Allan Stewart, vice president, investment fund services at Clearstream and Catherine Gotti Bras, ETF product manager at Clearstream, have revealed the firm is focusing on ETF product development to enhance its global ETF service offering.

Clearstream being involved in the whole lifecycle of the ETF (from issuance to post-trade) has much potential for bringing operational efficiency, cost reductions for the benefit of the entire ETF ecosystem from issuer to end-investors.

Among the main development areas, Clearstream is looking at enhancing the ETF issuance to reply to market needs (in few words: ‘simpler, quicker, cost effective’). The Clearstream issuance model offers several options and a lot of flexibility to accommodate ETF issuers according to their own strategy.

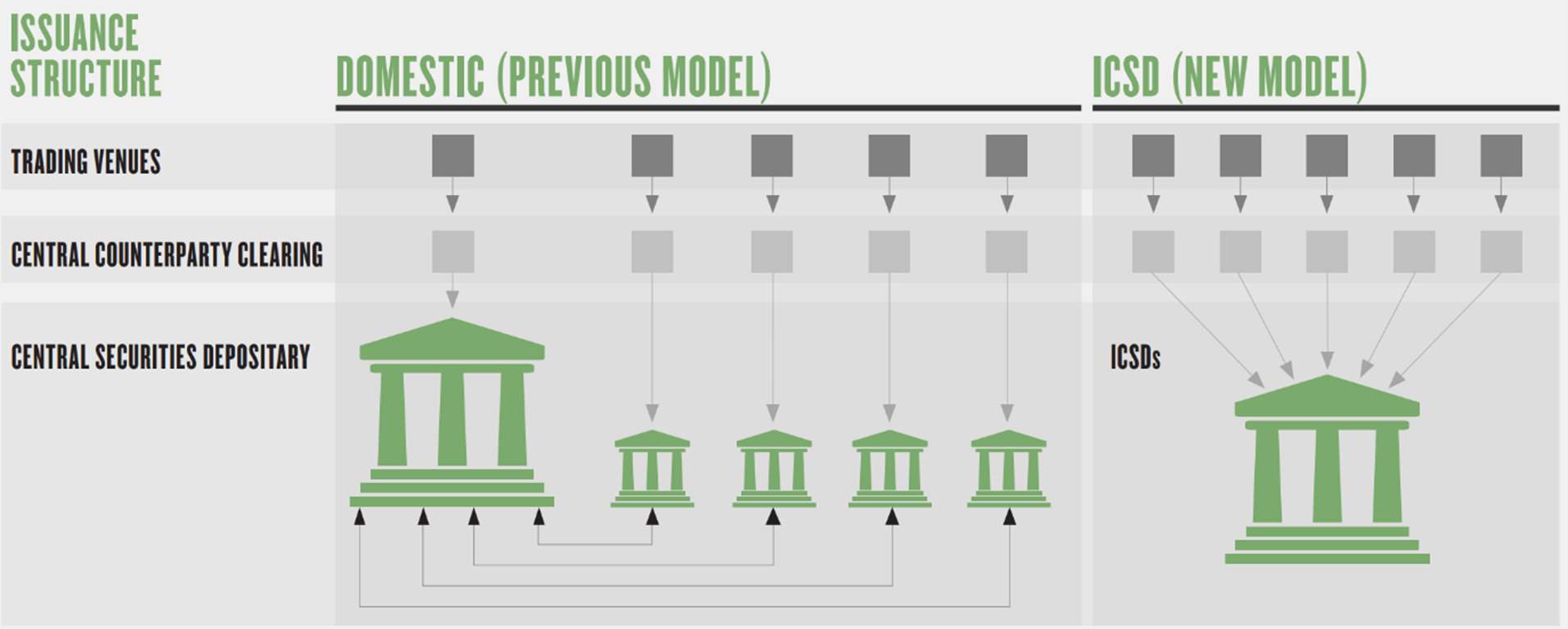

The introduction of the International Central Securities Depository (ICSD) model in 2013 has been a key step in reducing fragmentation across the European ETF market by introducing a centralised ETF issuance process.

Instead of issuing and settling via multiple local central securities depositories (CSDs), ETF issuers have migrated their ranges to the ICSDs run by Clearstream and Euroclear which enable improved centralised settlement performance and reduced liquidity fragmentation in a European and global market characterised by multiple listings and currencies.

Source: SSGA

“A majority of ETF trades that occur on exchanges and over-the-counter (OTC) now settle through the ICSD infrastructure,” Stewart said. “This has made it far easier for issuers to cross-list their ETFs.”

State Street Global Advisors (SSGA) and BlackRock were the first ETF issuers to migrate to the model before Brexit meant Euroclear UK & Ireland was no longer able to provide CSD issuance services for Irish-domiciled ETFs due to passporting issues.

This caused all Irish-domiciled ETF issuers to migrate to the ICSD model last year which Stewart said has made the ETF market more efficient and cost-effective.

“Life has become more streamlined for market makers. Previously they had to be more mindful about where trades were settling,” he added.

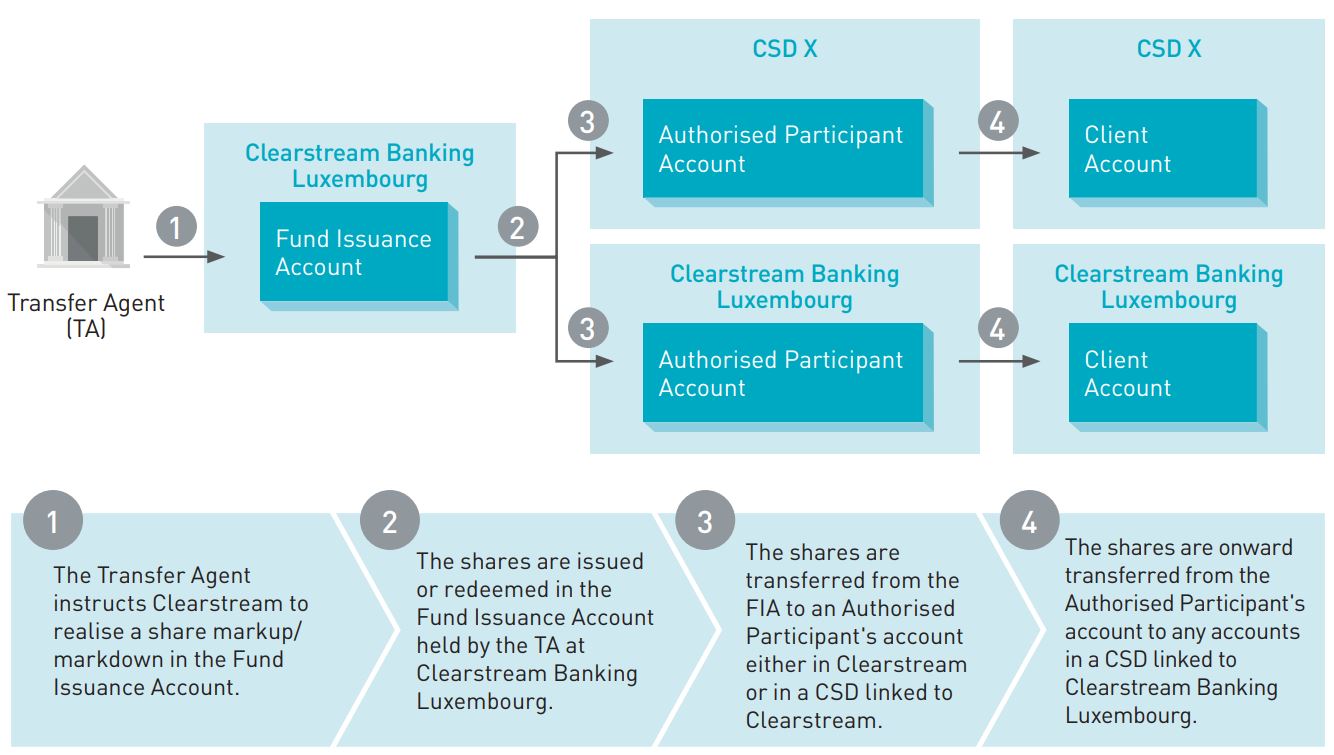

Furthermore, steps have been taken by Clearstream to improve the model with the introduction of ‘ICSDplus’ which provides improved settlement and introduces cost efficiencies further by removing the need for an issuing agent (i.e. a common depositary).

In Clearstream’s ICSDplus model, ETF issuers deal directly with Clearstream using a fund issuance account (FIA) which facilitates the direct issue of ETFs in the ICSD infrastructure.

The transfer agent is fully synchronised with the FIA structure without the need for the creation of a global certificate. So, besides settlement efficiency for secondary market orders, the Clearstream ICSDPlus issuance model ensures the easy settlement of primary market orders. This model is even more relevant in the context of CSDR regulation and Settlement Discipline Regime, Gotti Bras added.

“We have innovated by building on an existing system we operate for mutual funds,” Stewart continued. “The ICSDplus model can deliver shares to authorised participants very quickly as the common depositary is no longer intermediating between the ICSD infrastructure and the ETFs themselves.”

Source: Clearstream

For Gotti Bras, issuance goes along with settlement. In that area, Clearstream is looking at further reducing market fragmentation in the European market, unnecessary costs and settlement delays. Creation redemption and realignment of ETF inventory are two major inefficiencies of the ETF ecosystem. Cross-border realignment solutions and using ETFs in securities lending and collateral management is also something that Clearstream is very much focusing on.

Future developments

The next stage for Clearstream, Stewart said, is to address the opaque nature of the European ETF market – one of the biggest challenges for ETF issuers looking to get a better understanding of how investors are using their ETFs.

According to data from Clearstream, around half of ETFs across the €1.3trn European market are held in Clearstream which puts the firm in a key position to provide data to the market.

“Issuers are largely blind about where their ETFs are sold,” he said. “The UCITS ETF OTC market is very opaque so we are now looking to profile the market.”

This, they said, will be achieved by providing data on who is holding ETF and on the flows with analytics and clear visuals, benchmarking, and intelligence analytics which will complement Clearstream’s existing holding and transactional transparency reporting.