Today's new ETF listings from around the world.

London

KraneShares KWEB brought over to London

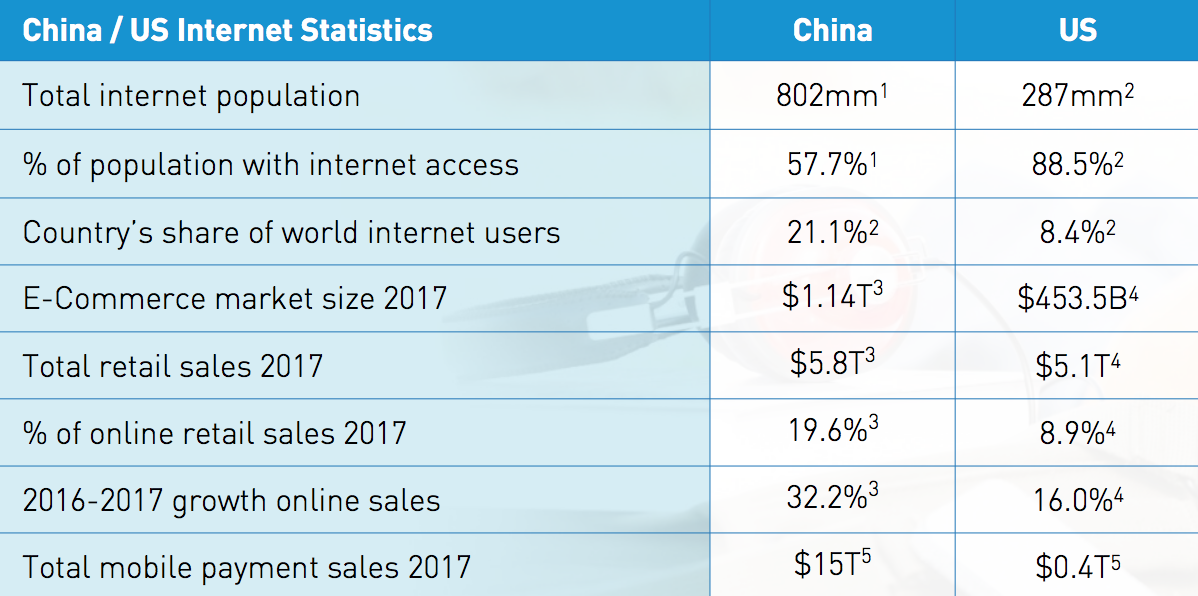

China ETF specialist KraneShares is bringing its $1.3b China Internet ETF over to London. The KraneShares CSI China Internet ETF (KWEB) seeks to provide "access to Chinese internet companies that provide similar services as Google, Facebook, Twitter, eBay, Amazon...[and] exposure to companies benefitting from increasing domestic consumption by China's growing middle class," a presentation from KraneShares says.

Source: KraneShares

KWEB tracks an index put together by CSI, the largest index provider in China, that focusses on Chinese internet companies listed overseas. The index excludes hardware and most software providers and has a heavy leaning, as one might expect, towards the BAT - Baidu, Alibaba and Tencent.

KraneShares says it has been one of the top-performing China funds in the US (including mutual funds) the past five years, with an annual average performance of 18% up to 30 June 2018.

Product Review - KWEB or EMQQ?

For any ETF startup, breaking into the crowded US market is a hard task. It requires snatching ground from the world's largest asset managers. Doing so successfully - and building a $1bn product like KWEB - is a special achievement. Having proven KWEB in the US, KraneShares is now trying its luck in London, which seems like the logical next test market.

Curiously, KWEB arrives on the London Stock Exchange a mere fortnight after the Emerging Markets Ecommerce ETF (EMQQ) another successful US ETF. While EMQQ and KWEB are different in important respects, both focus on Chinese internet companies and heavily weight the BAT. More curiously still, the two funds charge virtually identical fees - KWEB charges 0.85% compared to EMQQ's 0.86%. Comparing how these two funds perform and gather assets will make for interesting viewing. If nothing else, KraneShares and HANetf - EMQQ's white labeller - know who to benchmark themselves against.

In performance terms, KWEB has had a rough time in 2018, delivering a YTD return of -17%. It faces the dual challenges of China's trade tensions as well as investors double guessing tech valuations.

****

Powered by Ultumus data