Smart beta exchange-traded funds have gathered market share in Europe over the past few years as investors have wised up to the attractions of the product. A hybrid of active and index strategies, smart beta ETFs offer various advantages compared to traditional market-cap-weighted ETFs, including potentially better diversified exposure to portfolios and enhanced protection against volatility.

Wider adoption of such vehicles has, however, been hindered by financial advisers and investors lacking an in-depth knowledge of the product and the long-running bull market in which smart beta ETFs tend to underperform.

The fallout from the COVID-19 pandemic in providing smart beta ETF with the chance to shine. It is early days but so far the product is failing to exploit the opportunity.

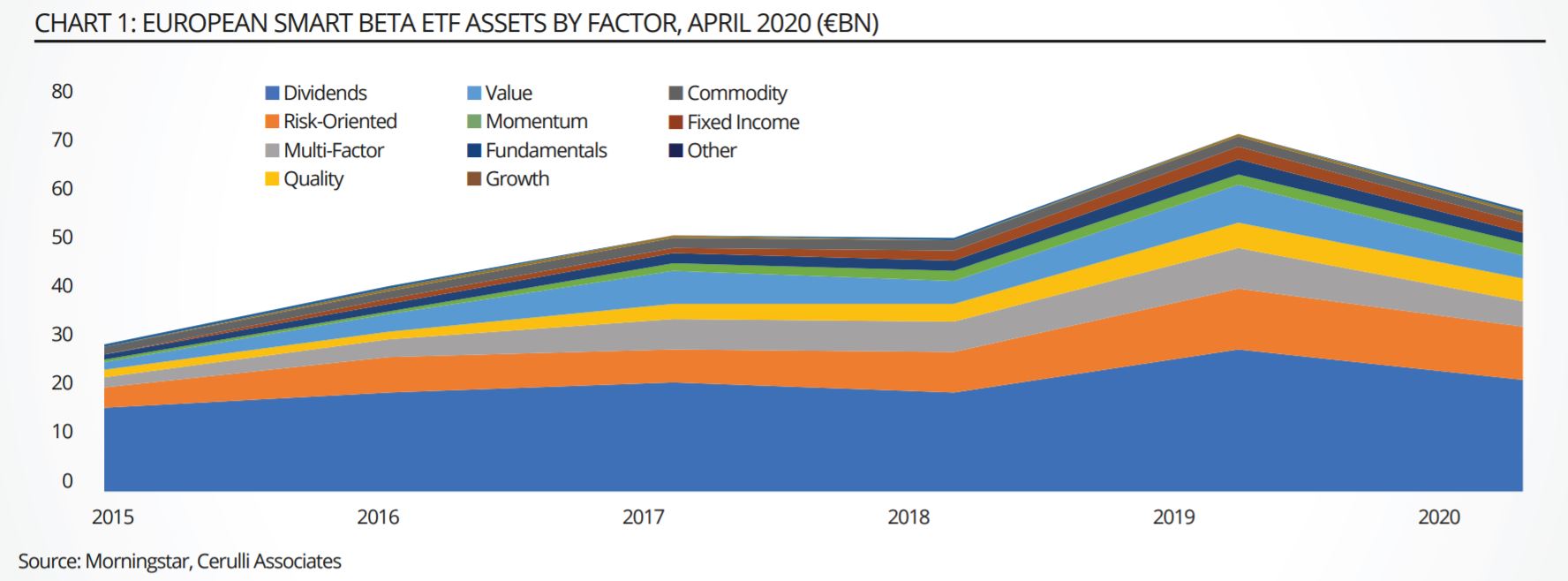

The assets of smart beta ETFs domiciled in Europe have ballooned in recent years, from €28.9bn in 2015 to €71bn at the end of 2019, according to data from Morningstar. Last year, net inflows amounted to €9.3bn – the highest annual intake of the past five years, equating to a CAGR of 25% in the time period.

But that was then. In the first four months of 2020, which have been blighted by exceptionally high levels of volatility, smart ETFs domiciled in Europe have bled €3.3bn.

As a rule, these vehicles underperform in bull markets and excel when markets fall. With markets having boomed for the past decade, investors have understandably not seen the need to pay the higher fees charged by smart beta compare to other market-cap ETFs.

In theory, smart beta should be able capitalise on the pandemic. However, it is important to note that not all smart beta ETFs are created equal. The space contains a broad spectrum of varying strategies and factors. And the strategies have certainly not performed in unison during the first four months of 2020. For example, momentum, dividend, fixed income and commodities were the only strategies to gather new flows. Conversely, multi-factor and value were hard hit by the coronavirus-triggered volatility, suffering net outflows of €1.8bn and €1.5bn respectively.

During the period under review, European smart beta ETFs with a global focus attracted net inflows of €1.3bn, while those with a North America and a Europe focus bled €2.9bn and €1.1bn respectively, according to Morningstar data.

At the end of April 2020, dividend-based ETFs accounted for the biggest share of total assets in smart beta in Europe at 39.5%, followed by risk-oriented ETFs (including low-volatility strategies) at 18.9%. Multi-factor ETFs comprised 9.5%, quality 8.1% and value 7.7%. On April 30, dividend strategies AUM stood at €21.9bn, followed by risk-oriented ETFs with €10.5bn in assets and multi-factor with €5.3bn.

The assets of multi-factor strategies had contracted 35% compared to the end of 2019, when they stood at €8.1bn. Value strategies’ assets shrunk 42% in the first four months of 2020, from €7.5bn to €4.3bn, whereas they have attracted net inflow of €1.7bn in 2019, bled €1.5bn in 2018 and ended 2017 with a net gain of €2.5bn.

When it comes to issuers, BlackRock with its iShares reign supreme in Europe, with a market share of 47% at the end of April 2020. It is followed by State Street Global Advisors with 9% and Lyxor with 7%. However, when it comes to sales, Vanguard led by an impressive margin — its smart beta product platform recorded net new flows of €1bn in the first four months of the year. In second place was JPM Morgan with just (€191m) of net new money from investors.

A variety of smart beta products have been launched over the past two years. These included Franklin Templeton’s five smart beta products, which started trading on Zurich’s SIX Swiss Exchange in February 2018. In the same month, JP Morgan listed two smart beta products in Frankfurt that primarily target institutional investors in Germany. DWS has rolled out a smart beta ETF that invests in high-yielding investment-grade corporate debt in Frankfurt and London. And in early 2019, French smart beta specialist Ossiam launched an ETF that harnesses a machine learning algorithm.

Overall, however, smart beta ETF launches have been slowing. In 2017, 51 new products were brought to market in Europe; this compares with 35 in 2018 and a mere seven the following year. In 2020, six smart beta ETFs had been launched by the end of April, according to Morningstar. Of the 51 products launched in 2017, 22 were multi-factor strategies.

Multi-factor was also the strategy employed in 10 of the 35 ETFs launched in 2018; another 10 of these were in the fixed-income strategy domain. In 2019, six of the seven new launches were multi-factor.

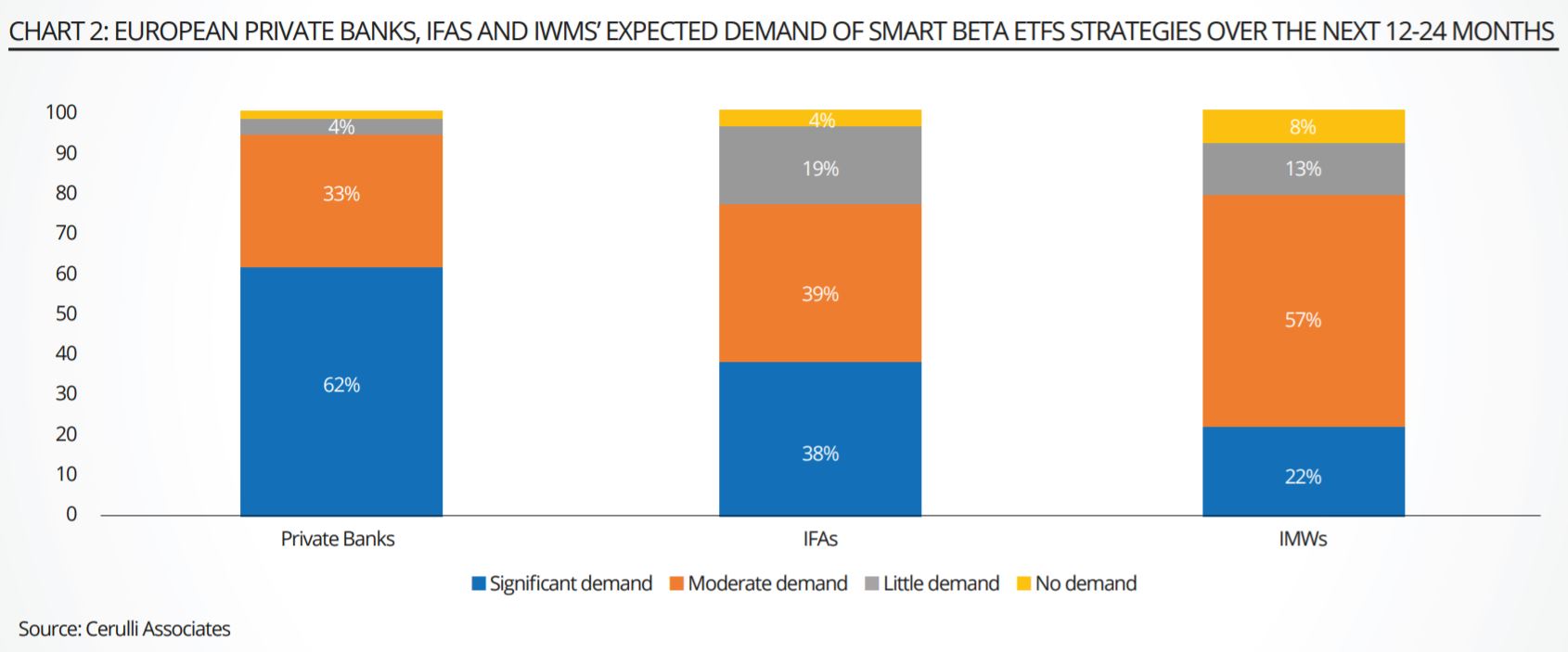

The future of smart beta will depend on how the products perform in the current highly volatile markets — it is still too early to conclude the outcome. An in-depth understanding of and comfort with the product will also be key factors. In this regard, Cerulli Associates’ research across Europe’s seven largest asset management markets — the UK, Germany, Italy, Switzerland, France, Spain and Sweden — shows that appetite for smart beta ETFs is on the rise among private banks, independent wealth managers (IWMs) and independent financial advisers (IFAs), and the knowledge and comfort factors are moving in the same direction.

Some 61.8% of the private banks surveyed in January 2020 in the abovementioned countries expect significant demand for these products in the next 12 to 24 months. Another 32.7% anticipate moderate demand. Of the IWMs surveyed, 22% expect significant demand and 57% foresee moderate demand. Some 38% of the IFAs that responded to Cerulli’s survey expect significant demand for smart beta ETFs and 38% moderate.

Asset managers in Europe are under increasing pressure from regulators and investors to offer more cost-effective investment solutions. ETFs, as wrappers, are now used as buy-and-hold funds, tactical asset allocation vehicles, trading instruments and as transparent, lower cost building blocks for portfolio construction. Specialisation within this sphere is giving users a larger array of options, which several of the ETF issuers and asset managers Cerulli spoke believe will fuel demand for smart beta.

There are, however, challenges to increased adoption, primarily a lack of knowledge of the products by financial advisers and investors. This is a major hurdle for managers seeking to enter the European ETF market with smart beta value propositions. Managers and ETF issuers need to keep up education programmes and marketing campaigns. Such programs can help to enhance trust in ETFs. ETF providers are already extending their educational programmes.

Many are also partnering with local distributors in different European countries. For example, at the end of 2018, Vanguard agreed to sell its ETFs via German online broker Onvista Bank, which is part of Commerzbank’s listed German online broker, Comdirect. In early 2019, BlackRock launched a promotional campaign with Postbank, a German retail bank, whose clients can now buy iShares ETFs at a “special-offer” price. In addition, BlackRock and Franklin Templeton are to start offering ETF-based saving plans for free (without order fees) in Germany through partnerships with ING’s German arm.

As Europe’s ETFs markets have become increasingly crowded in recent years, with new players arriving and incumbents broadening their product ranges, entering or developing these markets with a standardised value proposition may no longer be enough to attract flows. ETF issuers should consider introducing a specialised and diversified offering that includes not only smart beta, but also thematic and environmental, social, and governance. New niche products are likely to be launched this year, further widening the product menu for financial advisors in Europe. Competing with vanilla product offerings or simply on price requires scale, brand and strong capital markets infrastructure.

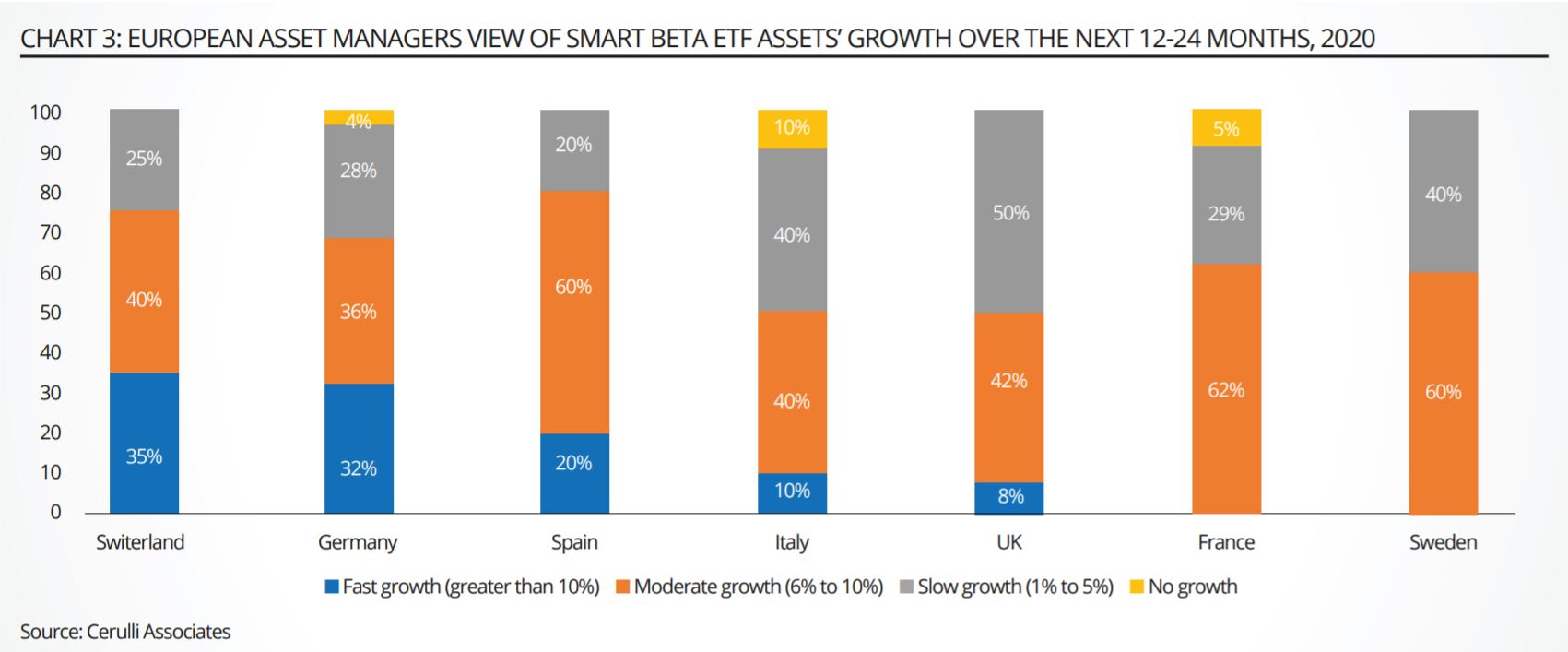

The views of the asset managers Cerulli surveyed at the start of the year varied depending on the country being considered. Some 35% expect fast growth of smart beta ETFs assets in Switzerland and 32% share this view for Germany. On the other hand, slow growth was predicted for the UK and Sweden by 50% and 40% of the respondents respectively.

Despite the growing appetite by wealth managers and financial advisors, the key question remains: are smart beta ETFs smart enough to navigate unchartered waters of a pandemic crisis?

Fabrizio Zumbo, associate director, European asset and wealth management research at Cerulli Associates

This article first appeared in the Q2 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy, click here.