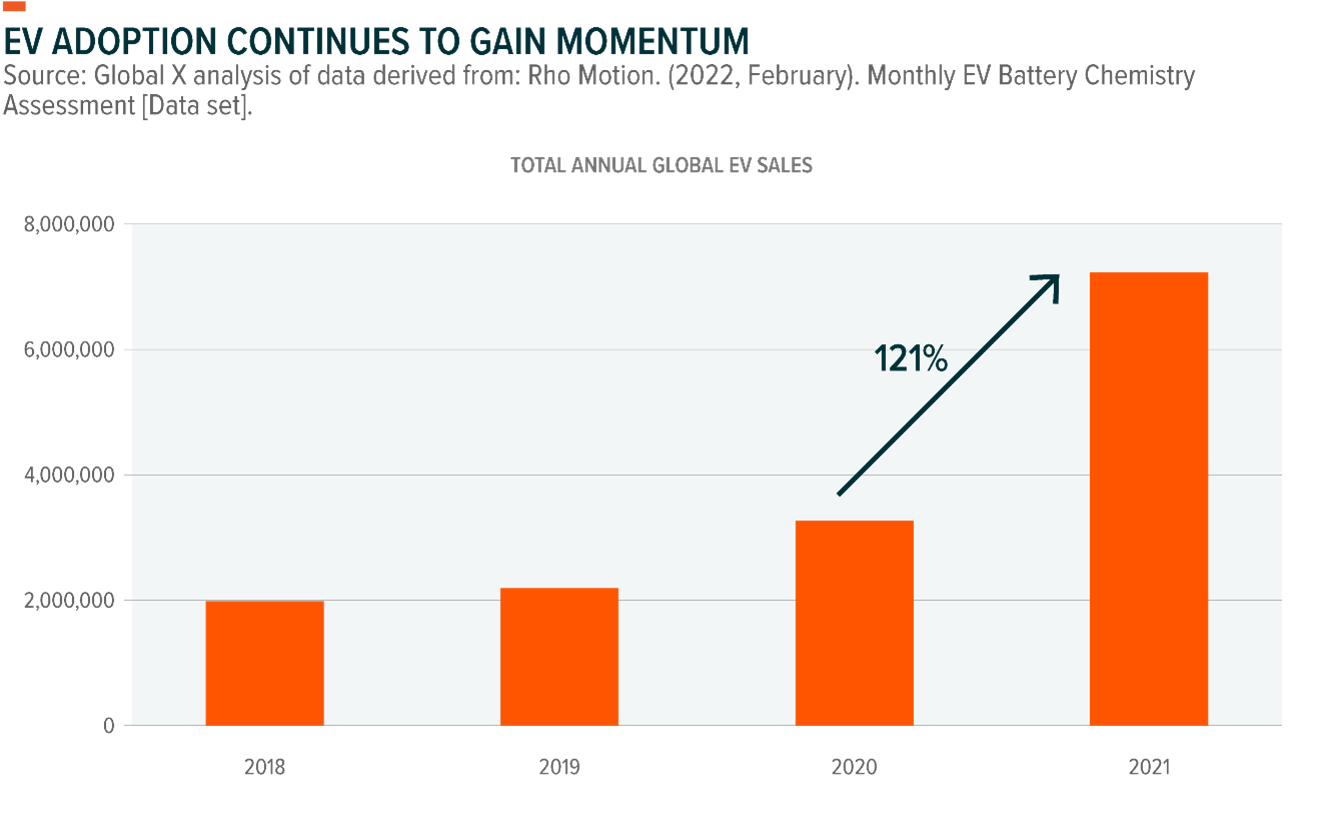

EV adoption is accelerating as governments and corporations work towards meeting climate change-related emissions reduction targets. Globally, 6.5 million EVs were sold in 2021, accounting for just under 9% of annual total car sales.1,2

While the EV segment’s share remained small compared to ICE vehicles, 2021 marked a significant increase from the 3.3 million EVs sold in 2020 and the 2.3 million sold in 2019.3 The EV momentum continued into January 2022, particularly in major markets such as China and the US.

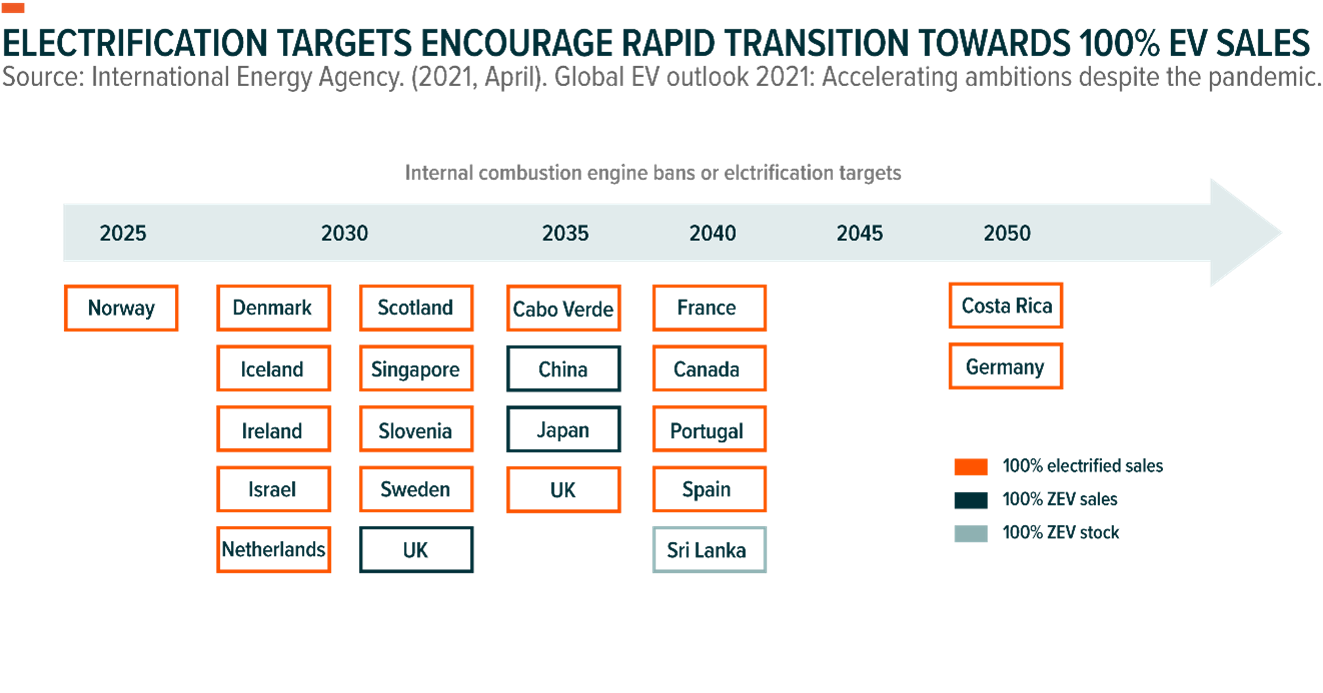

Industry forecasts have EVs reaching a 36% penetration rate by 2030, representing a $1.4trn opportunity.4,5 Over 135 countries have economy-wide net-zero emissions targets, with many aiming for 2050 or earlier.6Additionally, many countries have established support mechanisms and allocated funding to encourage EV adoption and the expansion of supporting EV charging infrastructure.

Original equipment manufacturers (OEMs) are also committed to electrifying their fleets and transforming the sector from majority ICE vehicles to EVs. General Motors, Kia Corporation, Jaguar Land Rover, Mercedes-Benz, Volvo, and Volkswagen are among the large list of OEMs that plan to spend billions on EVs to hit electrification sales targets.7

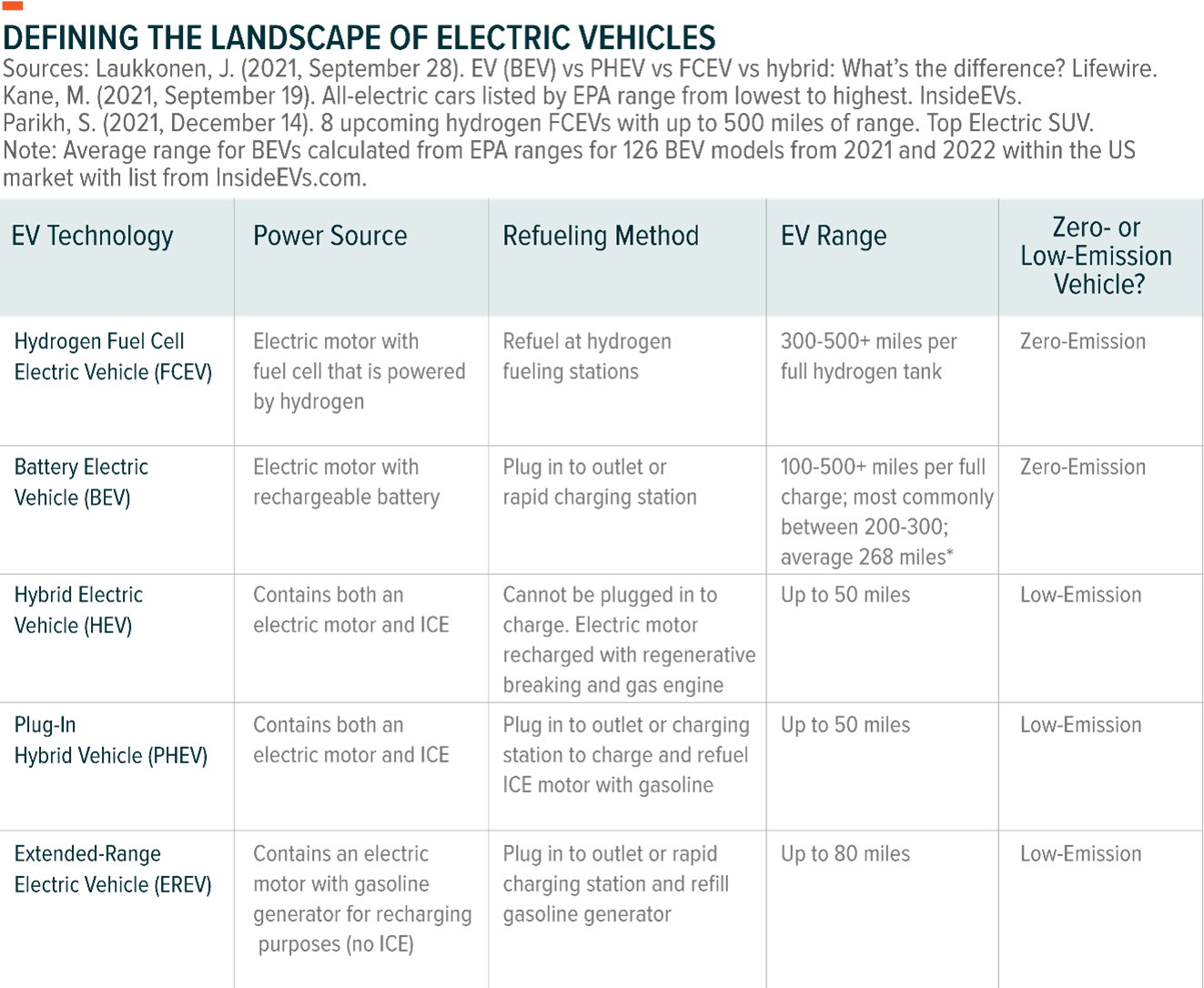

EVsclassify as either zero-emission or low-emission in relation to their greenhouse gas emission outputs.

Governments, companies, and consumers are focused on zero-emission vehicles. The two zero-emission vehicle technologies are battery electric vehicles and hydrogen fuel cell electric vehicles.

Battery Electric Vehicles (BEVs) are clearly the passenger car of choice among EVs, accounting for 71% of sales in 2021, while hybrid EVs made up roughly 28% and FCEVs less than 1%.8

BEVs come with the potential benefit of lower scheduled maintenance costs due to fewer parts than ICE vehicles, the potential for sizeable fuel savings, as well as an advanced charging infrastructure network.9

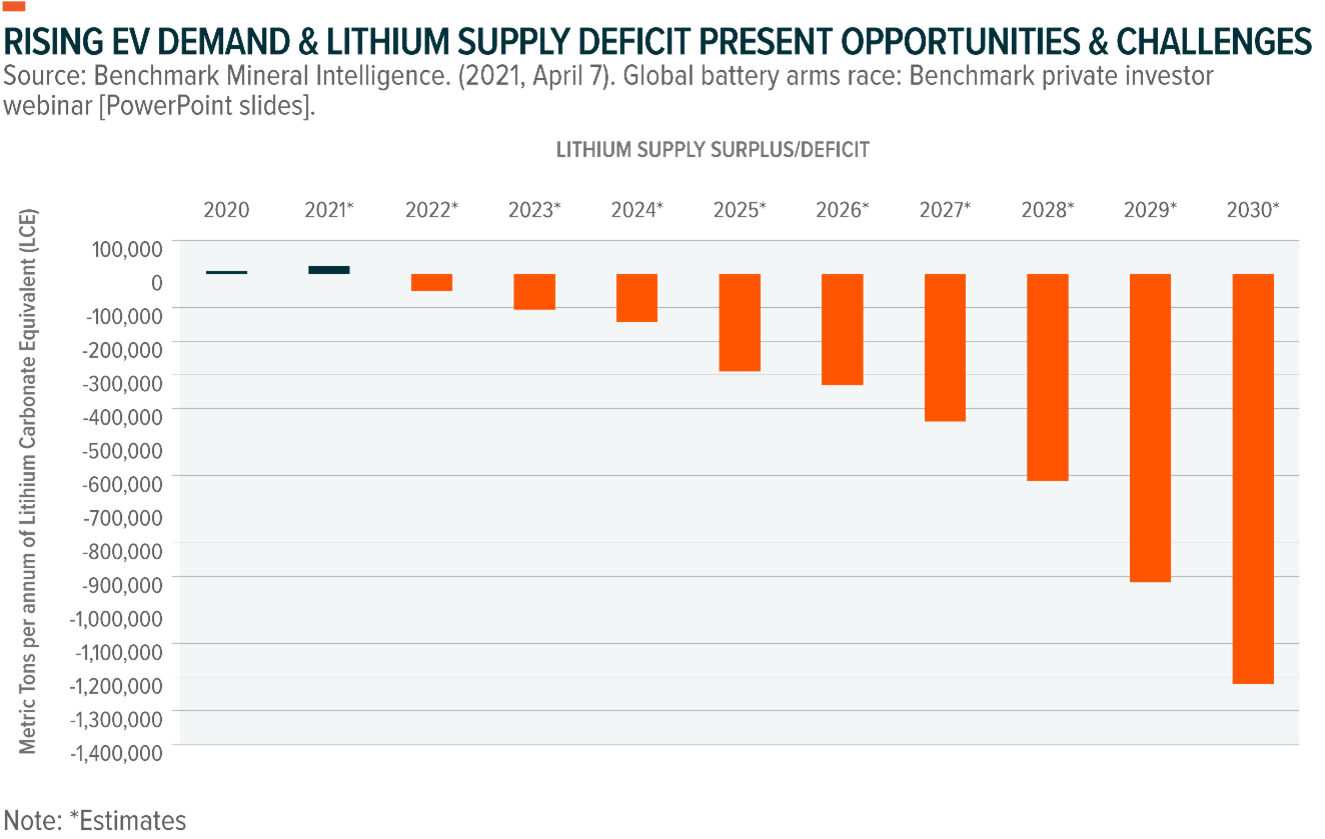

As BEV growth increases, we expect significant growth opportunities to emerge throughout the entire BEV supply chain, including in EV lithium-ion battery production and lithium mining. Europe is becoming the fastest-growing region for EV battery production outside of China.

Conversely, the lithium market faces its largest-ever shortage in 2022, due to delays in new mining projects from the COVID-19 pandemic.10Lithium mining needs to ramp up even more quickly over the coming years than currently planned to avoid a long-term deficit, higher EV costs, and weakened EV demand.11

Hydrogen Fuel Cell Electric Vehicle (Hydrogen FCEVs) technology offers several benefits over BEVs that make it an attractive zero-carbon emission option for the long-haul and heavy industrial vehicles specifically, including a higher energy storage density, shorter refuel time and less loss of performance in cold weather conditions.

Global interest in scaling up low-carbon green hydrogen production for use in transport and hard-to-electrify industries has several major companies creating plans to adopt FCEVs for trucking and heavy industry operations.

On the manufacturing side, leading truck makers, such as Daimler Truck AG and Volvo Group, are fully committed to an all-electric future and formed a joint venture to produce hydrogen fuel cell systems.12

On the heavy industry side, the mining sector stands out as an early adopter of FCEVs, with companies like Anglo American, Fortescue Metals Group, and Antofagasta all working to implement FCEV technology.

Sparse hydrogen fuelling networks globally will remain the primary barrier to the widespread adoption of FCEVs in the near term. However, we expect more fuelling stations as hydrogen gains acceptance, particularly in the long-haul trucking industry.

We believe that BEVs and FCEVs are on track to increase their market share as part of the global effort to slow climate change, given the segment’s increasing share of total car sales and the growing momentum for EV adoption.

For investors, the growing number of BEV passenger car models for sale and under development and the rapidly expanding BEV charging network can create investment opportunities throughout the BEV supply chain. Critically, lithium mining and battery manufacturing will need to ramp up to meet demand and for BEV growth to materialise.

For long-haul trucking and heavy-duty vehicles, FCEVs offer benefits such as lighter vehicle weights and shorter refuel times. Demand for FCEV technologies, particularly in support of fuel infrastructure, appears set to materialise over the long term, creating additional opportunities for differentiated exposure in the EV space.

Madeline Ruid is a research analyst at Global X

Rho Motion. (2022, February).

Monthly EV Battery Chemistry Assessment

[Data set].

Paoli, L., & Gül, T. (2022, January 30). Electric cars fend off supply challenges to more than double global sales. International Energy Agency.

Rho Motion. (2022, February). Monthly EV battery chemistry assessment: February 2022.

Note: Based on IEA’s Sustainable Development Goals aligned with the Paris Agreement. International Energy Agency. (2021).

Global EV outlook 2021: Accelerating ambitions despite the pandemic.

Baltic, T., Cappy, A., Hensley, R., & Pfaff, N. (2019, December).

The future of mobility is at our doorstep: Compendium 2019/2020

. McKinsey Center for Future Mobility.

Net Zero Tracker. (2021, November 25). PR: Post-COP26 snapshot [Press release].

Motavalli, J. (2021, October 4). Every automaker’s EV plans through 2035 and beyond.

Irle, R. (n.d.) Global EV sales for 2021. com. Accessed March 14, 2022.

Ford Motor Company. (n.d.)

Into the future with Ford.

Accessed March 14, 2022.

Benchmark Mineral Intelligence. (2022, February 4).

Where will new lithium supply come from in 2022?

Ibid

.

AB

(2021, April 29). Volvo group and Daimler Truck AG fully committed to hydrogen-based fuel-cells

– launch of new

joint

venture cellcentric [Press release]. Volvo

This document is not intended to be, or does not constitute, investment research as defined by the Financial Conduct Authority.

The value of an investment in ETFs may go down as well as up and past performance is not a reliable indicator of future performance.

Trading in ETFs may not be suitable for all types of investors as they carry a high degree of risk. You may lose all of your initial investment. Only speculate with money you can afford to lose. Changes in exchange rates may also cause your investment to go up or down in value. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Please ensure that you fully understand the risks involved. If in any doubt, please seek independent financial advice. Investors should refer to the section entitled “Risk Factors” in the relevant prospectus for further details of these and other risks associated with an investment in the securities offered by the Issuer.