a FT/Savanta survey. On the other hand, Deutsche Bank’s analysis shows that investors have severely curtailed their investment into ESG funds over the last three months. It may well be too early to call, but the consensus is that interest in ESG is here to stay.

In terms of flows into ESG ETFs, ETFGI recently released data showing that there had been record net inflows of $28.52bn Year to Date through May, with cumulative inflows of a record $82bn into ETFs globally.

Presently, Europe is leading with the most assets and largest number of ESG products, followed by the US and Asia Pacific ex-Japan. Morningstar data shows the number of sustainable funds launched in the UK jumped from 98 in 2009 to 396 in 2019; an increase of 304% within a decade.

Irrespective of differing reports, there is a definite uptick in investor demand for ESG. The International Monetary Fund’s annual Global Financial Stability Report showed that more than $900 trillion had been divested from fossil fuel-intensive activities in 2019 (which is up from practically zero in 2013).

That said, Bill Gates has commented: “Divestment, to date, probably has reduced about zero tonnes of emissions”.

If we look at oil companies, international corporates produce c.10% of global oil, the rest is produced by national companies. Additionally, the Economist suggests that less than a quarter of industrial emissions come from companies that can be influenced by investors.

ESG during coronavirus

At the beginning of 2020, pre-pandemic, most of the interest in ESG was centred around the ‘E’ environment and climate change, but this has changed through the pandemic. According to data from Deutsche Bank “Since the COVID-19 outbreak, that has been supplanted in the US by ’employee wellness’ (up 48 per cent) and ‘accounting practises’ (up 38 per cent). Other ESG topics that have increased in prominence are ‘supply chains’ (up 18 per cent) and ‘social inclusion’ (up 16 per cent).

In European corporates are still prioritising climate change (discussion up 25 per cent) while ’employee wellness’ (up 21 per cent) and ‘supply chain’ (up 15 per cent) have seen the second- and third-largest increases in management discussion.”

This is leading to more of a balance away from ‘E’ to ‘S’ – sustainability and ‘G’ governance. This is likely to increase as people scrutinise corporations reactions to the economic consequences of the pandemic by increasingly focusing on accounting practises.

We have all felt the impact of coronavirus on some level, but it is important to look at the data to understand what drove the outperformance of ESG products during this heightened volatility. It is likely that the top reasons include low exposure to oil-dependent companies, the fact that the aviation industry was hit hard by the fall in tourism and finally, the increased exposure to tech.

ESG ETFs continued to see inflows when the rest of the market saw outflows

In addition to increased investor and public ESG awareness, a belief that ESG will deliver strong performance has also been a driving force, with the majority of ESG funds having outperformed the wider market over 10 years.

This in part has led to flows in the UK increasing 37-fold in the last three years according to Calastone. In the US, Q1 inflows into sustainable funds passed $10B, CNBC outlined how in the US, it was retail investors that were behind the surge with around 80% of flows going into index funds.

However, there are clear geographical differences. The data shows a notable difference between the performance of US-focussed funds relative to funds in Europe and Japan. Essentially, US funds have tracked the S&P 500 while European and Japanese funds notably outperformed the Stoxx 600 and Topix, respectively. As mentioned earlier, ESG funds have benefitted from being overweight in technology stocks since the COVID-19 outbreak.

ESG data

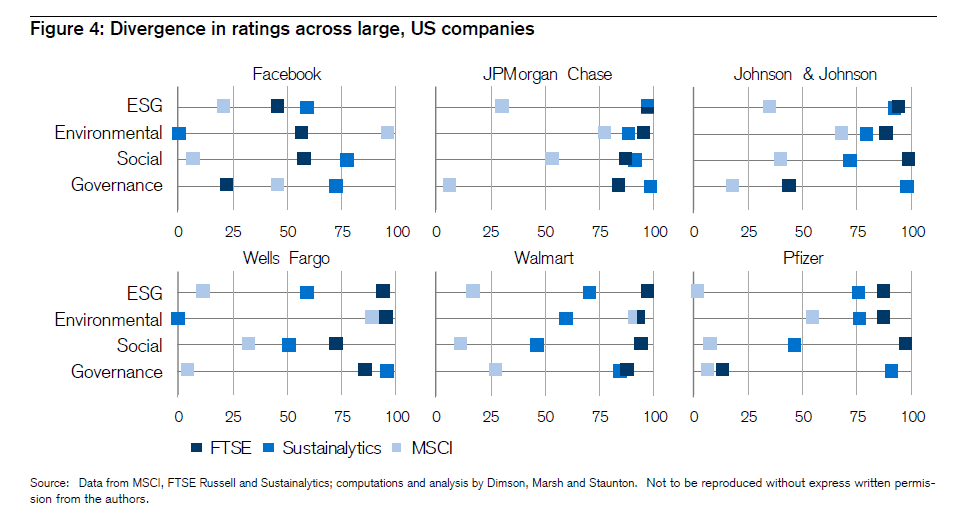

The lack of consistent ESG data is still a major concern for the ESG ecosystem and needs to be urgently resolved.

While investors should not ignore the lack of consistent ESG data, things are improving. For example, The Economist looked at the number of companies making emission disclosures over the past 5 years and reported a rise in S&P 500 companies from 53% to 67%, in the Euro Stoxx 600 from 40% to 79% and finally, in Nikkei 225 from 13% to 46%.

However, the issue remains significant – Credit Suisse Global Investment Returns Yearbook, shows how three of the main rating services graded six big U.S. companies on three main ESG factors:

Will incoming EU disclosure regulation help?

A new EU Disclosure Regulation EU/2019/2088 (“Disclosure Regulation”) that came into force in December 2019 requires disclosures to be made by asset managers and investment funds relating to sustainable investments and sustainability risks. Integrated ESG factors will have to be disclosed across websites, prospectus/pre-contractual documents, and annual reports.

Although this legislation is a very helpful step, SCM Direct believes companies’ ESG scores need to be audited by an independent third party, akin to financial report and accounts.

How big of an issue is greenwashing?

In 2010, the term ‘greenwashing’ was officially included in the Oxford English Dictionary. In the same year, the UN-backed Principles for Responsible Investment (PRI) was then set up to raise environmental, social and governance standards in the asset management industry. It placed c10% of its almost 2,000 signatories onto a watchlist for failing to meet their targets in 2019.

Since then, the PRI has “reported that 88 of the 185 companies put on notice have improved their standards, while a further 42 will meet their standards by the end of the year”. Despite this seemingly good start, “50 companies with more than $1tn of assets under management have failed to improve, with many refusing even to meet the PRI, and will be delisted at the end of 2020”.

SCM produced a report into greenwashing in 2019 which called for an improvement in regulation within the industry as we believe greenwashing could lead to the next mis-selling scandal.

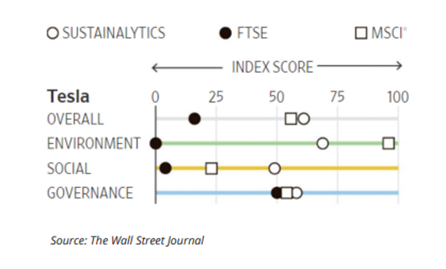

At present, there are several data scoring providers – PRI, ESG Clarity RRI, Sustainalytics, FTSE, MSCI – but there is a very low correlation between these providers on individual ESG scores as shown by the Tesla example here:

Other examples can be found here.

What more can regulators do to improve the ESG sector?

Unfortunately, the idea of what is ‘ethical’ is a subjective matter and therefore makes it hard to reach uniformity of classification. But the investment industry needs to urgently agree on definitions if it is to prevent widespread greenwashing. For example, our research found:

Various ethical funds were investing material amounts in tobacco, alcohol, gambling, and defence stocks.

Key ethical quantitative data provided by companies are not audited and open to widespread abuse.

Ethical scores/ratings varied enormously between data providers in terms of individual securities. For example, Tesla is top on one provider’s scoring, bottom by another and average by another. When a company fails to disclose a piece of information, one provider would give it a low score whilst another assumes an average score for the missing item.

Ethical scores/ratings varied enormously between data providers in terms of individual funds. For example, an identical search for “socially responsible” funds utilising two different investment platforms (powered by the same data provider) produced completely contradictory results.

Many ethical funds/strategies found to be investing significant amounts via plain vanilla Government Bonds e.g. one ethical portfolio invested 96% of its assets in a UK Government Bond fund, just 3% via an ethical fund and 1% in cash.

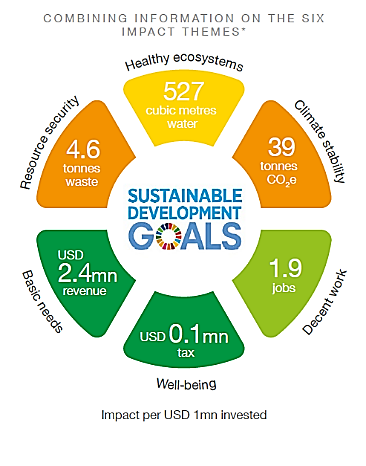

Since we launched in 2009 SCM we have been advocating 100% transparency of holdings, published every six months for all investment and pension products. This is becoming even more urgent in the ESG sector when you consider our research findings. This could be accompanied by a colour coding traffic light system, as suggested by UN Sustainable Development goals:

Alan Miller is co-founder and CIO and Barnaby Barker is an investment analyst at SCM Direct

Sign up to ETF Stream’s weekly email here