The rise of thematic investment indices offering exposure to the latest trends such as artificial intelligence and space is wreaking havoc among quant investors, according to research conducted by Robeco.

The report, titled Betting Against Quant: Examining the Factor Exposures of Thematic Indices, by David Blitz, head of quantitative research at Robeco, argued thematic indices have strong negative exposure to the profitability and value factors, implying a likelihood of lower long-term returns.

As a result, Blitz argued investors in thematic ETFs are trading against quantitative investors who are searching for long exposure to the same factors.

“By going short in key asset pricing factors, investors in thematic indices are effectively trading against quant investors, who prefer stocks that are currently cheap and profitable,” Blitz added.

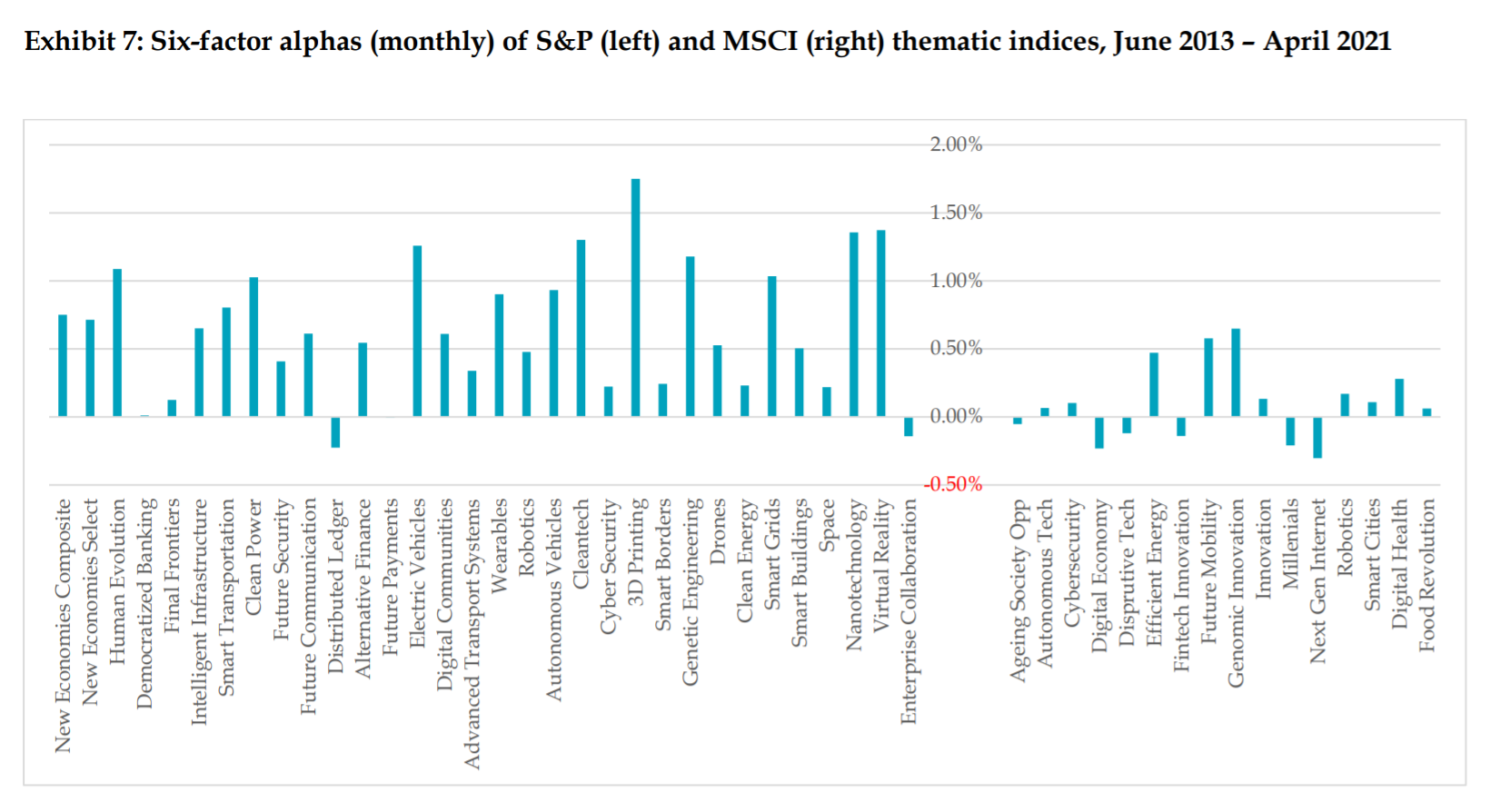

The research found almost all of S&P Dow Jones Indices’ (SPDJI) themed benchmarks had market beta above 1, with the average level coming to 1.21. They also had a high average volatility ratio – which factors in both systemic and idiosyncratic risk – of 1.67 meaning they display sizeable amounts of both risk considerations.

Directionally similar but less dramatic, the beta and volatility ratios of MSCI’s thematic indices came to 1.07 and 1.22, respectively, owing to these tending to incorporate a larger number of constituents – and often less pure-play towards their chosen themes than SPDJI.

Regarding factor exposure, SPDJI and MSCI both demonstrated positive average exposure towards size factor, at 0.65 and 0.10, with SPDJI scoring higher due to its equal weighting methodology versus MSCI which favours market cap.

Unfortunately, earlier research from Blitz and Matthias Hanauer, director of quant selective research at Robeco, illustrated the size premium has failed to materialise since it became widely discussed 40 years ago.

Where periods of factor outperformance have existed are on the Fama-French factors, covering value and profitability which Blitz stated are the most relevant factors for future expected returns.

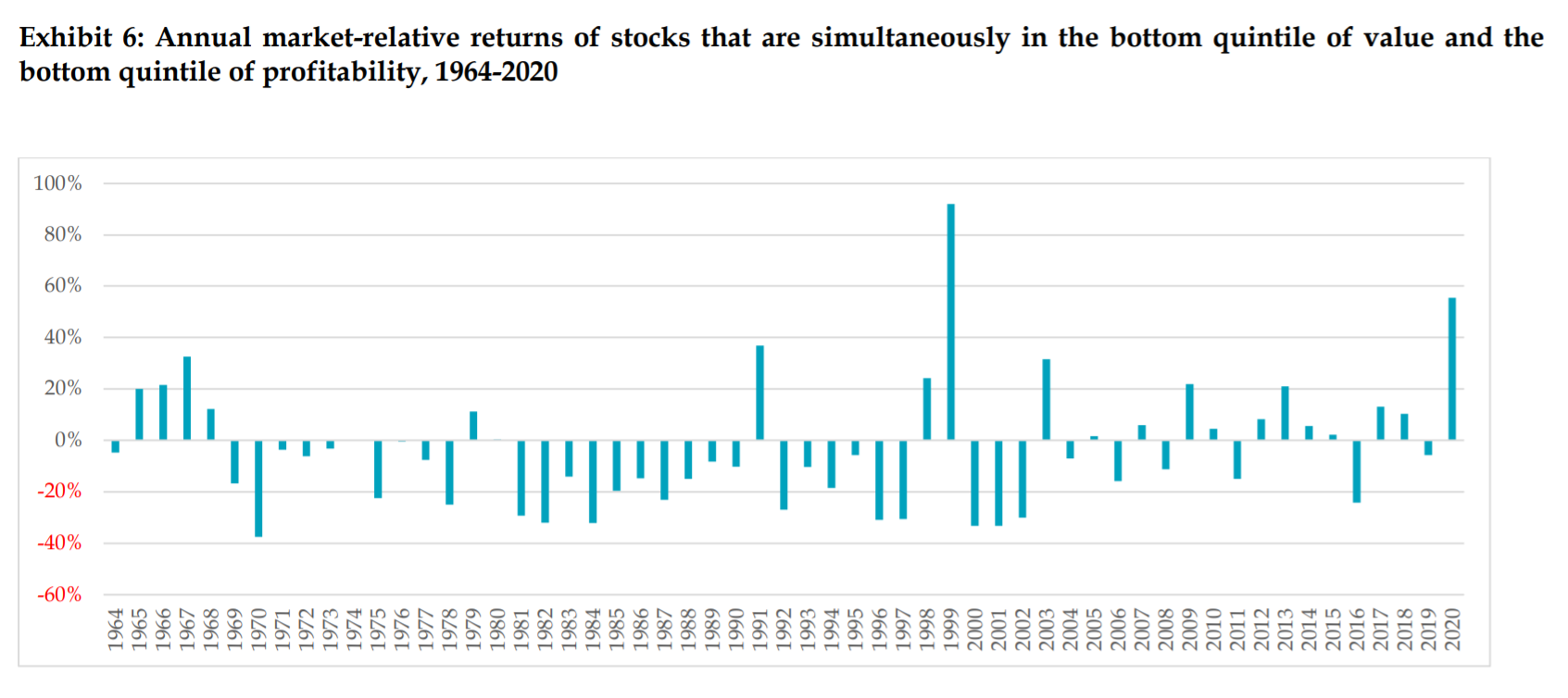

To these factors, however, the research found all but four of 48 thematic indices from the two providers have a “strong” negative exposure towards the value factor, with only one offering a “marginally” positive exposure towards the profitability factor. This implies both companies’ thematic indices invest in stocks with weak profitability and high valuations.

Source: Robeco

Blitz said: “If we assume that these Fama-French factors have long-term annual premiums of 3% (which would be in line with their historical long-term realised averages) then this implies long-term expected average underperformances of 5.58% for the SPDJI thematic indices and 3.87% for the MSCI thematic indices.”

In recent years, thematic indices have actually tended to outperform both the broader market and any factor exposure.

In fact, it is worth noting factors such as value can go as long as a decade or more underperforming the market. Also, while currently unprofitable and overvalued companies underperform on average, thematic indices tend to only capture a small subset of these companies which pertain to themes benefitting from their own idiosyncrasies.

Source: Robeco

However, it is also true that ETF issuers launch strategies targeting themes with strong past performance, a lot of media buzz and positive public perceptions. Once the initial rush by retail and sentiment-driven investors dies down, orthodox asset pricing theory kicks in and these products regularly underperform, the report said.

Thematic ETFs have exploded over the past 18 months with more issuers entering the space. According to data from Global X, there are 69 thematic ETFs listed in Europe with $38.4bn assets under management (AUM), up from under $10bn at the start of 2020.

A redeeming point for thematics are non-financial investment cases, such as individual moral convictions prompting exposure to clean energy or individual interest leading to investment in a theme such as AI and robotics.

If investors do not mind sacrificing some returns for sentimental or intellectual motivations, this is an edge thematic indices have over factor investing. Looking ahead, though, Robeco argued active management of thematic strategies could lead to new products with improved factor characteristics.

Further reading