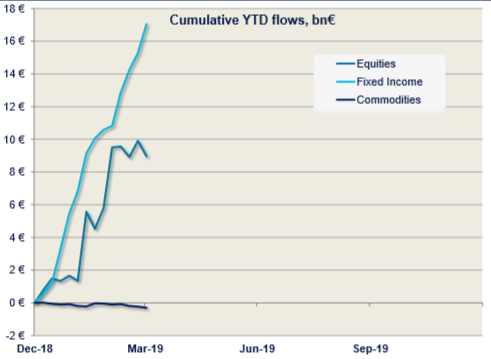

The European ETF market saw €25.6bn inflows for Q1 2019, despite Eurozone equity ETFs seeing outflows of €4bn, according to Amundi’s latest flows report. Across the pond, US investors remain far more inclusive of ETFs, pumping €51.7bn into their portfolios over the same period.

Regardless of the equity market rebounding from its difficult period in Q4 2018, investors appear to be diversifying their portfolios as both US and European investors invested twice as much in fixed income ETFs than equity. US and European fixed income ETFs saw inflows of €35.3bn and €17bn, respectively.

European investors preferred government bond ETFs over corporate, posting inflows of €8.4bn and €7.6bn, respectively. US investors had an opposite preference as corporate bond ETFs saw inflows of €19.7bn compared to government bond ETFs which saw only €8.9bn.

Commodity ETFs were the only asset class to see negative flows in all regions for the quarter, having significant outflows throughout March. The US and Europe sold off €727m and €264m for the month, respectively, causing the asset class to have negative flows for the quarter worth €884m.

European cumulative YTD flows, source: Amundi

Socially responsible (SRI) equities remain popular among investors as the global product range saw inflows of €2bn, €800m of which came from European equities.