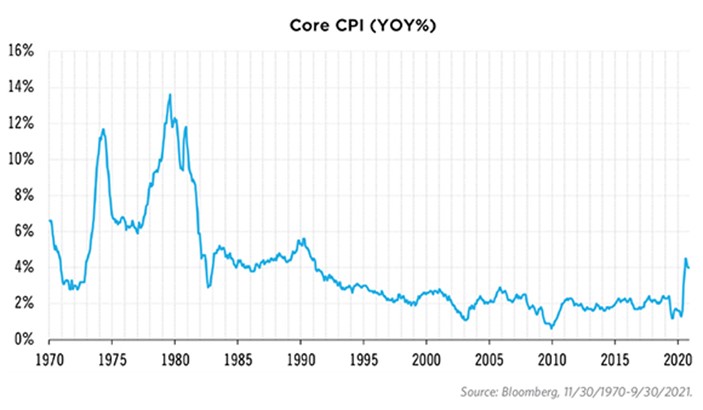

According to the latest reading of consumer prices in the US, inflation has not been this hot since the early-1990s. The core Consumer Price Index (CPI) for September 2021 registered growth of 4% year-over-year, down from the previous month’s 4.5% print, but still double the Fed’s 2% inflation target.

The core CPI measure strips out food and energy prices but if you leave those in, inflation is running even hotter – 5.4% as of September.

Consumers are feeling the pinch. Everything from home prices to car prices to food prices has been surging, and many are starting to worry that the US could be entering a sustained period of higher inflation.

If that is the case, bond ETFs could take a hit but that is only one possible scenario. There is still the potential for a much more benign future in which inflation cools down significantly from here.

Transitory camp

Those who foresee this more optimistic course for inflation – a group that includes the Federal Reserve – argue that high inflation is merely transitory, the consequence of massive one-off economic stimulus, a post-pandemic reopening of the economy, and base effects (unusually low inflation last year).

Regarding the latter, the core CPI only increased by 1.7% year-over-year in September 2020 when the economy was still very much at the mercy of COVID-19 trends. Comparing prices this year to last year’s depressed levels makes inflation seem hotter than it would be under more normal circumstances.

Additionally, the $5trn of fiscal stimulus unleashed due to COVID-19 – including hundreds of billions of dollars worth of direct cash payments to taxpayers – is obviously not something that will be repeated on an ongoing basis.

Likewise, the immediate post-pandemic period, when a colossal amount of pent-up demand was released all at once, is a one-time situation. It is this third factor that is driven severe supply constraints and logistics bottlenecks across the world, and it may be the biggest driver of inflation today.

As Federal Reserve Chair Jerome Powell recently said: “The process of reopening the economy is unprecedented, as was the shutdown at the onset of the pandemic. As the reopening continues, bottlenecks, hiring difficulties, and other constraints could again prove to be greater and longer-lasting than anticipated, posing upside risks to inflation.”

However, he added: “While these supply effects are prominent for now, they will abate, and as they do, inflation is expected to drop back toward [the Fed’s] longer-run goal.”

Deflationary trends

Powell and the Fed expect inflation to average 2.2% in 2022, down from 4.2% this year. If that is the case, the “inflation is transitory” camp will have won out, putting inflation back on a much more subdued path, in line with what the economy saw during the decade after the Global Financial Crisis.

In the period between the end of 2009 and the end of 2019, inflation only averaged 1.8%, while interest rates lurched ever lower.

The great savings glut, an ageing of the population and deflationary technological trends were factors driving inflation and rates downward during that period. If those secular trends reassert themselves, today’s high levels of inflation won’t last long.

On the other hand, if something has truly changed post-COVID-19 – say, sustained, higher levels of fiscal spending – perhaps inflation could linger at more elevated levels than before. The economy only has a certain amount of productive capacity. If there is more demand than supply, higher prices will result.

Risks to bond ETFs

Nowhere would the risk of high inflation manifest itself more clearly than in the bond market. Bond investors are hypersensitive to vagaries in the inflation rate, as inflation matters a great deal regarding what “real” (inflation-adjusted) return those investors receive.

Higher-than-expected inflation could spark a sell-off in bonds, particularly in bonds with longer maturities that are more sensitive to changes in interest rates (bond prices and yields move inversely). The iShares $ 20+ Year Treasury Bond UCITS ETF (IDTL) dropped 5.9% this year, as long-term rates climbed off their record lows of 2020.

The iShares $ Treasury Bond 7-10yr UCITS ETF (IBTM), which hews closely to the all-important 10-year Treasury bond, has fallen 3.9% on a year-to-date basis.

If inflation surprises to the upside, these ETFs will likely take a hit. Conversely, they could also rally if the long-term disinflationary trend that was evident pre-pandemic reasserts itself.

Credit spreads and corporate bonds

Corporate bond ETFs, like the iShares $ Corp Bond UCITS ETF (LQDE) and the iShares $ High Yield Corp Bond UCITS ETF (IHYA), face a somewhat different dynamic than Treasuries. Interest rates matter for them, of course, but so do credit spreads – or the additional yield that investors demand for taking on credit risk.

As the economy has boomed and corporations find themselves flush with cash, credit spreads have narrowed to all-time-low levels, offsetting some of the negative pressure from rising rates. LQDE is down 1.9% on a year-to-date basis, but IHYA has risen by 2.5%.

Debate rages on

With the Fed set to begin unwinding its massive stimulus programs in the coming months, all eyes will be on the inflation data. The trajectory for consumer prices will have ramifications for how quickly or slowly the central bank tightens its monetary spigots, shifting interest rates in the process.

Recently, just the hint of the Fed tapering its bond purchases in the coming months was enough to push rates all over the place.

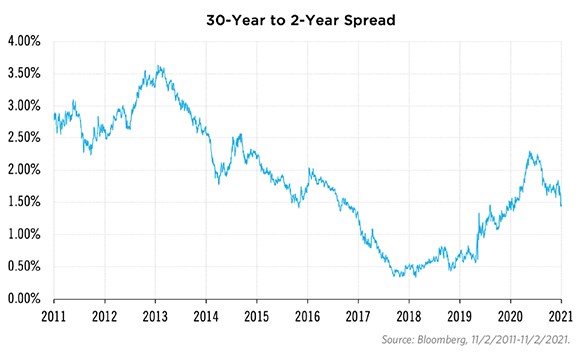

Since the start of the year, the 30-year Treasury bond yield, which is sensitive to inflation expectations, edged up from 1.64% to 1.97%, while the two-year Treasury yield, which is driven more by the Fed’s policy rate, surged from 0.12% to 0.51%, its highest point in a year and a half.

This flattening of the yield curve is a win of the “inflation is transitory” camp, though the inflation debate is far from over.

This story was originally published onETF.com

Related articles