Water is the most important commodity on the planet and it is fast becoming scarce for many people across the world.

According to the World Health Organisation (WHO), as many as 2.2 billion people have limited access to safe drinking water while half of the world’s population is set to be living in water-stressed areas by 2025.

As Thomas Schumann, founder of Thomas Schumann Capital, who is speaking at ETF Stream’s Big Call: Thematic ETFs event on 31 March, stressed: “Nearly a third of the world is subject to water stress, a burgeoning crisis that only promises to get worse.

“Furthermore, some 41% of assets owned by MSCI All Country World index companies are in high water stress regions.”

With World Water Day taking place on 22 March, ETF Stream has provided a breakdown of the four water ETFs listed in Europe which collectively have $4bn assets under management (AUM).

iShares Global Water UCITS ETF (IH20)

Europe’s largest water ETF – and oldest – is the iShares Global Water UCITS ETF (IH20) which has gathered $2.3bn assets under management (AUM) since launching in March 2007.

Tracking the S&P Global Water index, IH20 currently offers exposure to 48 companies involved in two water-related businesses; water utilities and infrastructure and water equipment and materials.

The total weight for each of these two areas of the water market is capped at 50% while individual stocks whose primary business is water-related are capped at 10% while a cap of 5% is given for companies with partial water exposure.

The methodology leaves an ETF with 53.7% exposure to the US, 16.9% to the UK, 7% to Switzerland, 5.8% to France and 3.1% to China.

IH20 is the most expensive water ETF on the European market with a total expense ratio (TER) of 0.65%.

Lyxor MSCI Water ESG Filtered UCITS ETF (WATU)

Next on the list is the $1.4bn Lyxor MSCI Water ESG Filtered UCITS ETF (WATU) which switched from tracking Société Générale’s World Water index to the MSCI ACWI IMI Water ESG Filtered Net Total Return index in November 2021.

The index captures companies involved in water supply, water utilities, water treatment and water related equipment while excluding those involved in certain controversial businesses such as nuclear weapons, tobacco, thermal coal and UN Global Compact violators.

Carrying a TER of 0.60%, this leaves an ETF currently exposed to 39 companies with 53.3% in the US, 16.8% in the UK, 6.4% in Japan and 6% in France.

L&G Clean Water UCITS ETF (GLUG)

Launched in July 2019, the L&G Clean Water UCITS ETF (GLUG) offers exposure to the largest basket of stocks out of the four ETFs with 61 holdings.

Tracking the Solactive Clean Water index, GLUG is exposed to companies actively engaged in the global clean water industry through the provision of technological, digital, engineering or utility services.

Europe’s cheapest water ETF with a TER of 0.49% has 62.5% exposure to the US, 9.4% to the UK, 5% to Japan, 4.6% to Finland and 3.5% to Switzerland.

Like the rest of Legal & General Investment Management's thematic ETF range, GLUG is equally weighted which gives it a natural bias to small caps versus its competitors while also leaving it less reliant on the performance of a few names.

If any individual stock exceeds 15% of the index, the company weights are adjusted so they are once again equally weighted.

Global X Clean Water UCITS ETF (AQWA)

Finally, the most recent water ETF to hit the European market is the Global X Clean Water UCITS ETF (AQWA) which launched in December 2021.

Like LGIM’s GLUG, AQWA also tracks a Solactive index, the Solactive Global Clean Water Industry v2 index, which is a market-cap weighted basket of currently 38 holdings.

With a TER of 0.50%, it invests in companies aiding in the provision of clean water through industrial water treatment, storage and distribution infrastructure as well as purification and efficiency strategies.

In order to be included in the index, companies must generate at least 50% of their revenues from clean water activities and meet certain ESG requirements such as the UN Global Compact principles while the maximum number of stocks is 40.

Rebalanced semi-annually, each stock has a maximum weight of 8% while the aggregate weight of companies above 4.5% cannot exceed 40% of the index.

Key stats

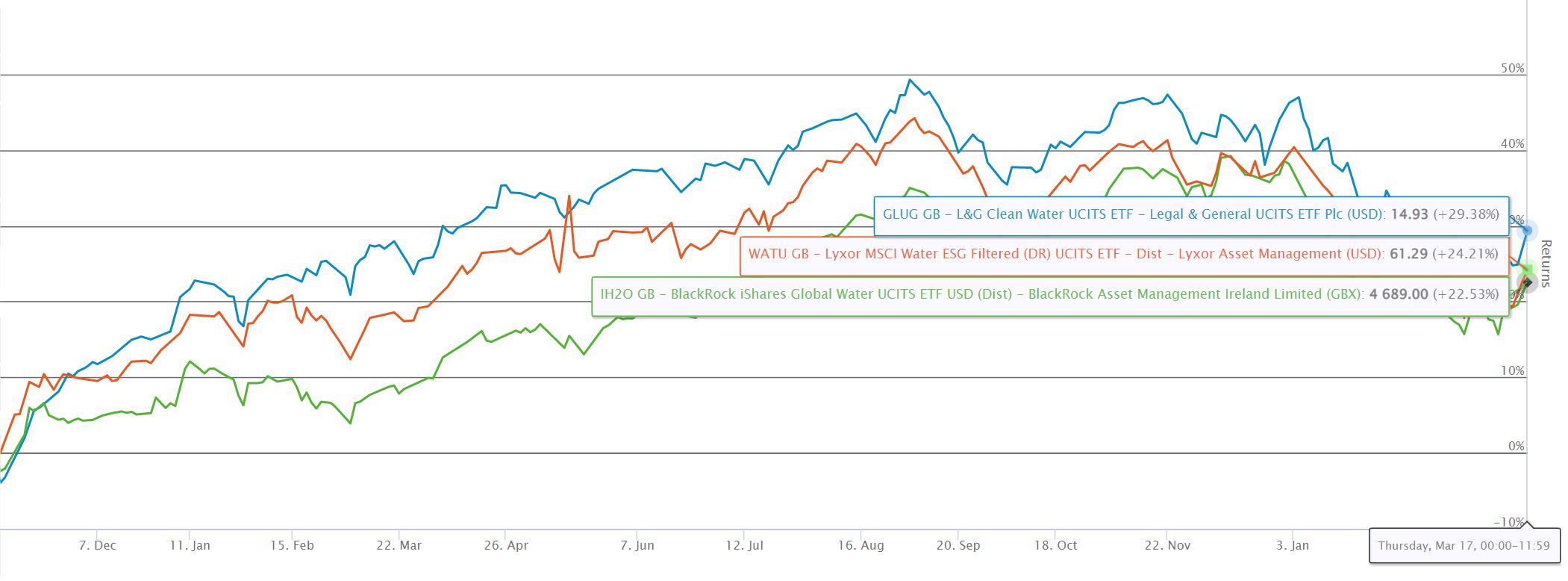

Since Lyxor – now Amundi – listed a US-hedged version on 29 October 2020, GLUG has been the best performing water ETF with returns of 29.4% versus 24.2% for WATU and 22.5% for IH20.

Chart 1: Water ETFs performance (29 October 2020-21 March)

Source: ETFLogic

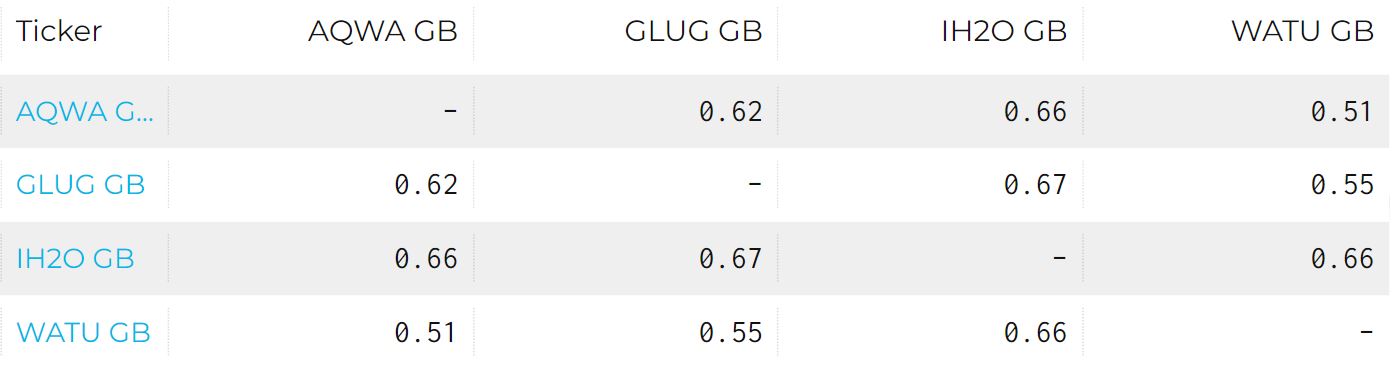

Meanwhile, GLUG and IH20 have the highest portfolio overlap with 67% of the same holdings while the lowest correlation is WATU and AQWA with 51% of the same holdings, according to data from ETFLogic.

Chart 2: Basket overlap of water ETFs (0-1)

Source: ETFLogic

Related articles