This journey has led us to become the second-largest sustainable ETF provider in Europe, with $35bn AUM, representing a 16% market share, according to etfbook.com. During this decade’s worth of experience with SRI solutions, innovation continues to be at the heart of UBS’s approach to sustainable investing

Climate change specifically has been rising to the top of investors’ agendas and this has been a key feature in the development in our sustainable offering. UBS has made several enhancements to its ETF shelf not only to meet our investors’ needs here but also to consider broader changes within the rapidly evolving sustainable investing space.

The first step in this direction was taken with the benchmark change on our existing UBS SRI ETF range to the new MSCI SRI Low Carbon Select index methodology at the end of 2020.

This new approach was developed in close conjunction with MSCI to create a customised solution that maintains the key sustainability features of the MSCI SRI philosophy, but with an additional focus on improving the climate risk profile and limiting exposure to stranded asset risk.

A second key milestone in our recent journey came in Q1 2021 when we launched our range of Paris-aligned ETFs that aim to support investors in reducing their transition and physical climate risks, benefit from opportunities arising from the transition to a lower-carbon economy while aligning with the EU Paris-Aligned Benchmarks minimum standards.

Our most recent initiative has been the launch of the new UBS ESG Universal Low Carbon Select ETF range. This is a set of customised products aiming to be core replacements that have limited tracking error vs their respective parent indices while achieving various sustainability objectives in terms of ESG improvements as well as a substantial carbon footprint reduction.

What drives the carbon footprint of a portfolio?

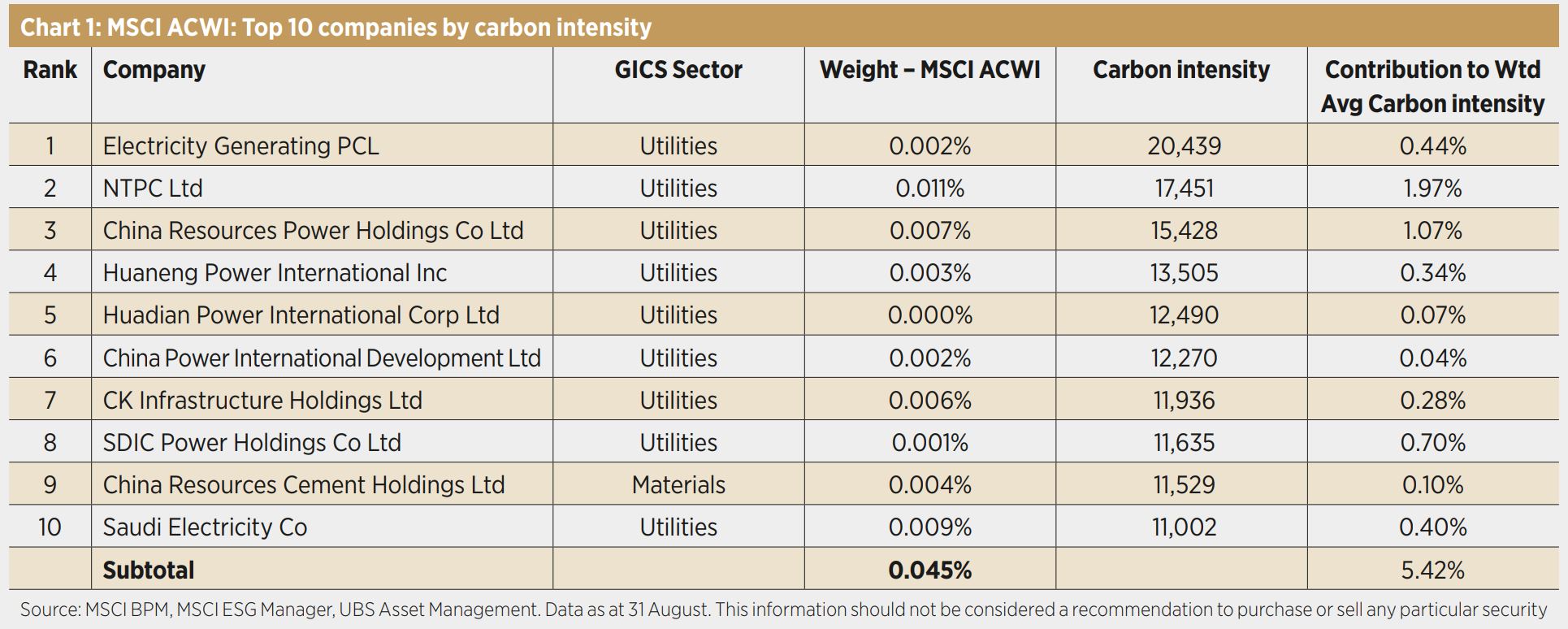

Taking the MSCI ACWI index as a starting universe, we can analyse the carbon intensity of each company in order to understand what the key drivers of the portfolio’s carbon footprint are. In Chart 1, we highlight the 10 companies with the highest carbon intensity (Scope 1 + Scope 2 tCO2e /$m sales) and we can see how these minimal number of companies, despite having a relatively small weight (~45bps, keeping in mind that ACWI has ~2964 constituents), are contributing 5.42% to the MSCI ACWI Weighted Average Carbon Intensity (WACI), which is quite high. This confirms that a limited number of names are responsible for the vast majority of the carbon intensity in a portfolio, suggesting that we can substantially improve the carbon profile of a portfolio by performing targeted exclusions.

By being able to identify and exclude the most carbon-intense names, we can achieve certain climate-related objectives while maintaining the risk-return characteristics of the market cap weighted parent index.

What is the definition of a “highest emitter”?

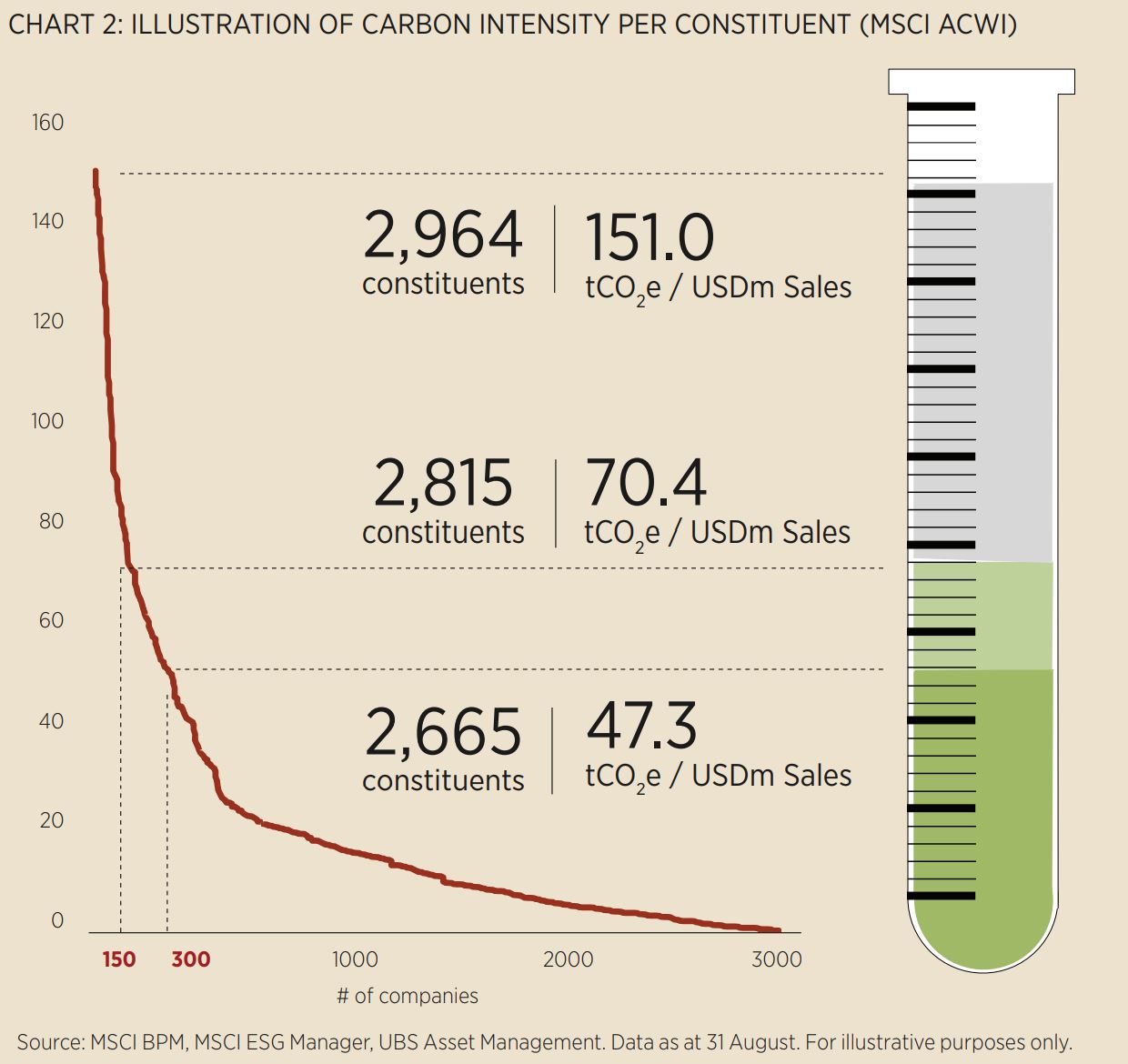

We have seen in the previous section how the carbon footprint of the portfolio is influenced by a relatively small number of companies. What is less intuitive is how to define the threshold for exclusion that balances the trade-off between carbon footprint reduction and portfolio representativeness. In order to illustrate this problem, in Chart 2 we show the marginal contribution to weighted average carbon intensity of each company in the MSCI ACWI index.

All the constituents of the portfolio are sorted in descending order based on their carbon intensity (Scope 1 + Scope 2 tCO2e/$m sales) and the red line shows the rolling weighted average carbon intensity, obtained by recursively excluding the most carbon intense companies in the portfolio. The steepness of this curve indicates the marginal benefit of each exclusion, and it can help us understand the optimal cut-off point based on the number of exclusions.

In the chart, we highlighted two potential thresholds for the highest emitters: the worst 5% and worst 10%. Taking the latter as an example, a 10% threshold means that the 10% companies with the highest carbon intensity are classified as “highest emitters” which, out of the ~2964 of MSCI ACWI, amounts to 299 companies excluded. As shown in the chart, removing these 10% highest emitters reduces the portfolio constituents to 2665 but has a substantial impact on the carbon emission which is reduced by almost 70%.

Similarly, by excluding the worst 5% emitters (~149 companies) the weighted average carbon intensity decreases by ~50%. Both these examples confirm how a limited number of targeted exclusions can substantially improve the carbon emission profile of a portfolio.

The challenges of a practical implementation

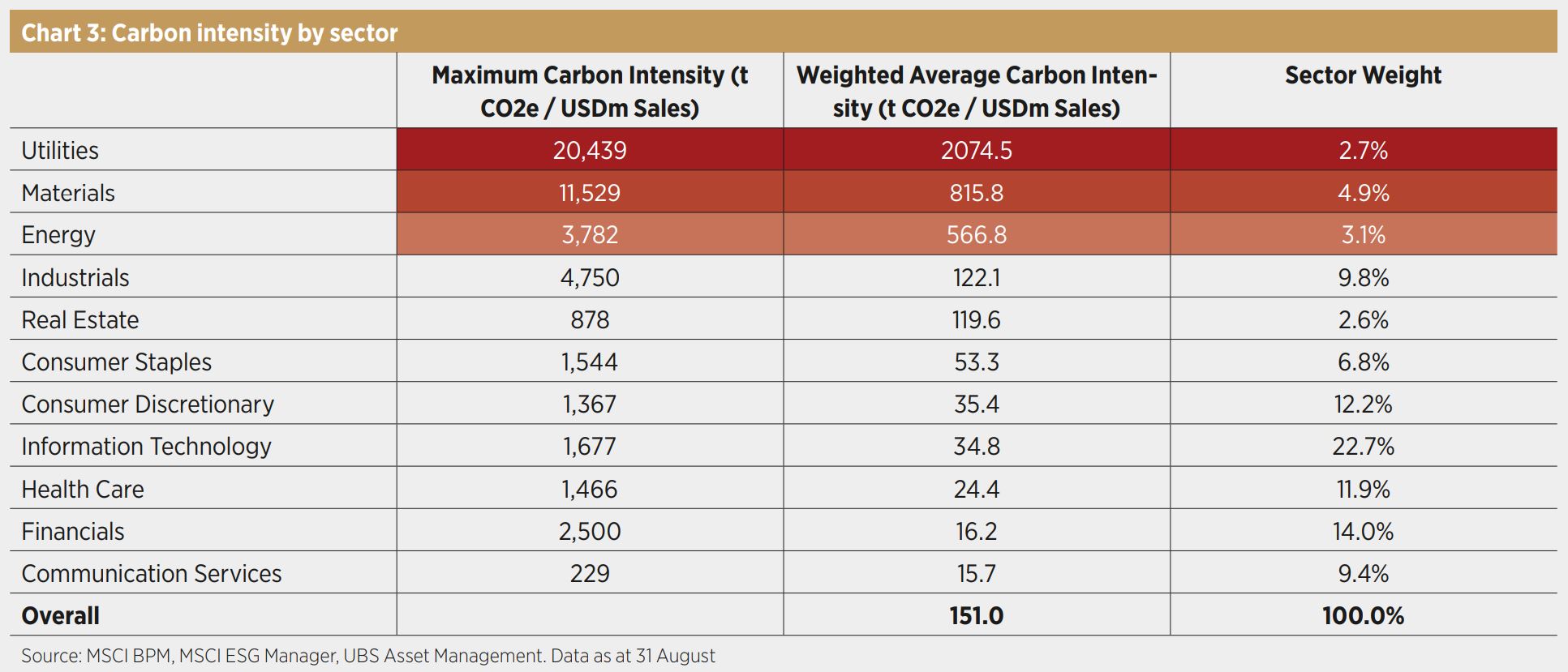

As described in the previous section, it is apparent how relatively few companies drive most of the carbon intensity of a portfolio, making this concept of “highest emitters” intuitive and relatively easy to apply at first glance. Nevertheless, it is important to note how the companies flagged as highest emitters belong essentially to a select group of sectors: Utilities, materials, energy and industrials. This is to be expected, as the business model of a utility or energy company tends to be, by nature, more carbon-intense compared to sectors like financials or communication services.

As shown in Chart 3, the average utility company is likely to have far higher emissions than the highest emitting IT or communication services company.

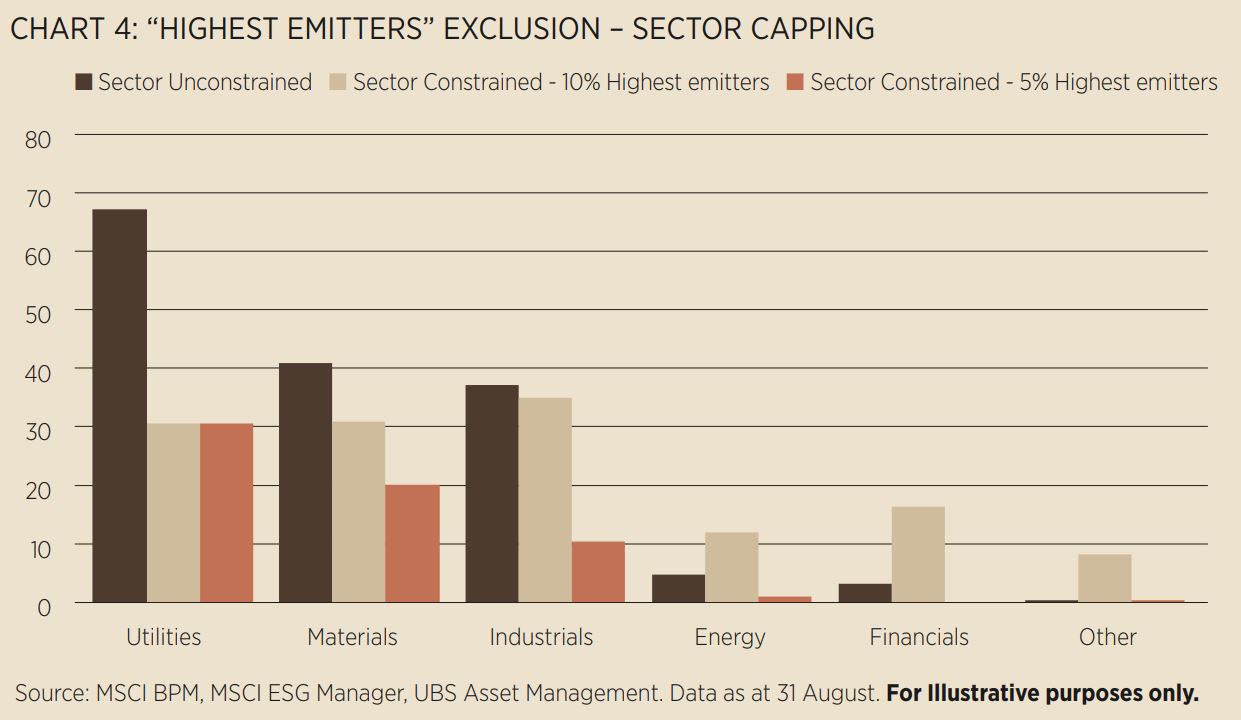

Given these large sectoral differences in carbon intensity, a “blind” exclusion simply based on the company’s carbon emissions would cause certain sectors to be almost entirely excluded from the portfolio. Looking at Chart 4, we can see how the exclusion of the 10% highest emitters from MSCI ACWI would remove almost 70% of the utilities sector and 40% of the materials sector. In order to mitigate this problem, we have introduced a capping threshold which, within each GICS sector, limits the number of exclusions only up until a maximum of 30% of the weight of that sector in the portfolio. In case this limit is reached for any sector, no further securities are excluded from that sector. The capping on the maximum weight excluded helps up to a certain extent, to keep a sector allocation reasonably close to the parent index upon which it is built.

Another positive outcome of the sector-constrained exclusion approach is that it allows us to keep the most carbon-efficient company within each sector while removing the laggards of each sector. As shown in Chart 4, thanks to the 30% capping, the fewer exclusions in the utility, materials and industrials then spill over to other sectors like energy and financials, where the least carbon-efficient are removed as well.

Additional exclusions selection criteria

The concept of “highest emitters” and their exclusion is a cornerstone of two families of ESG ETFs offered by UBS: the UBS ETF MSCI ESG Universal Low Carbon Select and the UBS ETF MSCI SRI Low Carbon Select ranges. The former aims to be a “core-replacement” solution that achieves certain ESG and carbon reduction objectives while limiting the tracking error vs the standard parent index (typically below 1%). The latter instead looks to select only the best-in-class companies from an ESG perspective and is suitable for investors with more restrictive exclusion criteria as well as having ambitious ESG goals. For this reason, in the “lighter green” ESG Universal Low Carbon Select range, the worst 5% emitters are excluded while in the “darker green” MSCI SRI Low Carbon Select range, the threshold for exclusion is set at 10%.

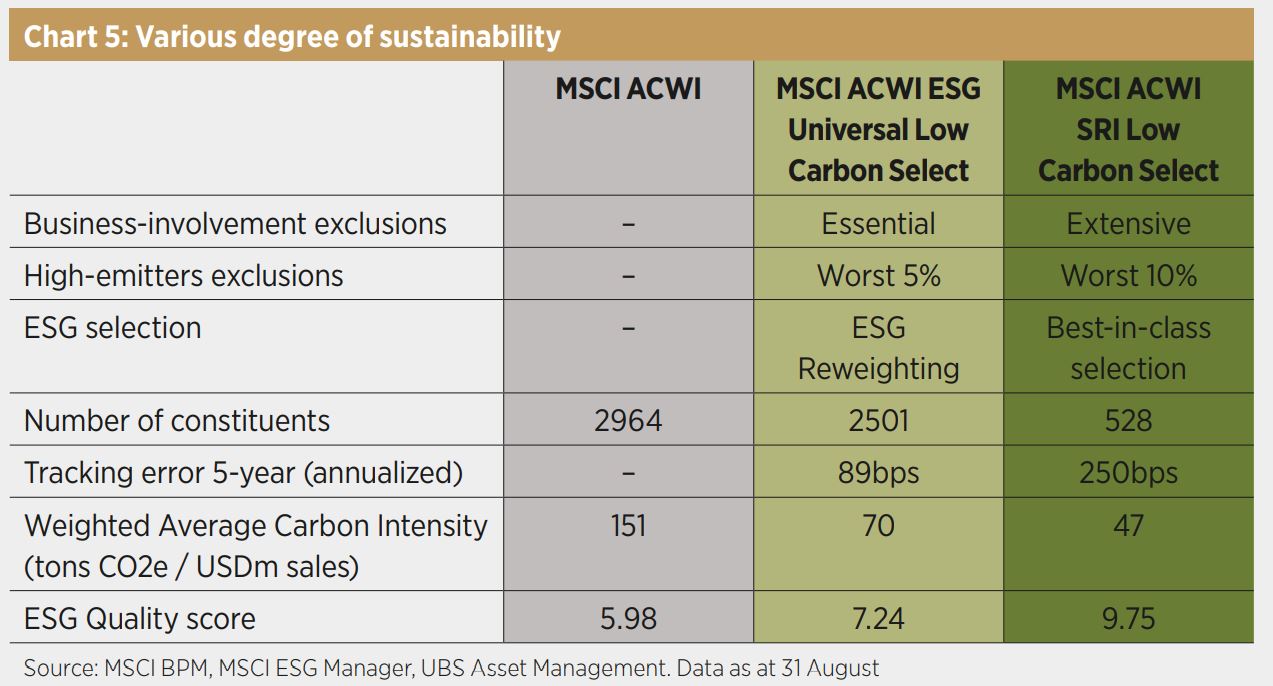

As shown in Chart 5, the severity of the “highest emitters” filter is not the only differentiating factor between these two ETF ranges. Other differentiating factors pertain to the exclusion criteria, with the “light green” (ESG Universal Low Carbon Select) excluding a selected set of business activities while the “dark green” (SRI Low Carbon Select) has a more comprehensive and stricter set of exclusions. The last key difference between these two approaches relates to the ESG selection, with the “light green” approach that aims to reweight companies in order to increase the allocation to ESG Leaders and ESG Improvers while decreasing the weight assigned to ESG Laggards and to companies with deteriorating ESG profiles. On the other hand, the “dark green” suite has a best-in-class ESG approach which selects only the top 25% ESG rated companies per GICS sector.

As shown at the bottom of the table, these different screening criteria drive sustainability characteristics (ESG score and carbon footprint) as well as the tracking error.

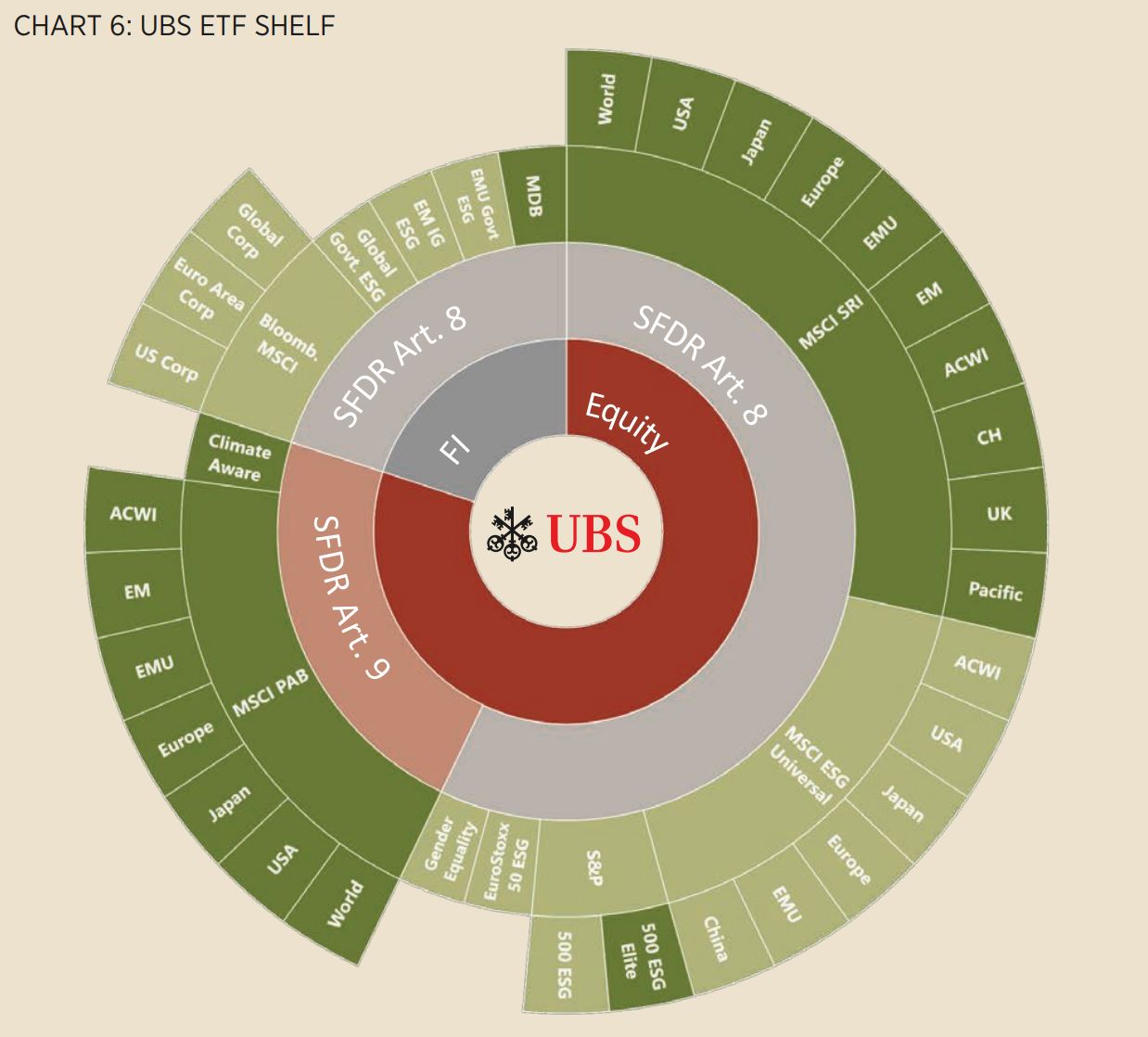

UBS ETF: Different shades of green

Our shelf offers our clients “different shades of green”: some funds use a light-green screening approach that excludes a more limited number of controversial business activities as well as the removal of ESG laggards (e.g. UBS ESG Universal Low Carbon Select, UBS S&P 500 ESG), while other products have a dark-green approach that selects only highly-rated companies and excludes a broader list of controversial business activities (e.g. UBS SRI Low Carbon Select, UBS S&P 500 ESG Elite).

Our sustainable shelf also covers fixed income, with several products on corporate bonds developed with Bloomberg. Next to the large ranges of ETFs, through the years we have also developed more thematic exposures like our sustainable development bank bonds ETF, an ETF focused specifically on gender equality not to mention having launched a suite of innovative Fixed Income Sustainable ETFs in 2015. These products are all classified as Article 8 under SFDR.

Our suite of Paris-aligned ETFs are classified as Article 9 funds under SFDR. The aim is to support investors in reducing their transition and physical climate risks, benefit from opportunities arising from the transition to a lower-carbon economy while aligning with the EU Paris-Aligned Benchmarks minimum standards.

Willem Keogh is head of passive and ETF investment analytics and Davide Guberti is associate director, passive and ETF investment analytics at UBS Asset Management

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

For marketing and information purposes by UBS.Before investing in a product please read the latest prospectus and key investor information document carefully and thoroughly. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor is it a complete statement or summary of the securities, markets or developments referred to in the document. Members of the UBS Group may have a position

in and may make a purchase and/or sale of any of the securities or other financial instruments mentioned in this document. Units of UBS funds mentioned herein may not be eligible for sale in all jurisdictions or to certain categories of investors and may not be offered, sold or delivered in the United States. The information mentioned herein is not intended to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not a reliable indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Commissions and costs have a negative impact on performance. If the currency of a financial product or financial service is different from your reference currency, the return can increase or decrease as a result of currency fluctuations. This information pays no regard to the specific or future investment objectives, financial or tax situation or particular needs of any specific recipient. The details and opinions contained in this document are provided by UBS without any guarantee or warranty and are for the recipient’s personal use and information purposes only. This document may not be reproduced, redistributed or republished for any purpose without the written permission of UBS Asset Management Switzerland AG or a local affiliated company. Source for all data and charts (if not indicated otherwise): UBS Asset Management

This document contains statements that constitute “forward-looking statements”, including, but not limited to, statements relating to our future business development. While these forward-looking statements represent our judgments and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. A summary of investor rights in English can be found online at: ubs.com