How you should invest your money is at an inflection point; equities are showing double-digit returns and bond funds also rallying. Do you charge into fixed income with the possibility of recession on the horizon? Or do you think it’s unlikely to happen for a while and take the upside from higher risk assets?

There is obviously no right answer, but there are products that might still present an opportunity to investors that could help on both fronts.

High yield bond ETFs are one such product that sit in the middle.

As Peter Sleep, senior portfolio manager at 7IM, says: “If you can accept the price volatility we believe you can make a return from high yield bonds of around 4%-5%, which compares well with gilts, and has a volatility that sits in between equities and gilts.”

Junk

High yield bonds – also known as junk bond ETFs – are high-paying bonds with a lower credit rating – and therefore risk – than other bonds such as gilts and treasuries/municipal bonds. Because the risk of default is higher, they typically pay a higher yield. Issuers of these bonds tend to be start-up companies or capital-intensive firms with high debt ratios.

In the case of high yield fallen angel ETFs, these include high yield corporate bonds from issuers in developed markets that have – at some point in their trading history – been downgraded to a sub-investment grade.

And market watchers argue that they should be part of your portfolio.

BlackRock put out a note this week from Scott Thiel, deputy CIO of global fundamental fixed income, saying; “We see high yield bonds as a key source of income in bond portfolios, and advocate a balanced and diversified approach.

The best performing of the funds we looked at year-to-date is Invesco’s US High Yield Fallen Angels UCITS ETF (FAHY); it has returned nearly 9% YTD with a TER of 0.45% (one of the cheaper ETFs of its kind).

Below is a chart of FAHY in black compared with the worst performing high yield ETF this year, the iShares EUR High Yield Corp Bond UCITS ETF, which has returned 2.95%. There will be some currency discrepancy here, but the difference is still clear.

Source: Bloomberg

FAHY tracks the Citi Time-Weighted US Fallen Angel Bond Index, which measures the performance of “fallen angels” – bonds which were previously rated investment-grade but have subsequently downgraded to high-yield. The index includes US Dollar-denominated bonds issued by corporations domiciled in the US or Canada. Any such bonds, with a rating changed from investment-grade to high-yield in the previous month, are eligible for inclusion in the index and will be held in the index for a period of 60 months from inclusion provided they continue to meet the inclusion criteria.

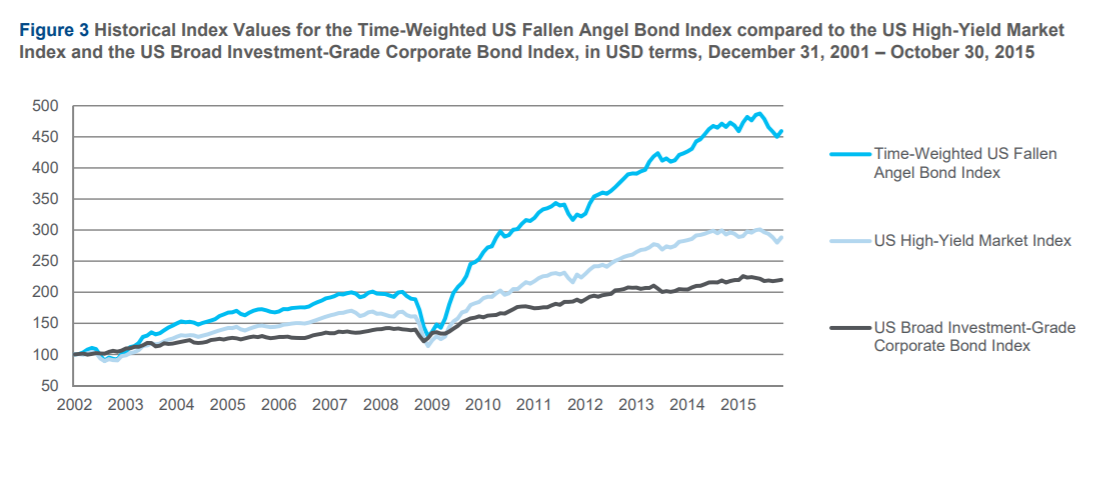

Below is a chart from Invesco that shows the performance of FAHY against the US high yield market index and the US broad investment-grade corporate bond index.

BlackRock’s blog says that “first-quarter corporate earnings results pointed to healthier fundamentals in high yield issuers. These include signs of declining gross leverage and near-record high levels of interest coverage – a measure of issuers’ ability to service their debt.”

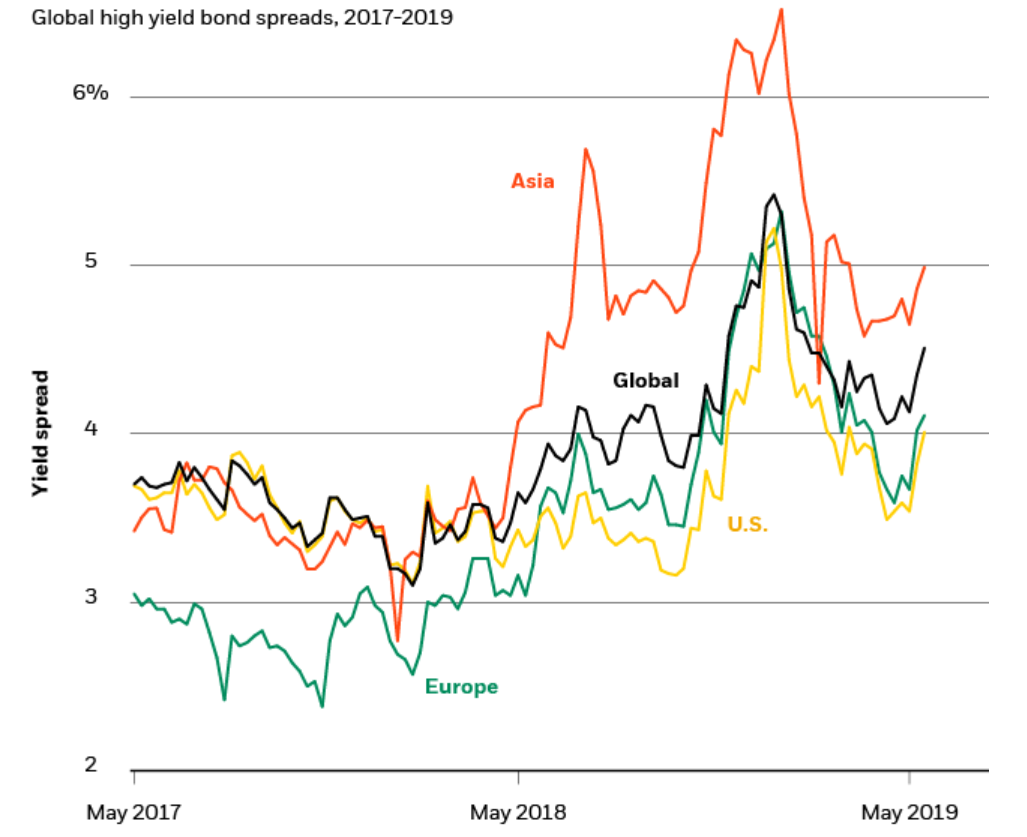

Another reason they are promising is that the spread between high yield and gilts has widened in recent years.

A chart from the BlackRock blog below also shows the global high yield bond spreads over the last two years.

Source: BlackRock

Thiel says: “The difference in yields between high yield bonds and comparative government bonds – have widened, as perceived safe havens outperformed. These moves come amid a longer-term widening trend in credit spreads over the past couple of years. We see rates generally stable in the near term, with income taking back the reins from price changes as the key driver of credit returns in the quarters ahead.”

However, investors should still proceed with caution as high yield bond ETFs are still considered risky.

Sleep explains that high yield securities are called “junk” securities for a reason - they are not safe. All investors worth their salt know that if you want a higher yield, you have to take more risk. It should therefore be logical that something called high yield has high risk attached to it.

“Companies that issue high debt are deemed by the rating agencies to have a higher risk of going bust. This may be because for instance they have dangerously high levels of debt or because they are highly cyclical. As a result, you receive a higher level of income for taking this risk of bankruptcy. Bankruptcy can occur at any time, but it is fair to say that bankruptcy risk is at its highest during a recession like in 2008. Some of this bankruptcy risk can be hedged away by diversifying across many high yield companies in a fund or an ETF. However, this will not fully protect you from price volatility. For instance, during 2008, the iShare USD High Yield ETF dropped by 32% which was a similar drop to the S&P 500 which dropped by 48%,” he adds.

If you want access there are lots of options on the London Stock Exchange, we list a number of them below here with performance to 22 May from the start of the year.

RISE

HYLD

HYGU

HIGH

HYFA

FAHY

FAGB

SHYG

SHYU

SDHY

SDHA

IHYE

IHHG

WNGE

WIGG

IGHY

JNKE

ZHYG

XHYG

M’ment Fee: 0.25%

YIEL

ETFYTD RTNTERINDEXiShares Fallen Angels High Yield Corp Bond UCITS ETF7.07%0.50%Bloomberg Barclays Global Corporate ex EM Fallen Angels 3% Issuer Capped IndexiShares Global High Yield Corp Bond UCITS ETF6.40%0.50%Markit iBoxx Global Developed Markets Liquid High Yield CappediShares EUR High Yield Corp Bond UCITS ETF6.38%0.55%Markit iBoxx EUR Liquid High Yield IndexiShares EUR High Yield Corp Bond UCITS ETF5.25%0.50%Markit iBoxx EUR Liquid High Yield IndexInvesco US High Yield Fallen Angels UCITS ETF8.50%0.45%Citi Time-Weighted US Fallen Angel Select IndexInvesco US High Yield Fallen Angels UCITS ETF8.98%0.45%Citi Time-Weighted US Fallen Angel Select IndexInvesco US High Yield Fallen Angels UCITS ETF7.93%0.45%Citi Time-Weighted US Fallen Angel Select IndexiShares EUR High Yield Corp Bond UCITS ETF2.95%0.50%Markit iBoxx EUR Liquid High Yield IndexiShares USD High Yield Corp Bond UCITS ETF8.18%0.50%Markit iBoxx USD Liquid High Yield Capped Index.iShares USD Short Duration High Yield Corp Bond UCITS ETF5.75%0.45%Markit iBoxx USD Liquid High Yield 0-5 Capped IndexiShares USD Short Duration High Yield Corp Bond UCITS ETF5.64%0.45%Markit iBoxx USD Liquid High Yield 0-5 Capped IndexiShares USD High Yield Corp Bond UCITS ETF5.92%0.55%Markit iBoxx USD Liquid High Yield Capped IndexiShares USD High Yield Corp Bond UCITS ETF6.58%0.55%Markit iBoxx USD Liquid High Yield Capped IndexiShares Fallen Angels High Yield Corp Bond UCITS ETF6.59%0.55%The Fund aims to track the performances of the Bloomberg Barclays Global Corporate ex EM Fallen Angels 3% Issuer Capped Index, which includes bonds originally issued as investment grade and have since been downgraded to sub-investment grade (Fallen Angels)iShares Fallen Angels High Yield Corp Bond UCITS ETF7.03%0.55%The Fund aims to track the performances of the Bloomberg Barclays Global Corporate ex EM Fallen Angels 3% Issuer Capped Index, which includes bonds originally issued as investment grade and have since been downgraded to sub-investment grade (Fallen Angels)iShares Global High Yield Corp Bond UCITS ETF6.14%0.50%Markit iBoxx Global Developed Markets Liquid High Yield CappedSPDR Bloomberg Barclays Euro High Yield Bond UCITS ETF5.74%0.40% The fund's objective is to track the performance of European High Yield Corporate Bonds as represented by the Bloomberg Barclays Liquidity Screened Euro High Yield Bond IndexBMO Bloomberg Barclays Global High Yield Bond GBP Hedged UCITS ETF7.23%0.35%he Fund seeks to provi- de an exposure to global fixed-rate, high yield bonds that have a maturity grea- ter than one year, which is hedged to sterling and a minimum issue size of USD 500m (or equivalent currencies)Xtrackers II EUR High Yield Corporate Bond UCITS ETF5.21%TER: 0.35%Markit iBoxx EUR Liquid High Yield Index.Lyxor BofAML EUR High Yield Ex-Financial Bond UCITS ETF5.76%0.45%The Fund seeks to reflect the performance of the BofA Merrill Lynch BB-CCC Euro Developed Markets Non-Financial High Yield Constrained