China's ETF market has gone from strength to strength, in spite of the trade war suppressing local stock prices.

China’s strengthening ETF market owes primarily to growing institutional demand and an increasingly diverse ETF product offering.

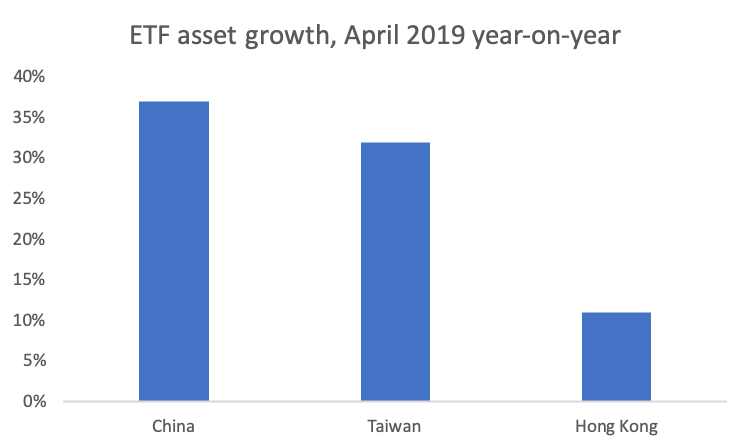

According to Chris Pigott, head of Hong Kong ETF servicing at Brown Brothers Harriman (BBH), total ETF assets across the Greater China region saw 27% growth year-on-year through April.

China registered the strongest growth at 37%, followed by Taiwan with an increase of 32%, while Hong Kong gained 11%.

China's ETF market saw record inflows in 2018. The strong flows have persisted this year as the uncertain market environment continues to divert capital into products, Pigott adds.

Figures from Shanghai-based data provider Wind Information show that there were 36 new listings in China last year, boosting the market’s total AUM to grow by 140 billion RMB (US$20.3 billion) to around 600 billion RMB as of December 2018.

Although the country’s ETF market still very equity centric that broad-based equity products currently account for 95% market shares, product innovation has been underway with more thematic products coming to market.

For example, Chinese regulators granted the approval to three ETF managers, China Asset Management Co, Bosera Asset Management, and Yinhua Fund Management, in June 2018 to launch the country’s first ETFs and feeder funds tracking SOE reform.

There are currently 300 listed SOEs in China with total valuation of around 14 trillion RMB. The restructuring of these SOEs’ ownership is one of the key focuses for the country’s economic reform. The related ETFs have been gaining market popularity as they enable investors to gain exposure to the SOE transformation.

As for Hong Kong, the city’s ETF market has also made significant headway in product innovation with the launch of two-time inverse product and actively managed ETF.

“Some leveraged and inverse (L&I) and money market short duration ETFs in Hong Kong secured significant net flows last year,” says Pigott.

With the launch of the city’s first two-time inverse fund, the CSOP Hang Seng Index Daily (-2x) Inverse Product, in late May, Pigott expects ETF issuers will continue to explore new opportunities in the L&I product space in view of the choppy market condition.

On June 18, China International Capital Corporation and ISBC Asset Management (Global) launched the ICBC CICC USD Money Market ETF – the first active ETF in Hong Kong.

Active ETFs have been a major driver in the US and Europe especially in the fixed income space. The market is still at its infancy in Hong Kong given that Financial Securities Commission gave the green light for these products only six months ago.

However, Pigott believes active ETF will gain popularity in the city, saying many local institutional investors are expected to increase their exposure to such products in the short run.

Citing a survey conducted by BBH with 100 Greater China institutional investors and fund managers and advisors earlier this year, Pigott points out alpha generation and historical performance are the key factors the professional investors consider when they come to selecting ETF.

“Fixed income ETFs are the first or second choices in terms of where [investors] want to see ETFs in their local markets. However, there are still product gaps for fixed income ETFs in Hong Kong,” he says.

In Taiwan, Pigott says fixed income ETFs have become the major driver of the ETF market that about 90% of the top 20 ETFs are fixed income products. With the significant flows from local insurance companies, the island’s fixed income ETF total AUM soared 900% in 2018 to NT$400 billion ($13 billion).

Recently, the Financial Supervisory Commission, the island’s financial regulator, launched new restrictions limiting the proportion of a single ETF a single institutional investor can hold.

The measure will slightly slow down the tempo of new ETF listing, but Taiwanese investors still have strong demand for the products especially offshore fixed income ETFs, he adds.