Fixed income ETFs are used to being thought of as an afterthought. When the first ETFs were built in the 1990s, they were focused on equities with the first fixed income products coming over a decade later with the arrival of four BlackRock bond ETFs.

Since then, equities have continued to dominate the wrapper, along with much of the product innovation.

However, there are signs that this could be changing as demand for fixed income grows. In August, US-based asset manager f/m Investments launched a range of single security US Treasury ETFs making it easier for investors to trade the most current Treasury at each key maturity.

The innovative new product has caught the attention of the market – it is understood Jane Street has committed $20m of their balance sheet to seed the funds – and could herald a turning point in product innovation.

While some of the most liquid securities, US Treasuries can be laborious to trade with investors often having to roll into a new note issued every month, adding a few basis points to the cost.

According to the founders, the new ETFs will help increase cash flow frequency while allowing investors to use the ETF as a strategic tool to express a variety of views as opposed to simply trading a US Treasury bond.

Alex Morris, president of f/m Investments, told ETF Stream: “US Treasury ETFs simply follow how the US government does its accounting, which has nothing to do with an investment thesis and everything to do with stimulus.

"They are products that can be thrashed out in liquidity spikes when the market goes haywire. You are buying single treasury ETFs as a direct antidote to that problem.”

While focused on US Treasuries, it does highlight the lack of innovation and out-of-the-box thinking in the fixed income ETF space, particularly as demand rises for the product as the economy turns.

Sharper tools for the toolbox

With roughly nine million fixed income securities globally, across government and corporate bond, compared to roughly 70,000 listed equities, the need to access the market innovatively is becoming more important.

Investors can access this sprawling fixed in-come market through ETFs that sample the Bloomberg Global Aggregate index, consisting of roughly 30,000 securities, however, many question the investment logic of this type of kitchen sink investing for fixed income.

One European-based ETF issuer looking to create more innovation in the space is fixed in-come specialist Tabula Investment Management.

Highlighting this was the launch of the Tabula US Enhanced Inflation UCITS ETF (TINF) in 2020, combining treasury Inflation-Protected Securities (TIPS) with exposure to US inflation expectations through breakevens, providing positive performance when inflation is rising.

“The answer to the question is yes, we need more innovation,” Michael John Lytle, CEO of Tabula said. “We need to create more specific slices of the fixed income environment where that slice has an investment logic to it.”

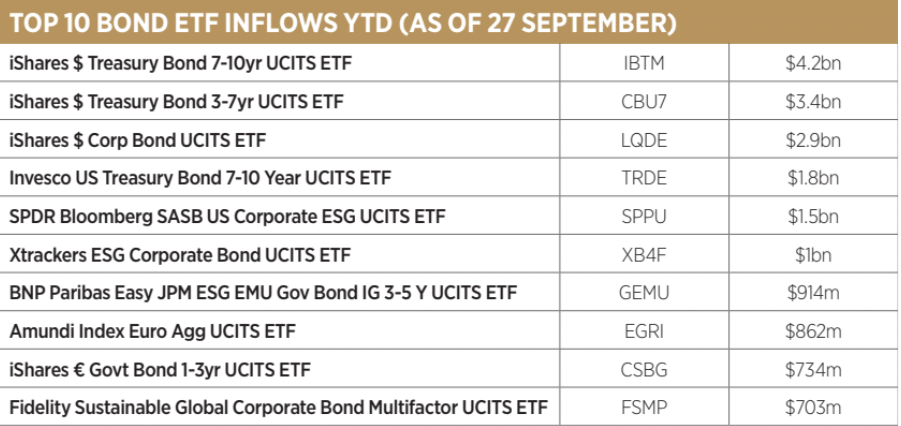

Source: ETFLogic

He added institutional investors have a much more nuanced focus on fixed income. For example, within investment grade bonds, investors think about AA-grade versus BBB very differently while high yield is constructed of even more diverse factors.

“They have not been given a passive solution with the right investment logic,” Lytle said. Morris agreed: “There is going to be a greater focus on the building blocks of true institutional quality portfolios and a much more hyper-focus on how portfolios are being built, particularly around liquidity.”

New demand will drive innovation

On the surface, single US Treasury ETFs look perfectly timed. Morris said he could see the demand for US Treasuries rising at the start of the year and believes this sort of demand will help drive innovation across the market.

“Now rates are going back up and investors have a more genuine interest and a need for fixed income, you are going to see a whole pile of new ideas because they are selling,” he said.

Despite this, Lytle said he believes fixed income innovation should also in part be driven by fixed income professionals with many issuers too focused on pushing equity products.

“Fixed income understanding rapidly deteriorates when you go into the general populace so the innovation comes from products that have matured in the institutional space,” he said.

It is also important to note it is not one-size-fits-all for investors. Insurance and pension funds could have a completely different way of using fixed income in their portfolios to family offices and asset managers.

“You have to manage all those conversations to figure out if there is enough demand developing from a certain type of investor in a certain geography to drive the innovation,” Lytle said.

“European investors are conservative by nature. Most do not want to be the first to invest in something so you have to find the investors in the marketplace who are willing to lead.”

He added unclear regulation in Europe, such as the Sustainable Finance Disclosure Regulation (SFDR), is also stifling innovation.

Despite this, Morris argued the time must be right on multiple fronts for innovation to thrive. Given time, we could see f/m Investment’s single-security US Treasury ETFs in the European market with Morris confident the product would work under the UCITS structure.

However, he is unsure whether demand for fixed income products among retail investors on the continent is quite the same as in the US.

“We have hit the think button for now as we are unsure if investors need bonds as much in Europe,” he added. “Your average investor will get their bond exposure primarily through their pension and have greater weighting equity elsewhere.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles