Europe is a continent defined by its wars but somehow one war never seemed to die: synthetic versus physical ETFs.

Yet that war too now seems to be over, with physical ETFs having won the day.

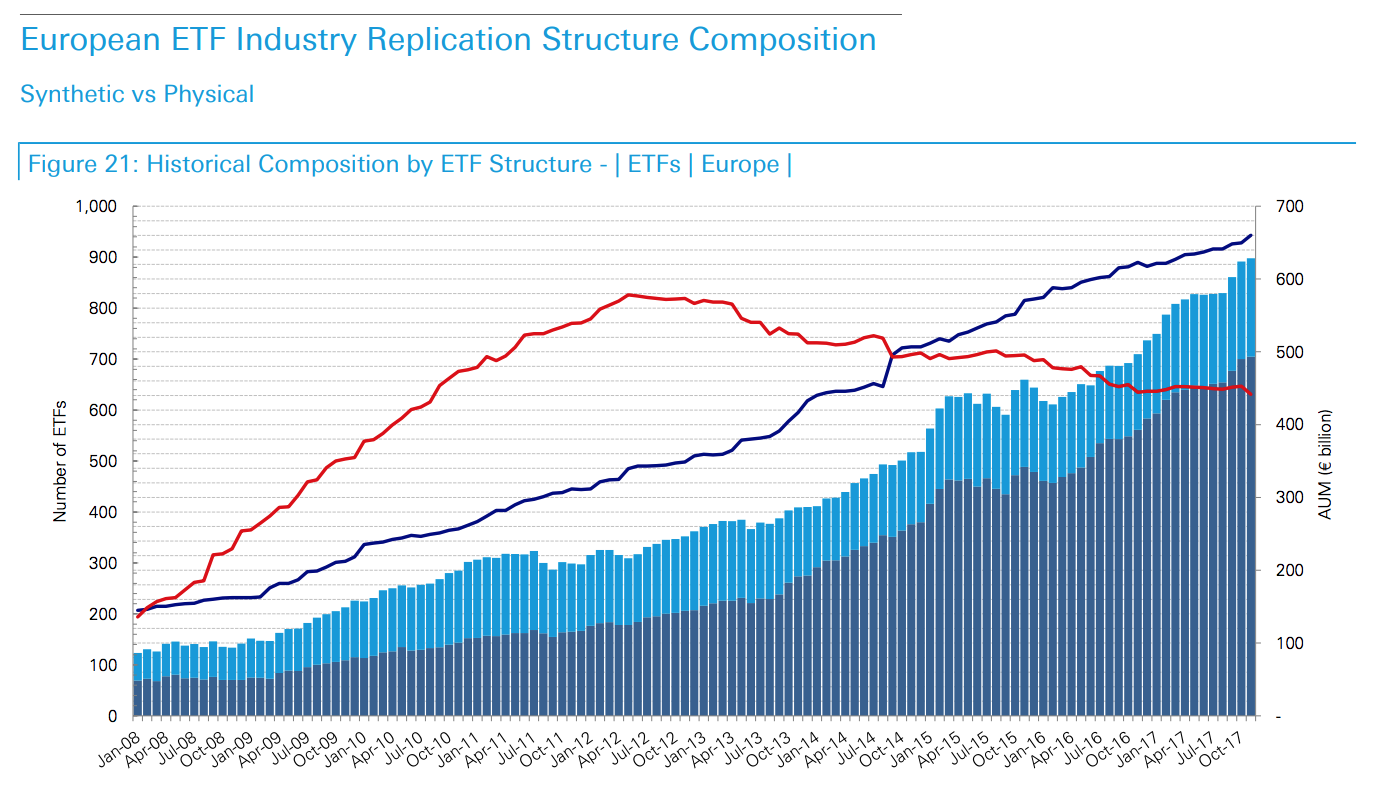

Physical ETFs are now the overwhelming favourite among European investors, and have been edging ahead since 2014, with the number of physical ETFs on European exchanges overtaking the number of synthetic, a recent survey by Deutsche Bank found.

AUM stashed inside physical and synthetic ETFs was more or less neck until 2011, the survey found. But now almost 90% of European ETF money is in physically-backed ETFs.

The tide seems to have turned in 2011, following warnings from the IMF and Financial Stability Board, both of which were unconvinced by swaps in the aftermath of the financial crisis. As the IMF warned at the time:

"While [synthetic ETFs] have reduced costs, they add a layer of complexity and increase counterparty and liquidity risks. The disproportionately large size of some ETFs compared with the market capitalization of the underlying reference indices poses a risk of disruptions in some markets from heavy ETF trading."

The overwhelming majority of synthetic ETF money is controlled by two French issuers: Lyxor and Amundi. With synthetic products making up the bulk of their assets. Deutsche Bank, WisdomTree and BlackRock then take up most of the rest. While other big names in ETF land - State Street and Vanguard - don't offer synthetic ETFs.

[caption id="attachment_4653" align="alignnone" width="513"] Source: JustETF.com[/caption]

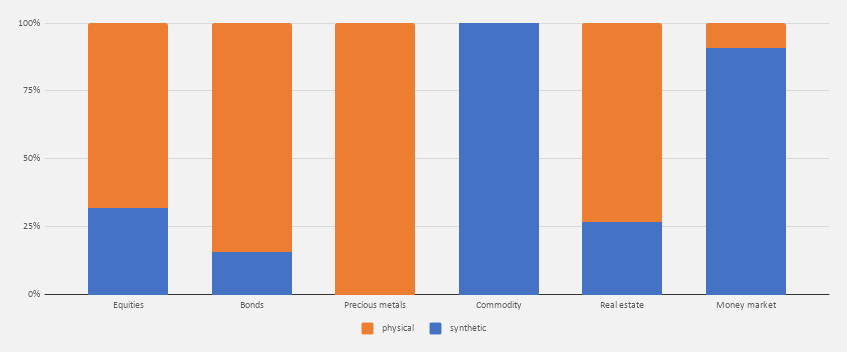

Among asset classes, synthetic ETFs are most commonly used to track money market and commodity indexes. This owes to the underlying, in the case of many commodities, being unholdable thanks to perishing (as in food supplies) and governments opposing commodities being hoarded by speculators. In the case of money markets, due to high turnover and transaction costs.