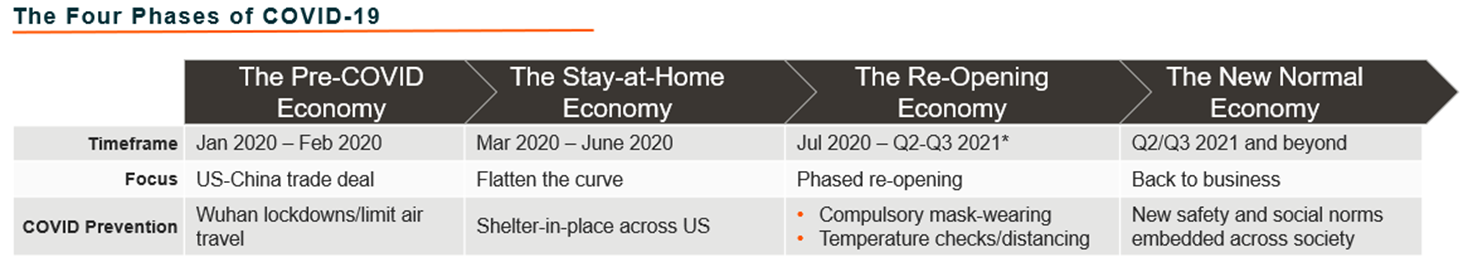

As vaccines are distributed more broadly, population-wide immunity to COVID-19 is getting closer to reality. However, lingering effects from the pandemic will continue to impact our society and the economy for years to come. In the post-pandemic world, which we dub the ‘new normal economy’, governments, companies, and organisations will need to address lasting challenges from the pandemic, like changed consumer preferences, choked supply chains, and weakened economies, while also collaborating to build greater resilience to future crises, like climate change. We expect four key themes to thrive during the multi-year new normal economy phase.

*estimated

Catering to omnichannel consumption: FinTech

During the height of the pandemic, thousands of businesses opened online storefronts or shifted resources to further support their online sales efforts. Shopify, an online platform that helps small businesses open and operate online stores, saw its revenue increase 86% in 2020.[i] Beyond just building their e-commerce presence, many businesses also shifted to accepting various forms of digital payments. Digital payments allow customers to purchase goods using a variety of methods from credit cards, to smart devices, payments apps, buy now pay later (BNPL) plans, or even crypto-currencies. Part of the impetus for this shift was simply the more hygienic nature of contactless digital payments compared to accepting physical cash. Relative to pre-pandemic levels, the share of cashless businesses nearly doubled in the U.S., Australia, Canada and the UK notably. But also driving this shift was the need to integrate payments methods that work both in-store and online, and that cater to the ever-changing preferences of consumers.

With a fully open economy, consumption activity is expected to surge as consumers unleash pent-up demand for goods, travel, and services. Yet preferences changed during the pandemic with many embracing online shopping and digital services. In the new normal, businesses must bridge this digital-physical divide with FinTech solutions, making transactions seamless wherever they occur and accepting several new forms of payment. The biggest beneficiaries of this trend may not be the retailers themselves, but the FinTech companies building the integrated platforms and solutions that allow merchants to seamlessly accept a range of digital payments both online and in-store.

Alleviating choked supply chains: Robotics and AI

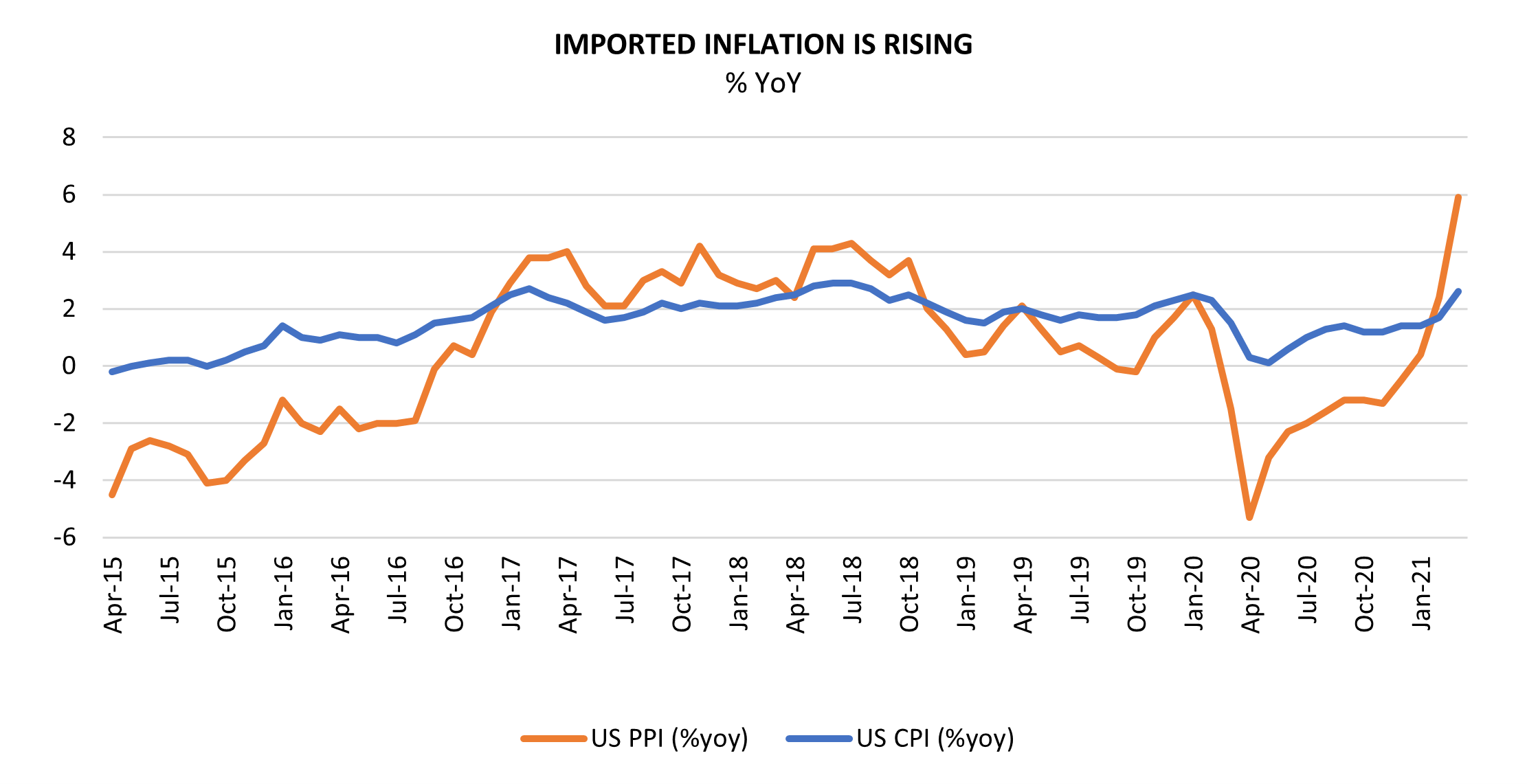

While consumption may be surging, global supply chains look ill-equipped to handle increasing demand. Part of the issue is the surging Chinese exports, as well as the Suez Canal blockage in March. But these challenges are compounded by the pandemic, with shutdowns interrupting the global maritime transport. The confluence of these factors caused the cost of shipping to double since last October, putting immense pressure on input prices.

CPI: Consumer Price Index. PPI: Producer Price Index. Source: Top graph: Freightos Baltic Index (FBX), Bottom graph: Bureau of Labor Statistics, as of 31 March 2021

Some industries are more affected than others. The accelerating pace of adoption of new digital technologies has drastically increased the demand for semiconductors over the past few years, contributing to global shortages. The pandemic, along with severe weather in Texas that shuttered semiconductor production, and the Suez Canal blockage, further exacerbated the backlogs which could take several months to unclog. Semiconductors are an essential component for the automobile industry with the rise of the smart car, which includes Bluetooth connectivity, driver assist features, navigation and hybrid electric systems. Until supply chains rebalance, the automobile industry could face headwinds.

Therefore, in the New Normal Economy, we expect companies to invest heavily in strengthening supply chains to avoid disruptions in the future. The likely answer is better use of technology and re-shoring of production. For example, sensors are increasingly used to monitor the conditions of goods during transport or to track inventory levels so companies can more efficiently manage their stocks. Robotics and automation will likely play an increasingly important role in manufacturing and supply chains as they can help reduce the costs of onshoring production to developed markets in the US and Europe, as well as improve productivity and safety.

Rebuilding for long-term growth: US infrastructure development

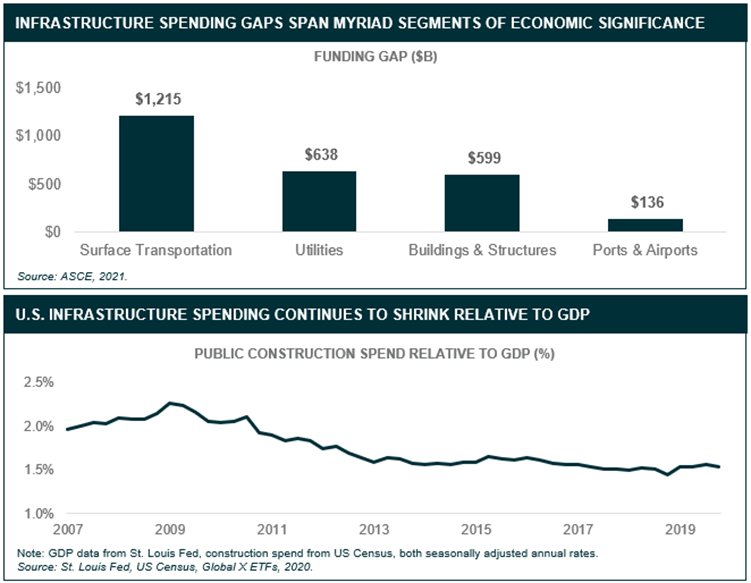

A macro environment featuring low interest rates, elevated unemployment, and a GDP output gap offers governments a unique window to invest in programs that stimulate economic growth over both the short and long-term.

In the US, the most glaring opportunity lies in rebuilding and modernising the nation’s infrastructure after decades of negligence. The American Society of Civil Engineers (ASCE) assigned U.S. infrastructure an overall letter grade of C-, highlighting that 43% of roads are in poor or mediocre condition, 7.5% of the nation’s bridges are structurally deficient, and 22 million Americans are drinking water from lead pipes.[ii] Repairing existing infrastructure is a basic first step, but more important will be modernising the country’s infrastructure for greater climate resilience, changing trends in urbanisation and commuting, and the rise of digital connectivity.

President Joe Biden’s $2.3 trillion American Jobs Plan seeks to address these infrastructure-related issues, allocating billions for several broadly defined categories of infrastructure including transportation, buildings, energy, water, and digital. The ambitious plan represents additional infrastructure spending equivalent to 1% of US GDP for 8 years.[iii] The beneficiaries of such a plan are numerous, ranging from construction and engineering companies, to commodities, and heavy machinery. Digital infrastructure like cell towers and data centre REITs could benefit too, along with water infrastructure and building-focused cleantech firms.

Preparing for the next crisis: CleanTech and renewable energy

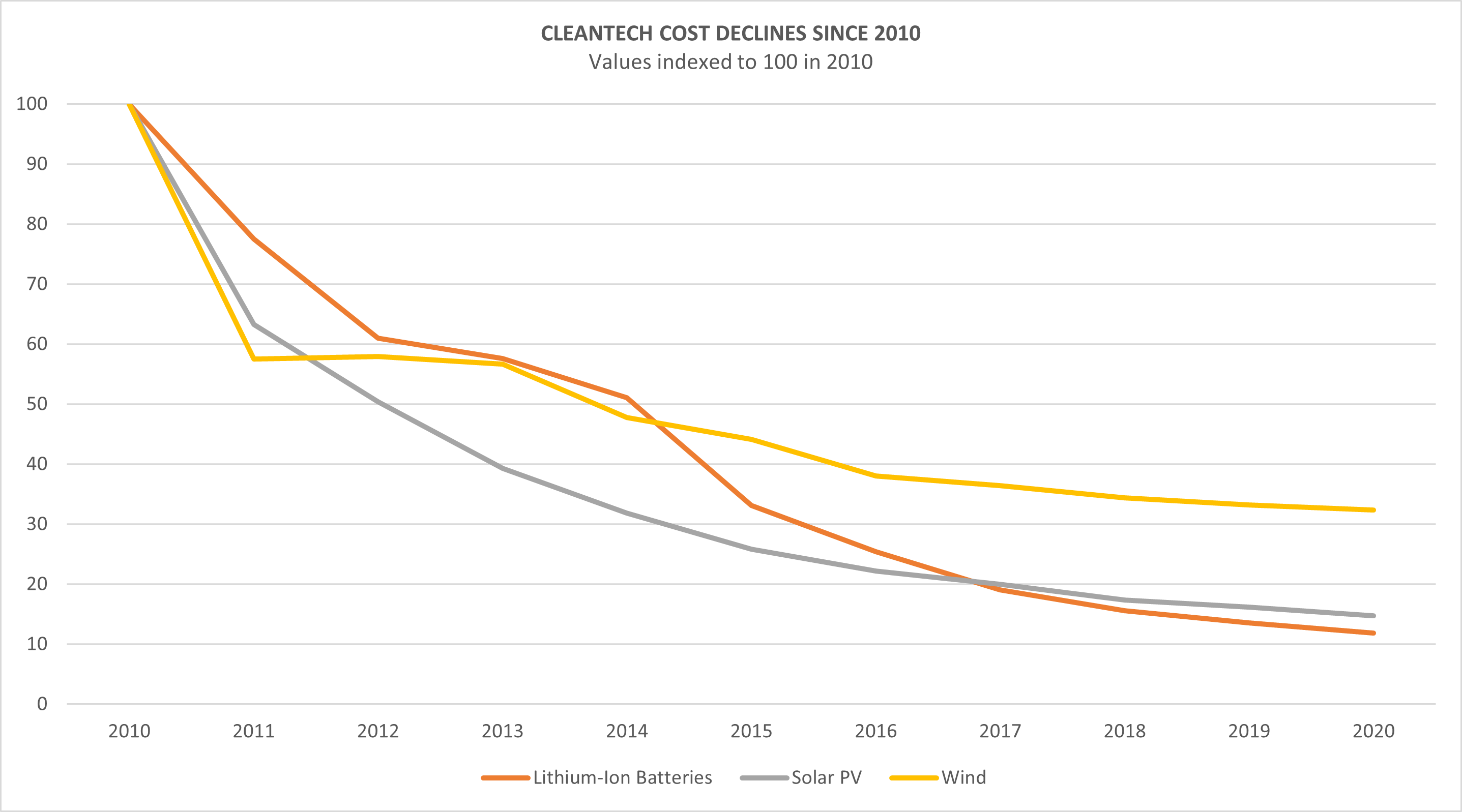

If there is a silver lining to COVID-19, it could be renewed enthusiasm for international coordination, particularly on the topic of climate change. Multi-national agreements and goal-setting are just the initial stages of a several-decade-long process that could require up to $110 trillion in investments in cleantech and renewable energy.[iv]

More mature clean technologies, like solar, wind, and lithium-ion batteries, have benefitted over the last decade from government grants and subsidies, which helped improve efficiency and achieve scale. As witnessed by cost declines ranging from 68-88% since 2010, early government support can play a critical role in making cleantech affordable and effective compared to their dirtier alternatives. Advancing areas like carbon capture, green hydrogen, electric heat pumps, and plant-based and alternative protein sources will also be essential to achieve net neutral emissions.

Source: Global X ETFs, BNEF, Lazard. Lithium-ion batteries measured by the volume-weighted average battery pack cost. Solar Photovoltaic (PV) and Wind measured by average levelised cost of energy.

Jay Jacobs, Morgane Delledonne, Pedro Palandrani, and Andrew Little are part of the research team at Global X

[i] Shopify, “Shopify Q1 2021 Financial Results Conference Call,” Apr 28, 2021.[ii] American Society of Civil Engineers, “2021 Report Card for America’s Infrastructure,” 2021.[iii] The White House, “FACT SHEET: The American Jobs Plan,” March 31, 2021.[iv] IRENA, “Renewable Energy Can Support Resilient and Equitable Recovery,” Apr 20, 2020.