Emerging market equities have been popular among ETF investors for a long time. The iShares Core MSCI EM IMI UCITS ETF (EIMI) is the fourth-largest ETF available in Europe with $19.2bn assets under management (AUM).

Its sister ETF, the iShares MSCI EM UCITS ETF (IEEM) was launched 16 years ago in 2005 and has $4.1bn AUM. Both ETFs compete with the likes of DWS, Amundi and UBS Asset Management which also offer large ETFs tracking the MSCI Emerging Markets index.

Elsewhere, the Vanguard FTSE Emerging Markets UCITS ETF (VFEM) has proven popular with investors having gathered $2.7bn assets since launch in May 2012.

Chart 1: One-year returns for EIMI and VFEM (4 August 2020-4 August 2021)

Source: ETFLogic

EIMI tracks the MSCI Emerging Markets Investable Market index, another flavour of the venerable MSCI Emerging Markets index that IEEM adheres to. EIMI’s index is more comprehensive thanks to its inclusion of small caps.

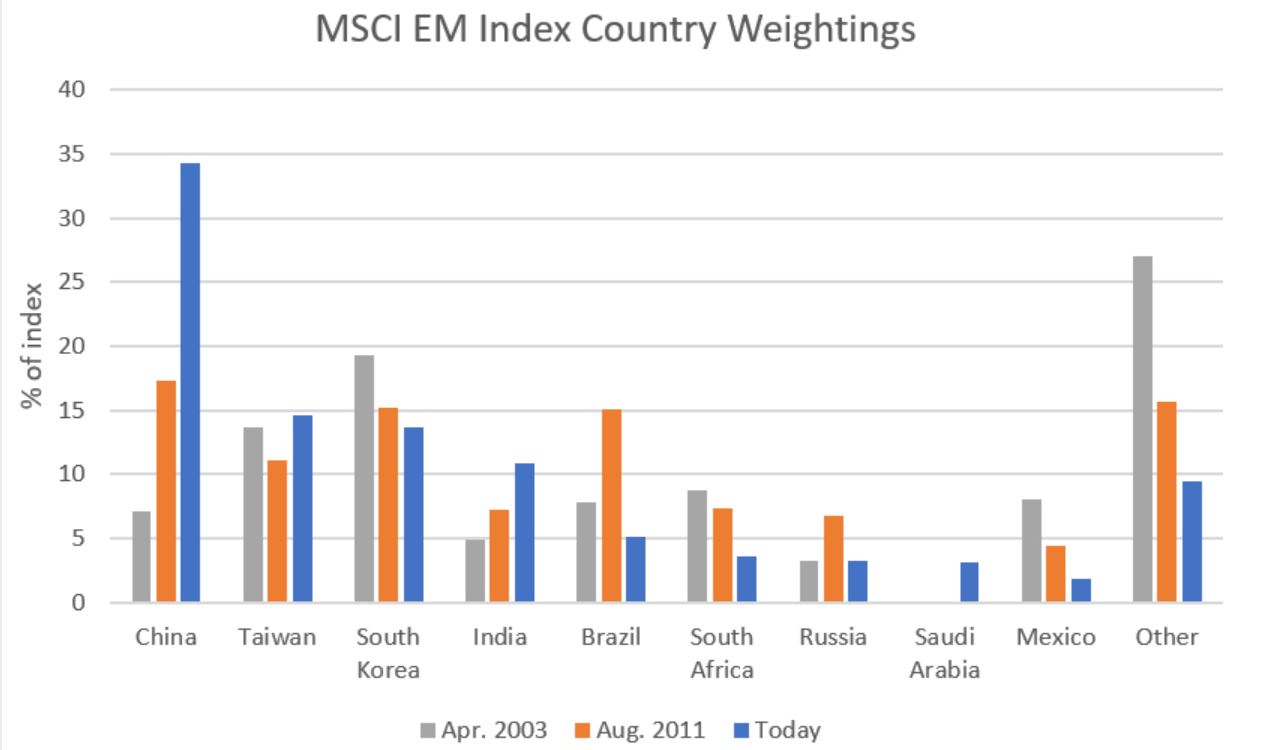

The MSCI Emerging Markets index is arguably the most recognisable emerging market index among investors. Less recognisable, however, is the makeup of the index over time.

Source: ETF.com

Today, investors are probably not surprised to hear that China is the largest weighting in the index, at 34%. But 10 years ago, China’s weighting way only half that, and in 2003, it was a mere 7%.

In contrast, Mexico’s proportion of the index has fallen from 8% to 2%, and South Africa’s has fallen from 9% to 4%.

There are clear explanations for China’s rising weighting – from the relaxation of restrictions on ownership of Chinese stocks to the inclusion of mainland equities into the MSCI EM index to the surge in the value of China’s stock market – together these factors have driven China to represent more than a third of the MSCI Emerging Markets index.

What the makeup of the index is next year or five years from now is anyone’s guess. Will China still dominate the index as you would expect, given the size of its market, or will geopolitical concerns play a part in driving the country’s weighting down from here?

The MSCI Emerging Markets index is one of the most dynamic indices, so investors should frequently look under the hood to see what they are really buying.

This story was originally published on ETF.com