The European stock market is roaring and money is pouring into the market, but active managers wouldn't know it.

According to a new report by ratings agency Moody's, total assets held by European money managers grew 4 percent to €9 trillion in the first half of 2017 as European stock markets hit record highs.

Despite the highly favourable conditions, active managers have mostly failed to thicken their profits, due to competition from cheaper ETFs and treasuries.

"Despite supportive markets during the first half of the year, European asset managers were unable to grow their fee revenues," said Marina Cremonese, a Vice President and Senior Analyst at Moody's.

"The majority of the new inflows were in relatively low fee products, 56 percent in treasury products and 27 percent in ETFs."

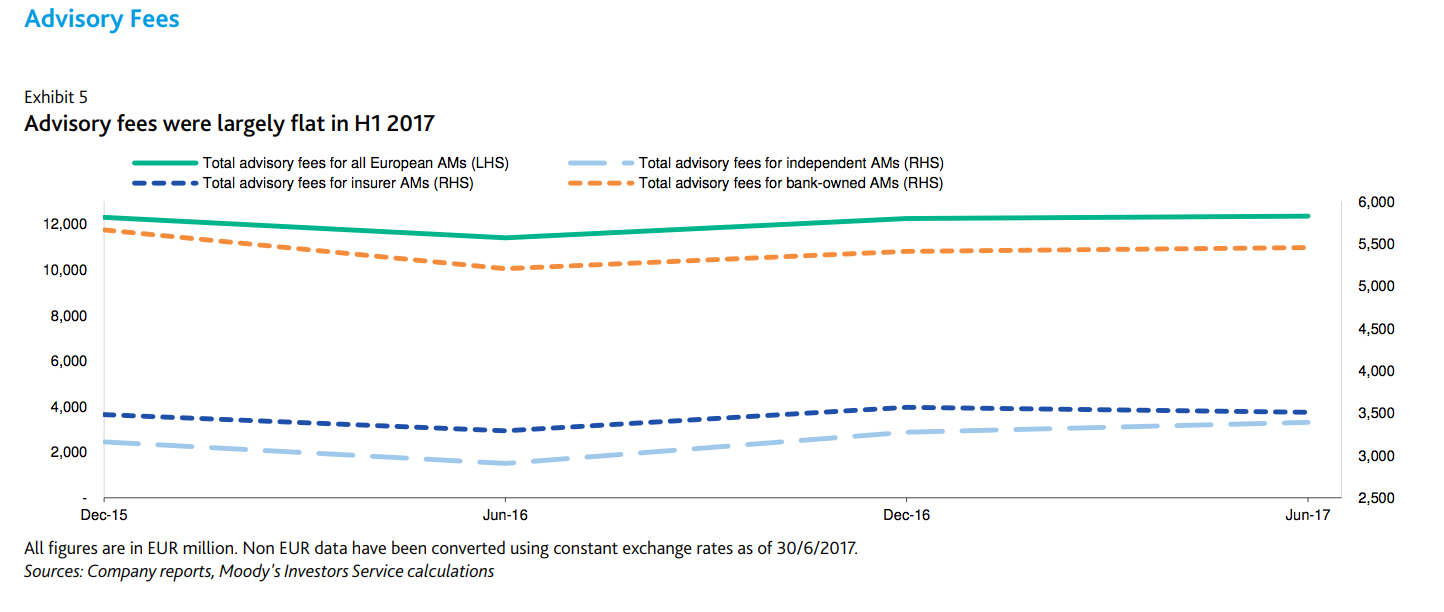

Fees raked in by active managers were flat in the first half 2017, rising a mere 1 percent since December last year. The stagnation also reflects the increasing costs of compliance, Moody's said.

But there were huge differences between asset managers, the report found, with some clear winners.

One winner was Societe Generale-backed Amundi, which saw its fees grow 8.5 percent. It tailed only Italy's Azimut, which logged a 16 percent increase in fee revenue.

The reported concluded with a warning that industry consolidation and the need to scale will remain important themes going forward, as passive management continues to put pressure on fees.