The number of strategic beta launches across the globe fell by almost half last year, according to research conducted by Morningstar, as the market shows signs of maturity.

According to the report, entitled A Global Guide to Strategic-Beta Exchange-Traded Products, there were just 132 strategic beta ETP launches in 2018, down from 257 the year prior. In total, there are 1,493 strategic beta ETPs globally with $797bn assets under management, as of 31 December 2018.

Furthermore, inflows into global strategic beta ETPs hit $87bn last year, an organic growth rate of around 11%, while overall assets grew by just 0.5% due to more volatile markets: "More recently, the pace of these products' market share gains has decelerated as ETFs tracking more-traditional benchmarks have been garnering their fair share of net new flows."

Morningstar said these latest developments pointed to signs of a maturing market. Along with the slowing pace of product launches, it said the increasingly crowded and competitive landscape will put pressure on fees, with "aggressive" cost reductions becoming more prominent in the future.

Alex Bryan, director of manager research, passive strategies - North America, at Morningstar, and co-author of the report, commented: "The decline speaks to the fact that the menu has been saturated.

"This process of growth and maturation will ultimately lead to a culling of the herd, which has already begun in some geographies, albeit to a limited extent."

Europe

In Europe, strategic beta ETPs saw $5bn net inflows last year, an organic growth rate of 8%, however, the overall market shrank 5% to $57.4bn. Dividend strategies retained the majority of overall assets while risk-orientated ETPs benefitted from more turbulent markets.

In a sign of maturity in the European strategic beta market, there were just 20 new products listed last year, less than a fourth of the launches seen in 2017.

The majority of new products last year were multi-factor equity strategies due to the "direct" result of crowding in the single-factor space, the report said.

"Despite the rising popularity of multifactor strategies, single-factor ETFs still horde the most assets in the European strategic-beta marketplace," Kenneth Lamont, manager research analyst, passive strategies - Europe at Morningstar and co-author of the report, added. "Their continued popularity should come as little surprise in the prevailing low-rate environment where dependable investment income is rather hard to come by."

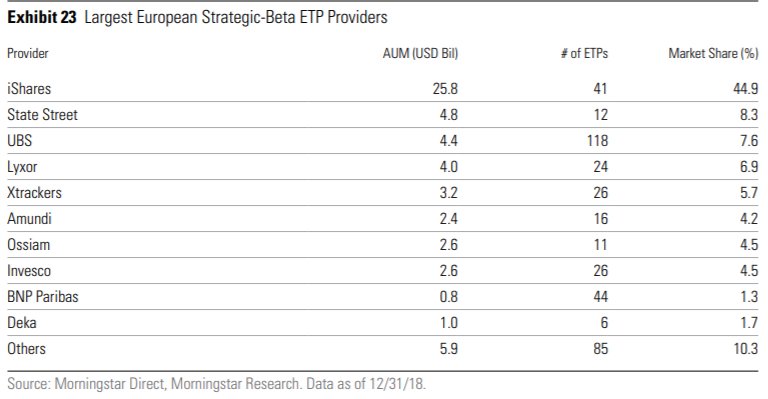

iShares continued to dominate the strategic beta space in Europe with market share of 45%, up from 44% in 2017. Lamont added the firm's "Edge" brand has played a "key" role in cementing its place as the leading provider for strategic beta products in Europe.

"As the European strategic-beta market has reached maturity, the opportunities available for new entrants have also fallen," he continued. "Only JP Morgan and Nordea entered the market in 2018."