The Nordic region has returned nearly 15% year-to-date and while it might not be the most obvious investment, there are good reasons to start considering it.

The region consists of Denmark, Finland, Sweden, Norway and Iceland. The countries are similar in that they all have high taxes, good social security and strong economies.

The benefits of investing are that the Nordic countries tend to have a low correlation with the US equity markets, good GDP growth, and lower price-earnings and price-book ratios than the S&P 500.

There is evidence that investors are becoming increasingly interested in the sector too.

A recent note from TheInvestor shows that a growing number of international investors are entering the Nordic commercial real estate market for the first time as they look for yield in Europe.

“Investors and investment managers are increasing their presence,” says Linus Ericsson, chief executive and head of debt & financial advisory, at JLL Sweden. “We’re seeing investment managers expand and bolster their portfolios,” he says, pointing to the Nordic region’s sound macroeconomic environment and political stability. GDP growth across the Nordics is forecast to be around 2 percent in 2019 and 2020. “Such sound credentials aren’t exactly a given in other European markets right now.”

If you want to invest then there are only two ETFs on offer on the London Stock Exchange that give access to the Nordics. One of from Amundi and the other from dbX.

Both ETFs track the MSCI Nordic Countries Total Return Net index. This provides exposure to large and mid cap equities, covering around 85% of the market.

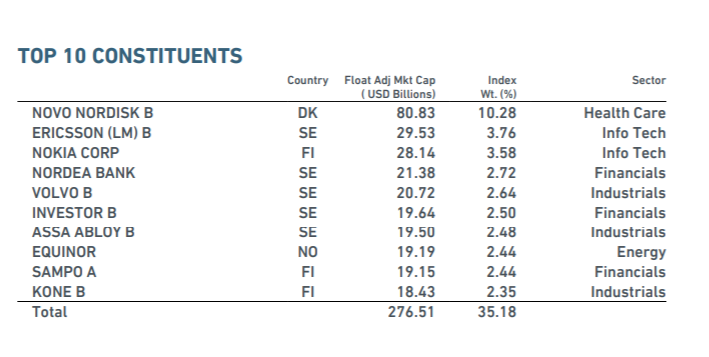

The index includes companies from the Denmark, Finland, Norway and Sweden. Sweden accounts for nearly half of the companies in the index at 43.0%, followed by Denmark at 28.9%, Finland 16.8% and Norway with 11.3%. The top ten constituents of the index are shown in this table:

Source: MSCI

The make up of each country is also very strong. Sweden is an export-focused country which focuses on vehicles, pharmaceuticals and machinery (think Volvo, Ikea and Ericsson phones). According to TheBalance, its largest trading partners include Germany, the UK, Denmark and the US. It also has a perfect credit rating and a low 41.4% debt-to-GDP ratio.

Norway focuses on shipping, oil and fishing. It has one of the biggest sovereign wealth funds globally. It also has a perfect credit rating and 30.3% debt-to-GDP ratio. According to InvestinNorway, it is a politically stable, modern and highly developed country with a very strong economy. The Norwegian economy is characterised by being open and mixed, with a combination of private and public ownership.

Norway has always been open to foreign investments. There are about 6,000 foreign-owned limited companies in Norway with many additional branch offices. Foreign companies represent about 25% of all value-creation in Norway and about 20% of the employment. Foreign investment has grown especially fast in Norway over the last decade compared to many other countries. The country is not a member of the European Union but it is a member of the EEA which gives access to the European single market.

Finland is in fact the only Nordic country that joined the Eurozone and currently uses the euro. BusinessFinland claims it is one the safest places for data.

Like the other Nordic countries, Denmark has a perfect credit rating and 44.5% debt-to-GDP ratio. According to the Balance, the country’s economy operates through a series of cooperatives and foundations rather than conventional corporations.

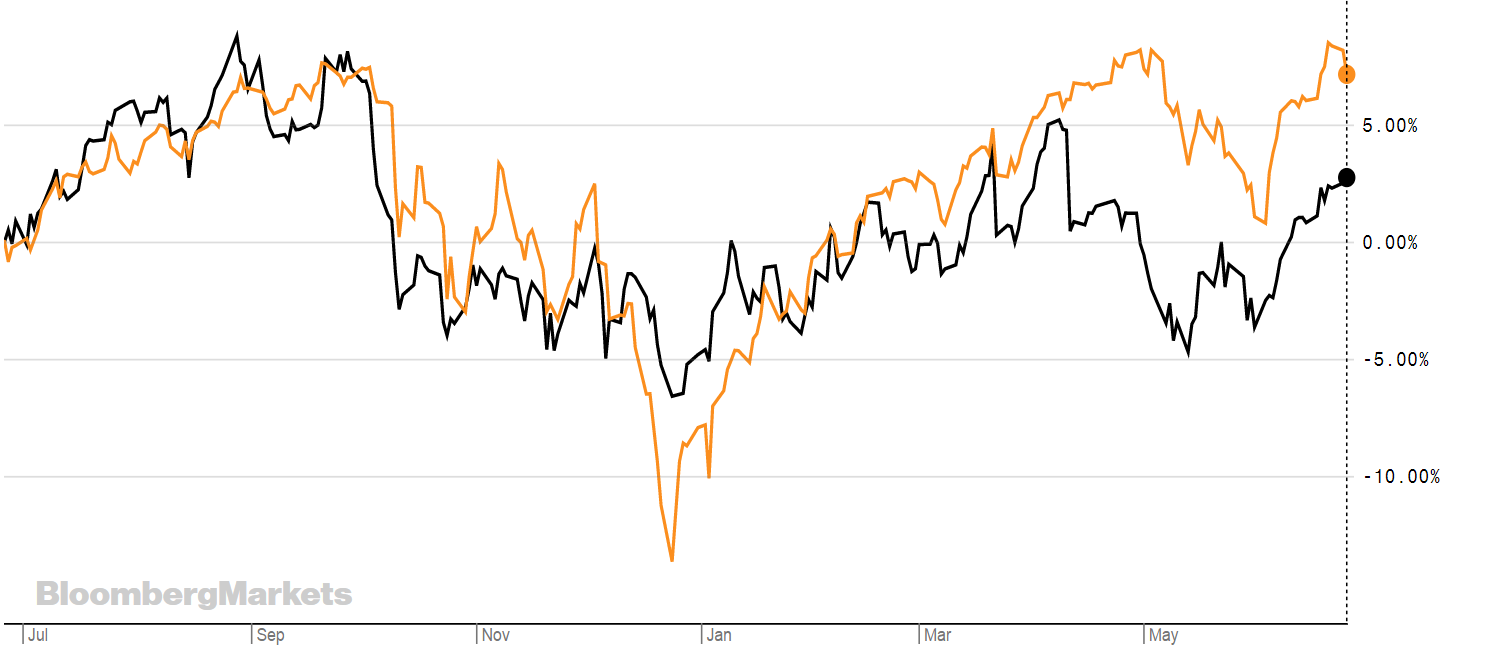

The graph below shows how the Xtrackers MSCI Nordic UCITS ETF XDN0 (in black) has performed against the S&P 500 (in orange). What’s interesting is that the volatility at the end of last year didn’t impact the Nordic region as it did US equities.

Source: Bloomberg

Peter Lidblom, DWS’s head of passive sales for the Nordics, said: “We have seen growing interest in ETFs in the Nordic countries in recent years. The market is still dominated by equities and active management, but passive solutions have had a number of good years driven by performance in relation to price.

"Investments are made in both nationally and internationally listed products and ETFs that replicate both local markets and international markets. Recently, the Finnish pension giant Ilmarinen invested over $800 million in one of our ESG ETFs.

"Since 2015 assets under management in Sweden, the biggest local market, has increased from approximately SEK 25 billion to SEK 37 billion in ETFs primarily listed on the Stockholm Stock Exchange.

"These numbers do not include investments by institutional investors, which generally trade over-the-counter, and have been investing heavily. Ilmarinen's investment in our ESG ETF is a good example of sustainability as a key driver for investments amongst these – institutional - players."

If you want access through the London Stock Exchange the two ETFs are on offer below.

XDN0

TER: 0.3%

CN1

TER: 0.25%

ETFYTD RTNTERINDEXXtrackers MSCI Nordic UCITS ETF12.71%M’ment Fee: 0.1%MSCI Nordic Countries Total Return Net IndexAmundi Msci Nordic UCITS ETF12.90%M’ment Fee: 0.15%MSCI NORDIC Countries Index TRN