The strong returns offered by technology index-tracking products meant almost one-in-three funds tripling investors’ money over the past five years were ETFs.

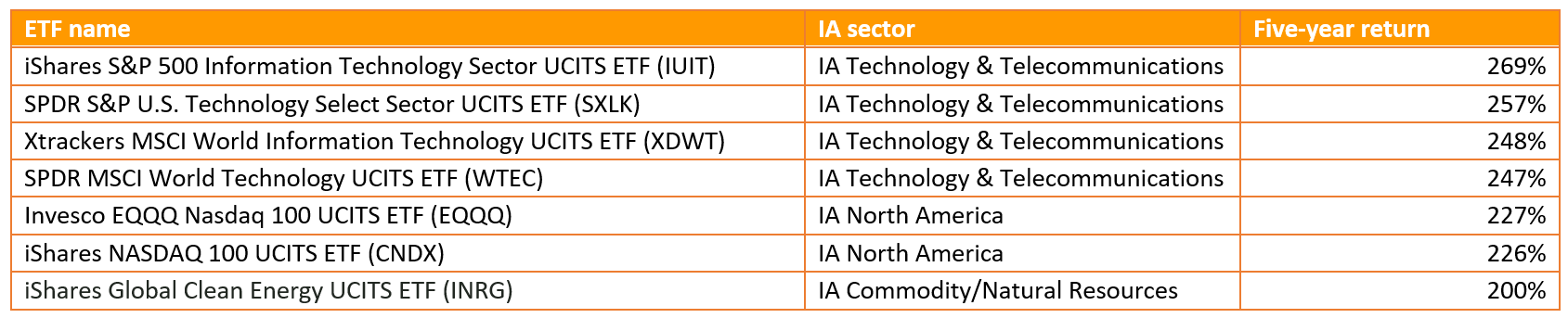

According to data from FE Analytics, only 25 of the 4,251 funds covered by the Investment Association’s (IA) sectors returned more than 200% during the period. Of this number, technology sector plays had a strong presence, along with some actively managed global and US strategies and a total of 7 ETFs.

Accelerated by the COVID-19 pandemic and demand for digital and remote work and leisure, the usual suspects of US tech – Microsoft, Apple, Amazon – and some more recent risers – Zoom, Tesla, Nvidia and others – have all surged over the past two years.

This recent boost only accelerated the low interest rate, pro-growth backdrop of the last decade, which has been supportive for these tech-heavy ETFs over the past five years:

iShares S&P 500 Information Technology Sector UCITS ETF (IUIT)

SSGA SPDR S&P U.S. Technology Select Sector UCITS ETF (SXLK)

Xtrackers MSCI World Information Technology UCITS ETF (XDWT)

SSGA SPDR MSCI World Technology UCITS ETF (WTEC)

iShares Nasdaq 100 UCITS ETF (CNDX)

Interestingly, the actively managed Baillie Gifford American fund was the top-performing tech-heavy and US-focused product, returning 320% in five years. However, unlike its passive counterparts, the fund’s outperformance slowed over the past year and it even underperformed the S&P 500 index over the past 12 months.

Outside of technology exposures, one of the most-discussed ETFs of recent years closed out the list of top performers – the iShares Global Clean Energy UCITS ETF (INRG).

Timing has been crucial for INRG investors, with the ETF returning -27.2% since launch in 2008 but up 200% in the last five years, according to FE Analytics.

Buoyed by the confluence of several tailwinds – the rise of ESG investing, thematic ETF popularity and Joe Biden’s election victory in 2020 – Europe’s largest clean energy ETF has returned 128% since the height of pandemic volatility last March.

Source: FE Analytics