Amundi has teamed-up with Solactive to launch a nine-strong core ETF range in response to client demand.

The Amundi Prime ETF suite will list on the London Stock Exchange on 14 March with total expense ratios (TERs) of 0.05%.

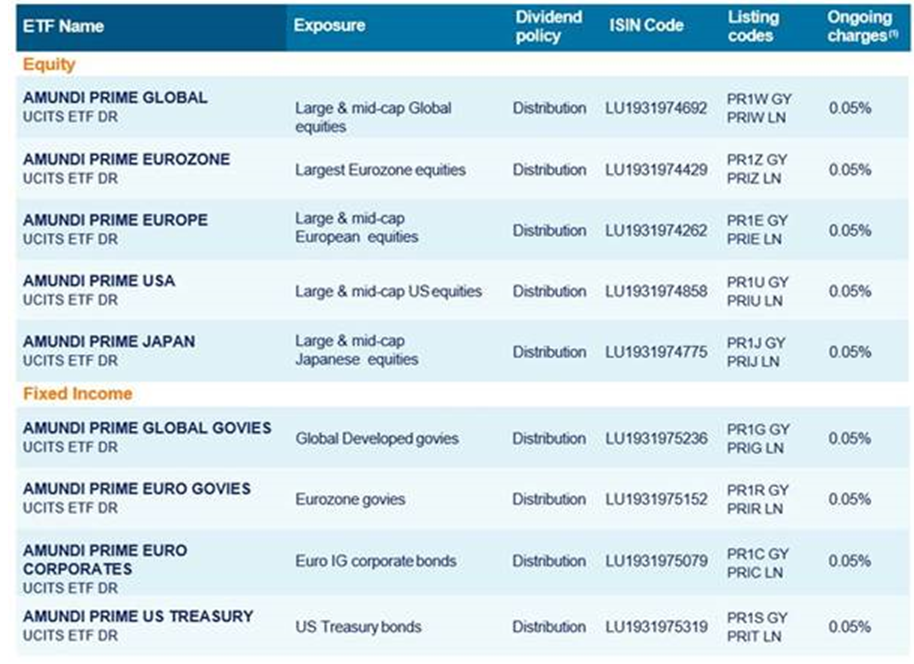

Physically backed, the five equity ETFs will offer investors exposure to global, eurozone, Europe, the US and Japan.

The four fixed income ETFs cover global developed government bonds, eurozone government bonds, euro investment grade government bonds and US Treasury bonds.

Each ETF received between €1m and €20m seed money with the range tracking Solactive's Global Benchmark Series (GBS). All ETFs exclude controversial weapons.

Fannie Wurtz (pictured), head of Amundi ETF, Indexing and Smart Beta, at Amundi, commented: "Our product development strategy has always been based on our constant dialogue with clients who are increasingly looking to include ETFs in their investment solutions.

"Price is a big driver when investors select an ETF however, replication and quality are equally important."

The firm also outlined plans to double its ETF, indexing and smart-beta assets under management (AUM) by 2023.

The firm said this will be achieved through three growth drivers; increase in client coverage through senior hires and exporting UCITS to outside Europe, expand offering through innovative solutions, and accelerate retail market penetration by launch of new core range.

As part of this push, the asset manager poached Ashley Fagan from BlackRock in January to head-up its ETF, Indexing and Smart Beta arm for UK and Ireland.

Source: Amundi