BlackRock has slashed the fees on its core bond ETFs and listed two new ETFs in Australia, in a move that will arguably position the firm as the country’s foremost bond ETF provider.

Fund Name

New management fee (% p.a.)

Old management fee (% p.a.)

iShares Core Composite Bond ETF

0.15

0.20

iShares Government Inflation ETF

0.18

0.26

iShares Treasury ETF

0.18

0.26

As part of a product renovation, BlackRock has made its core bond ETFs the cheapest in Australia by far. And has added two new ETFs that cover the Australian corporate bond market.

The iShares Core Corporate Bond ETF (ICOR), which listed last week, will give exposure to investment corporate grade bonds issued in Aussie dollars. The index is mostly made up of Kangaroo bonds and debts issued by Australian banks. It will compete against similar products from BetaShares and Vanguard, which proved very popular recently (table below).

BlackRock new corporate bond ETF is significantly cheaper than competitors

Ticker

Management fee (% p.a.)

Net transactional and operating costs

All-in cost ratio (% p.a.)

ICOR

0.15

0.01

0.16

VACF

0.26

0.04

0.30

CRED

0.25

0.09

0.34

Source: Ultumus; ETF Stream

The iShares Yield Plus ETF (IYLD), which also listed last week, is something of a hybrid between a corporate bond and a cash ETF. It aims to beat the reserve bank of Australia’s cash rate by investing in corporate bonds—making it seem like a corporate bond ETF. But it aims to do this while maintaining very little interest rate sensitivity—making it seem like a cash ETF.

According to Christian Obrist (pictured), head of iShares Australia at BlackRock, the company decided to list these funds based on its reading of what Australian investors were buying.

AUM ($M)

Running yield (% p.a.)

Effective duration (years)

Number of holdings

ICOR

10

3.22

3.9

52

VACF

556

3.57

3.8

366

CRED

339

3.48

6.5

39

“Looking at what the market actually consumes…we deemed that corporate credit should belong to our core suite,” he said.

He added that the appeal of listing new fixed income ETFs was that investors were running out of cash options as interest rates globally head to zero.

“If you look at cash ETFs – and even just cash in general, like retail term deposits and other cash funds – there is not much left in terms of yield on those products.”

Ticker

Fund Name

All-in cost ratio

Running yield (% p.a.)

Effective duration (years)

Benchmark

IYLD

iShares Yield Plus ETF

0.12%

2.47

1.08

RBA cash rate +0.75%

Great timing

The listings come at an ideal time for BlackRock.

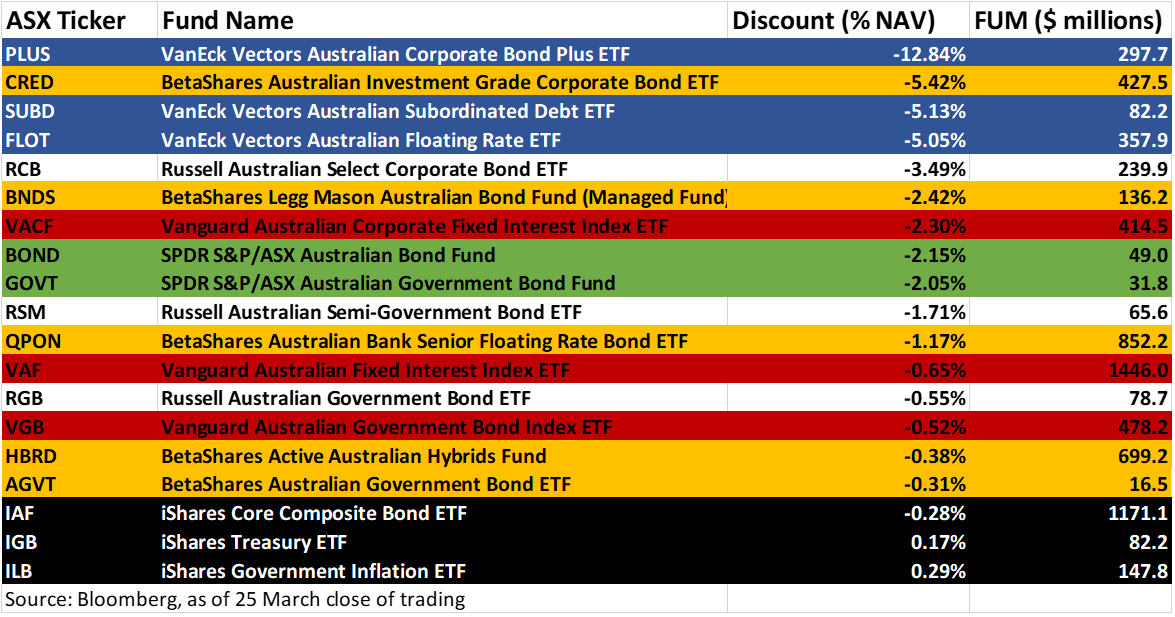

Thanks to the coronavirus, many corporate bond ETFs blew out on discounts in March and April. An ETF discount – much like a discount on a closed-ended fund – is where a fund trades at a price below the value of its assets.

The size of some discounts and the speed at which they emerged surprised – and in some cases, irritated – investors, as discounted ETFs fail to track their indexes. Most investors buy ETFs on the assumption that they will tightly track an index.

BlackRock bond ETFs were unaffected by discounts during peak volatility

BlackRock bond ETFs, however, proved uniquely immune. During late-March, when volatility peaked, iShares’ bond ETFs traded smoothly, cheaply and free of any major discounts.

This strong showing during the stressed market boosted BlackRock’s reputation. And helped ensure their Australian bond ETFs saw little outflows in April, after markets calmed down. ETFs that hit big discounts in March were more likely to see investors exit in April, an analysis by ETF Stream has found.

Aussie bond ETF discounts fade, with help from central bank

According to Obrist, BlackRock discounts were smaller than its competitors due to the technology the group uses.

“We have been in the ETF game for a long time,” he said.

“How many market makers are [ETF providers] connected to? What pricing systems are in place? What portfolio management systems are the products run on?... where I think we have an advantage is in the technology that surrounds our platform.”

Hitting profitability

The latest round of fee cuts will be cheered by investors, as lower fees make ETFs perform better.

But the latest cuts raise important questions about profit margins and the viability of the Australian ETF industry. According to ETF Stream’s rough calculations, IYLD and ICOR will need roughly $400 and $300 million worth of assets respectively to break even. Meaning the profit margins are very small.

These tiny profit margins are fine for BlackRock, which has enormous global scale. However, they make it difficult for new ETF businesses to enter the market. Some have suggested that the low fees – and the intensity of the Australian ETF fee war – means that there is now no room for a new ETF provider in Australia.

Australia's ETF fee war has gone too far

But in Obrist’s view, there may become room as the market gets bigger and more institutional money migrates to ETFs.

“It depends on what that provider will bring to the market...But I would say it is a lot harder if someone tries to compete in the core exposure group. You then need to raise a lot of assets...We have seen an increased institutional buyership of even the ASX products.”

Sign up to ETF Stream’s weekly email here