Vanguard’s investors are living up their reputations for buying and holding.

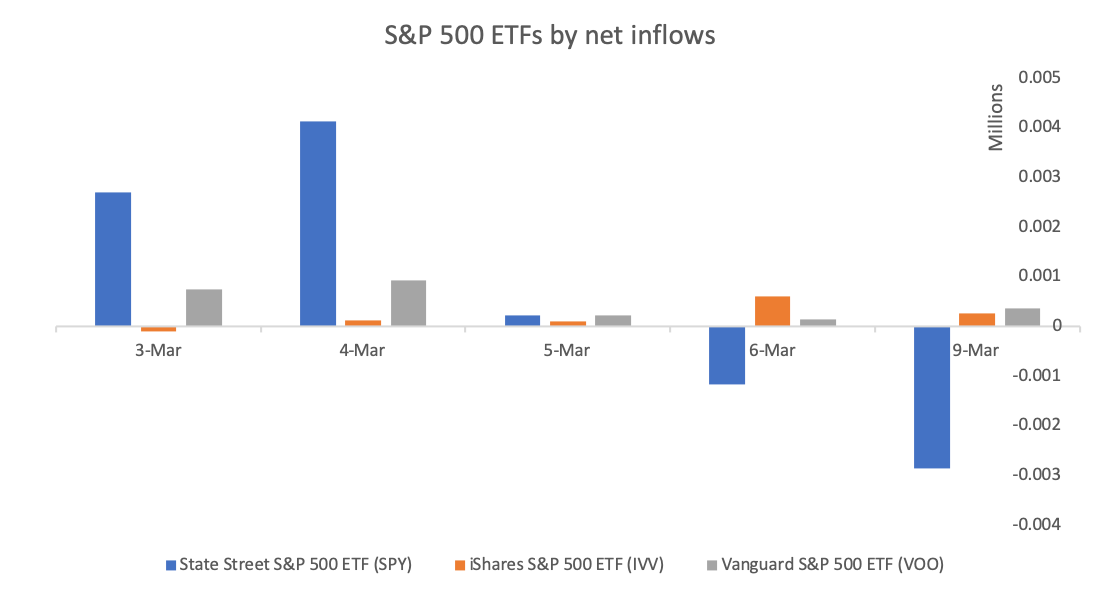

Through the extreme volatility the past fortnight, Vanguard’s S&P 500 ETF has seen net inflows on every single trading day, according to new flow data from ETF.com.

Even on Monday 9 March, when global markets fell 8%, Vanguard’s S&P 500 ETF saw net inflows.

According to Vanguard, only 1% of its American clients placed trades last week, of which 70% were buyers.

Panic sell-off shows limitations of junk bond ETFs

The flow data on Vanguard’s S&P 500 ETFs contrasts with those of its competitors from BlackRock and State Street, which saw outflows on some of the rockier trading days.

State Street's S&P 500 ETF (SPY), which is mostly used as a trading tool, saw particularly heavy outflows on some days.