Invesco has published its latest study, asking for investors' opinion on factor investing. The survey interviewed 300 investors, both wholesale and institutional, across 21 countries.

ETPs, primarily ETFs, account for over half of the vehicles used in factor investing for smart beta strategies according to the survey. Alongside active and passive methods, factor investing has emerged as the "third pillar of investing", with 60 per cent of investors saying they will increase their factor allocations over the next three years.

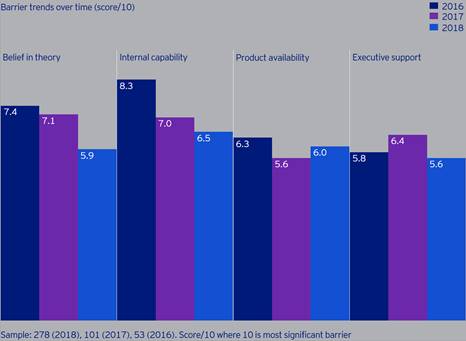

Four trends were identified as barriers to the development of factor investing. These barriers include belief in theory, internal capability, product availability and executive support. Scored from 1 to 10 (10 being the largest of barriers), investors believe that all factors, except for product availability, have become less of an obstacle since last year.

Investor capability has improved by 1.8 points, having initially been scored 8.3 in 2016 when the survey was first launched. These improvements suggest that more investors are gaining confidence in factor investing and it is gradually becoming more accessible in some parts of the world.

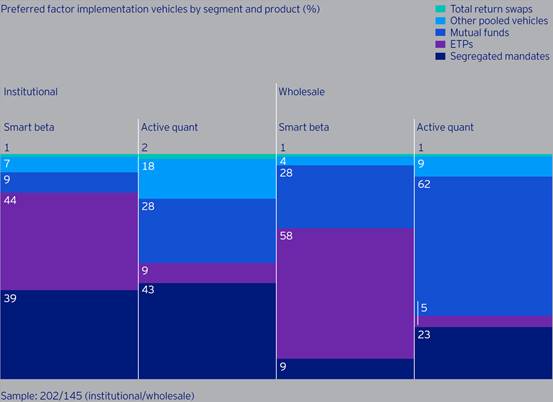

Newly introduced to the survey, investors were asked their favoured method of implementing factor strategies. Regarding smart beta, ETPs (including ETFs) were clear favourites when deciding which vehicle to use.

An average of 51 per cent of investors use ETPs as their desired implementation vehicle, with the nearest competitor being segregated mandates, with 23 per cent of investors preferring this method.

Smart beta investors within Europe and North American are much more active in using ETFs (55 per cent and 59 per cent respectively) compared to Asia-Pacific where segregated mandates reflect a larger portion of their portfolios. This could be a result from the lack of availability when it comes to exchange traded funds within Asia.

A popular theme emerging in the ETF market is the use of ESG (Environmental, Social and Governance) screened ETFs. Investors want to ensure that they are investing in funds which are not going to have a negative impact on communities or the environment. But can factor strategies be used to address these ESG requirements? Well the majority of those surveyed said no, however, 47 per cent of institutional investors do think it could be used. Additionally, 38 per cent of wholesale investors share the same opinion, hence it is still a significant portion of investors who believe ESG could incorporate factor strategies.

Georg Elsaesser, Senior Portfolio Manager at Invesco, said: "To see significant levels of support for more advanced applications such as ESG is encouraging for longer factor investing demand. Importantly, this belief resonates with both institutional and wholesale investors."