Australia’s ever-growing ethical ETF market got one fund larger two weeks ago, with State Street becoming the eighth ETF provider to list an ethical ETF.

While launching an ethical fund of some kind has become so common in Australia recently that it hardly merits noticing, State Street took an approach that does.

That is: they went for greenwashing. They didn’t just go for the trotters and the snout. They went for the whole hog.

Top 10 holdings ASX 200E200RARICommonwealth BankCSLCommonwealth BankCSLBHPCSLBHPWestpacWestpacWestpacNABANZNABWesfarmersNABWesfarmersWoolworthsTelstraWoolworthsANZFortescueANZMacquarie GroupTransurban GroupMacquarie GroupTelstraEvolution MiningTelstraRio TintoMagellan Financial Group

E200 and RARI look very similar to the ASX 200.

Rio Tinto, the mining company in the news recently for exploding sacred aboriginal sites, has been included in E200. Westpac, which is alleged to have funded child abuse, has been included. So too has Whitehaven Coal, the fossil fuel polluter and big time Liberal Party donor.

Top 10 holdingsASX 200FAIRGRNVCommonwealth BankFisher & PaykelFortescueCSLResmedGoodman GroupBHPCSLANZWestpacSonic HealthcareNewcrest MiningNABA2 MilkTelstraWesfarmersASXTransurbanWoolworthsXeroCSLANZTelstraBramblesMacquarie GroupBramblesASXTelstraCochlearSonic Healthcare

FAIR and GRNV are not closet trackers at all.

It's unfair just to pick on or single out State Street for launching greenwashed ethical funds. A great many global fund managers have done it too, including Vanguard.

But it raises an interesting question: why have they gone down this route? And is it the right approach for the Australian market?

Australia’s ESG ETF market is developed

Australia is different to other ETF markets in that ethical ETFs are actually quite established and profitable.

TickerETFAUM ($mln)FeeRun rate revenue ($mln)RARIRussell Australian Responsible Investment ETF208.80.45%0.9GRNVVanEck Vectors MSCI Australian Sustainable Equity ETF56.60.35%0.2FAIRBetaShares Australian Sustainability Leaders ETF558.60.49%2.7

The three Australian shares index ETFs are all profitable

Their growth owes to the country’s large upper class left, which is often – but not always – made of rich kids getting parental money.

A lot of people find upper class leftists uncomfortable.

ETFs are making the rich richer

But they have a lot of money. So the wealth management industry – brokers, advisers, superfunds, etc – need to find a way to cater to them.

Which is where ethical ETFs come in.

This demographic – and by extension the advisers and superannuation funds that cater to it – are serious about wanting ethical investing options. Much like they’re serious about electric vehicles. This means that a greenwash ETF isn’t really what they want. And by extension, a greenwash ETF isn't really what their representatives want either.

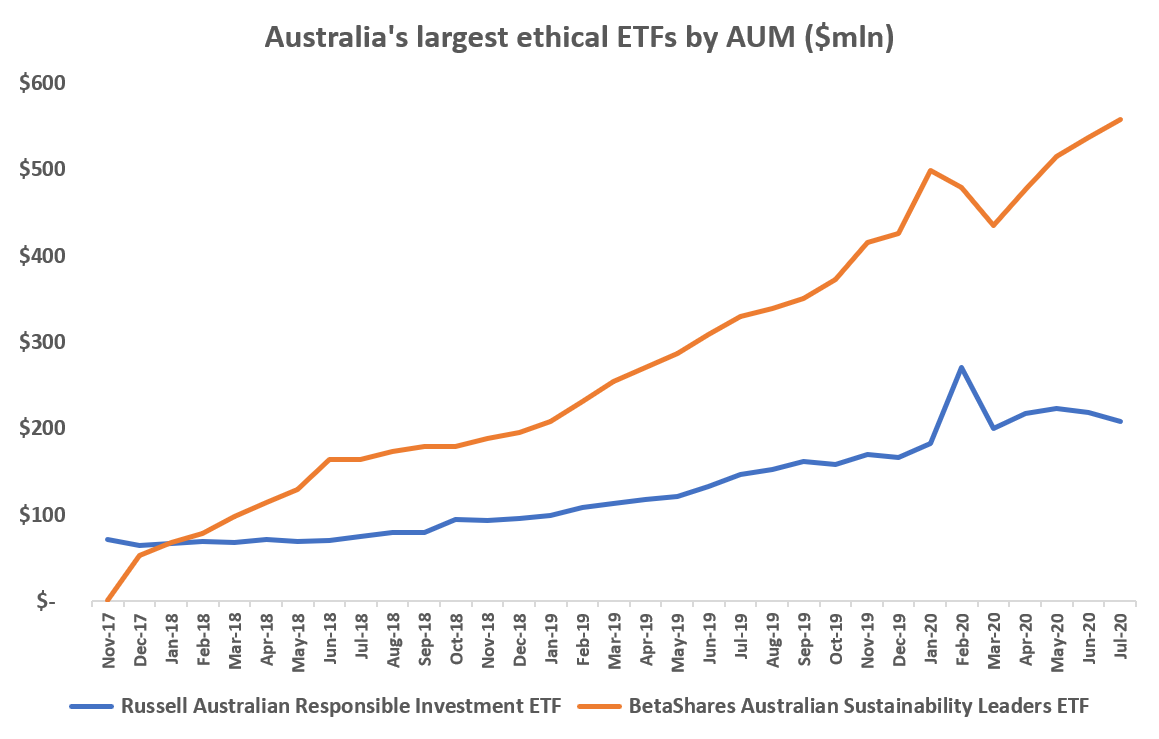

BetaShares FAIR, with its strong ethical screens, has overtaken Russell's RARI

This shows up clearly in that data. To look at the inflows into Australian ETFs in July, the ethical ETFs that did best are those with the most hardcore exclusions. Greenwash funds in recent years have either been forced to shut (UBS) or seen middling interest (Russell).

So State Street’s decision to go for greenwashing is a bit of a puzzle in this market.

So why have they done it?

Overseas decision makers

Part of the reason is surely that the final say on E200’s look and feel was made outside Australia. This often happens at big global companies. Overseas headquarters have final say on product. They can often overlook the specifics of a local market they’re trying to enter.

The other part I suspect is just the well-observed fact that it’s the small ETF providers – not the big ones – that tend to take more risk on product. And going for a less ambitious ethical screen in the manner that E200 has is less risky.