Years of unsustainable practices have brought our planet to breaking point. So, what progress has the EU Benchmarks Regulation (BMR) made in directing passive assets to address climate change?

In 2018, the European Commission adopted and published its Action Plan on Sustainable Finance. As part of this programme, we saw the creation of two new categories of benchmark under the BMR – Climate Transition Benchmarks (CTB) and Paris-aligned Benchmarks (PAB).

The establishment of these categories of benchmarks within the EU regulation acknowledged the importance of redirecting passively invested assets in addressing the climate emergency. Additionally, they bring a comprehensive and transparent index approach to addressing climate change.

CTB and PAB indices must comply with strict minimum requirements to achieve their climate objectives. Both require the exclusion of companies that have a negative impact on key environmental aspects such as climate change, pollution, marine protection and biodiversity, as well as companies that are involved in controversial weapons.

Beyond this, the primary differentiation between the two indices relates to their respective levels of climate intensity. The PAB integrates a more stringent carbon footprint reduction and a restricted investment universe than the CTB.

Significantly, the two climate benchmarks incorporate new attributes to allocate capital towards the most climate-virtuous companies:

They integrate a backward-looking approach, using reported historical data, and focus on Scopes 1, 2 and 3 upstream (supply chain for operations) and downstream (products) greenhouse gas (GHG) emissions with an explicit allocation towards the most climate virtuous companies.

They take into account companies’ climate strategies over the long run and their forward-looking commitment towards carbon emission reductions.

Delivering on expectations

It has now been a year since the introduction of the CTB and PAB indices and launch of the first CTB and PAB funds. The question is, how successful have they been in meeting their decarbonisation objectives compared to their parent index?

Amundi launched a range of CTB and PAB ETFs in 2020. In assessing the impact of these strategies, we look at the two Amundi climate ETFs that have attracted the most investor interest; these ETFs both offer global equity exposure, tracking the MSCI World Climate Change Paris Aligned Select Index and the MSCI World Climate Change CTB Select index.

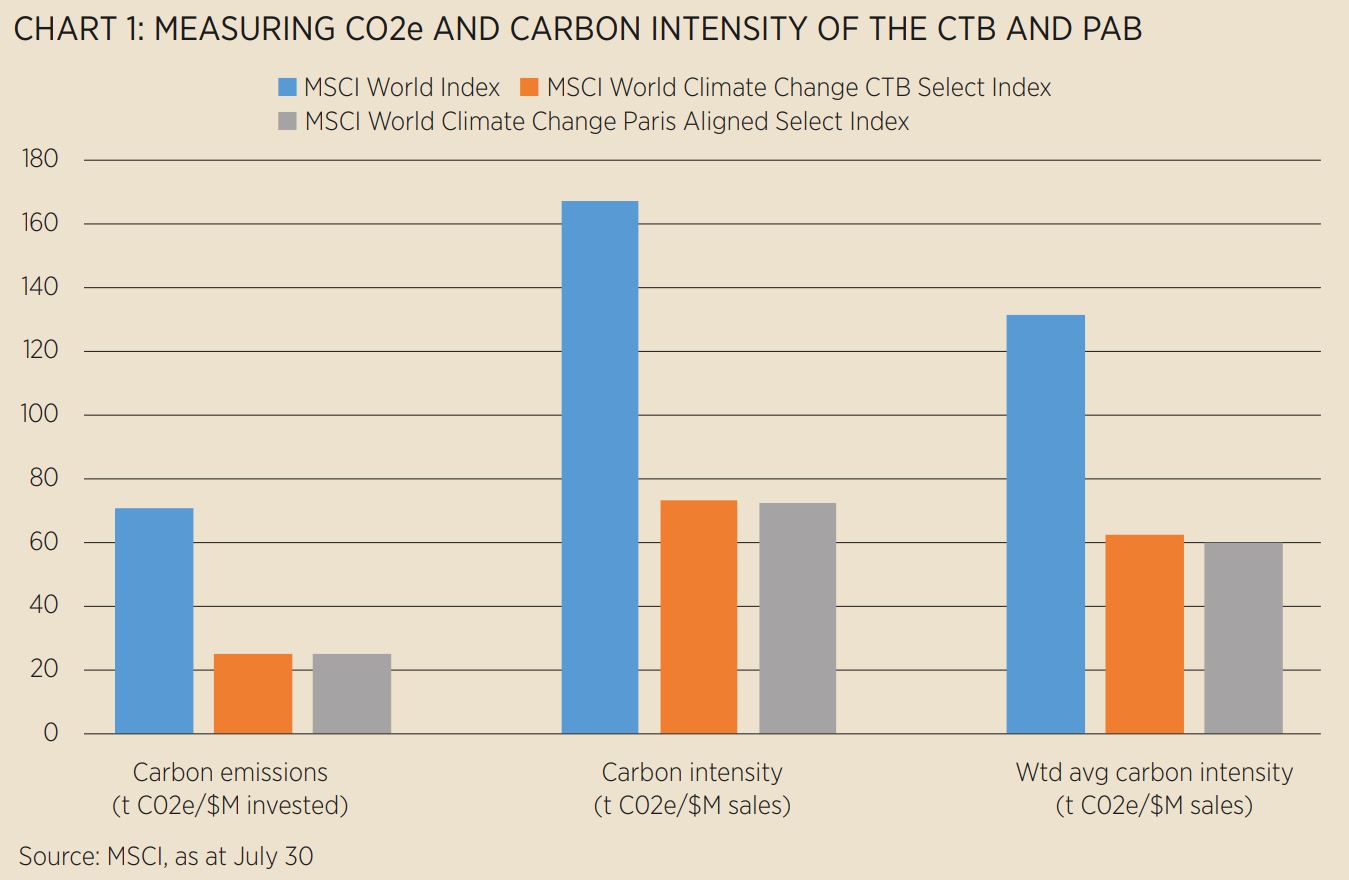

The primary area we look at based on the requirements of the benchmarks are the index carbon emissions and the index carbon intensity (see Chart 1) where we see a marked reduction versus the parent index.

Investors have many reasons to choose climate ETFs – it is for this reason that we believe it is important to offer a range of solutions to meet different needs. For example, for some investors, the priority in selecting a climate ETF could be managing climate-related risks such as stranded assets.

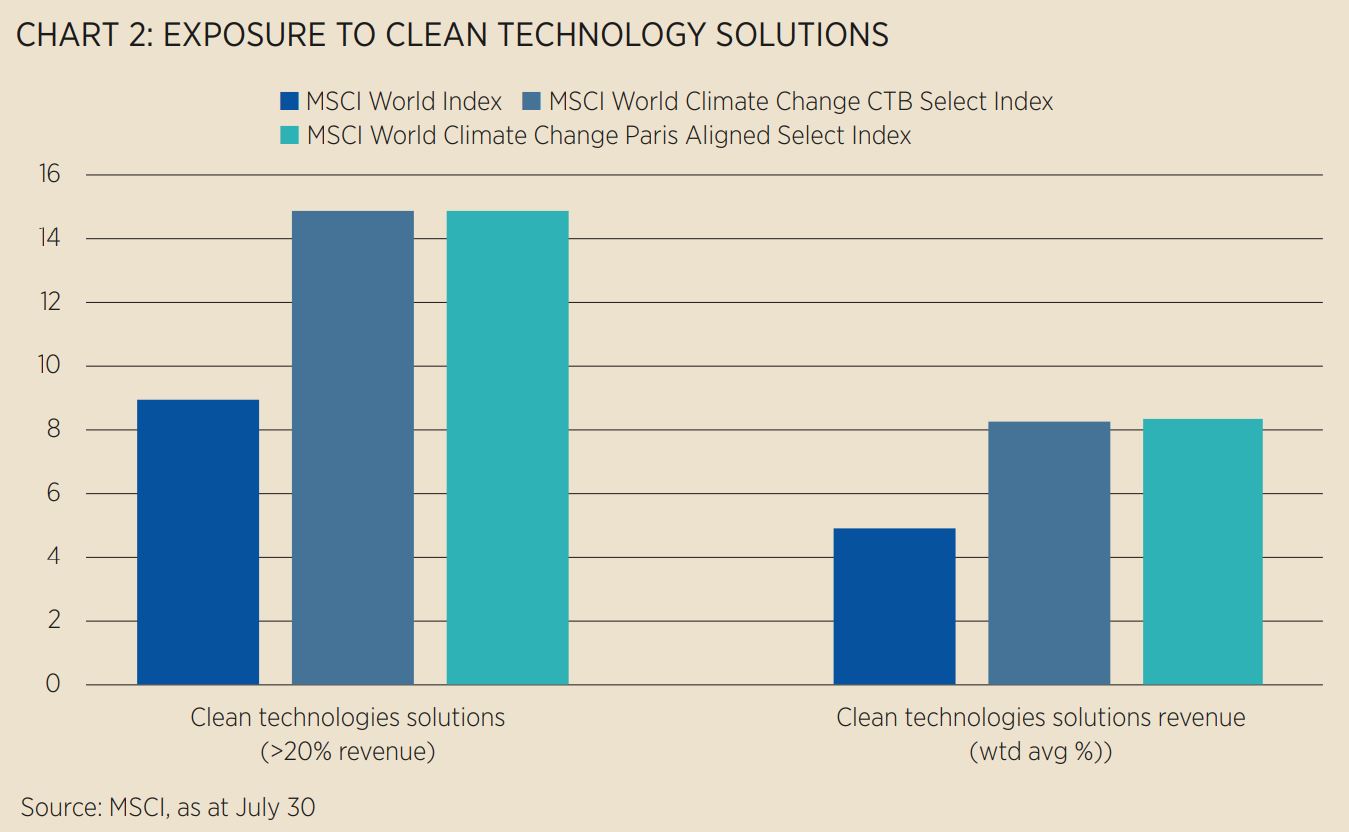

From that perspective, the data in Chart 1 demonstrates a clear reduction in exposure to companies that play a role in increasing fossil fuel and carbon emissions. These are key industries that may suffer premature write-downs or devaluations as we move from fossil-fuel led power to climate-friendly solutions. Another reason for climate investing may be an investor’s belief that over the long-term the sector offers exposure to innovative sectors with long-term potential. As we see in Chart 2, the CTB and PAB indices have an increased exposure to clean technology solutions.

These new indices provide a more comprehensive approach for index investors to introduce climate investing into their portfolios. Since Amundi became one of the first asset managers to launch a PAB-aligned ETF in 2020, we have seen strong demand and enthusiasm from ETF investors who now have the choice of almost 50 different low carbon, fossil-free or climate change ETFs. These ETFs represent over $11.5bn assets, 57% of which are flows we have seen in 2021. Amundi now offers a range of PAB and CTB ETFs covering both equity and fixed income and a range of geographical exposures.

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Important Information: This promotion is issued by Amundi (UK) Limited, registered office: 77 Coleman Street, London, EC2R 5BJ. Amundi (UK) Limited is authorised and regulated by the Financial Conduct Authority under number 114503. This document is not intended for residents of the United States of America or any “U.S. Person”, as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The “U.S. Person” definition is provided in the legal mentions of our website www.amundi.com.

For professional investors only. Past performance is not a guarantee or indication of future results. The funds and their relevant sub-funds (the “Funds”) under their respective fund range that are referred to in this document are recognised collective investment schemes for the purposes of Section 264 of the Financial Services and Markets Act 2000. Potential investors in the UK should be aware that none of the protections afforded by the UK regulatory system will apply to an investment in the Funds and that compensation will not be available under the UK Financial Services Compensation Scheme.

The content of this advertisement is for information purposes only and does not constitute a recommendation to buy or sell. “Amundi Index Solutions”, a Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520 Luxembourg. The sub-funds were approved for public distribution in Luxembourg by the Commission de Surveillance du Secteur Financier of Luxembourg.