BlackRock’s flagship China fixed income strategies have booked the steepest outflows of any ETF in Europe so far this year as surging US yields all but eradicate the advantage previously enjoyed by Sino bonds.

The $4.7bn iShares China CNY Bond UCITS ETF (CNYB) and $3.4bn iShares China CNY Bond UCITS ETF (CYBA) saw a combined $1.8bn outflows in the week to 29 April, respectively, according to data from ETFLogic.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said the two ETFs had amassed more than €1.5bn outflows each this year, the worst of any ETFs listed in Europe so far in 2022.

The only other ETFs in Europe to book more than a billion euros of outflows since the turn of the year are two S&P 500 trackers from Lyxor and DWS.

Massive outflows from CNYB and CYBA coincided with $635m rushing into the $3.7bn iShares $ Treasury Bond 3-7yr UCITS ETF (CBU7) over the same period, as surging inflation in the US forced the Federal Reserve to abandon its view of “transitory” inflation in Q1.

In March, the US central bank delivered its first funds rate hike since 2018 and increased its target rate from almost zero to between 25 and 50 basis points (bps).

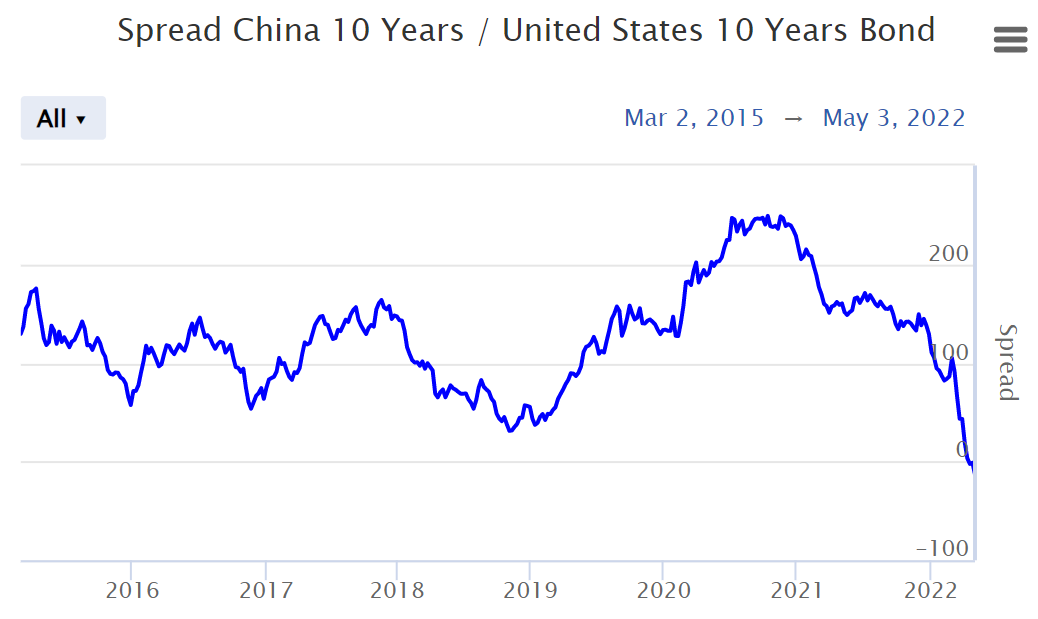

With the policymaker expected to deliver its first 50 bps rate hike since 2000 this week, 10-year US Treasury yields flirted with 3% on Tuesday. Not only has this yield spike been the steepest in more than a decade but significantly, it means 10-year US Treasury yields now exceed Chinese sovereign yields for the first time in 12 years.

Source: worldgovernmentbonds.com

While the People’s Bank of China has kept 10-year Chinese government bond yields steady at 2.8%, equivalent US Treasury yields have shot up by around 100 bps in the last three months, effectively ending the yield advantage offered by Chinese government bonds in recent years.

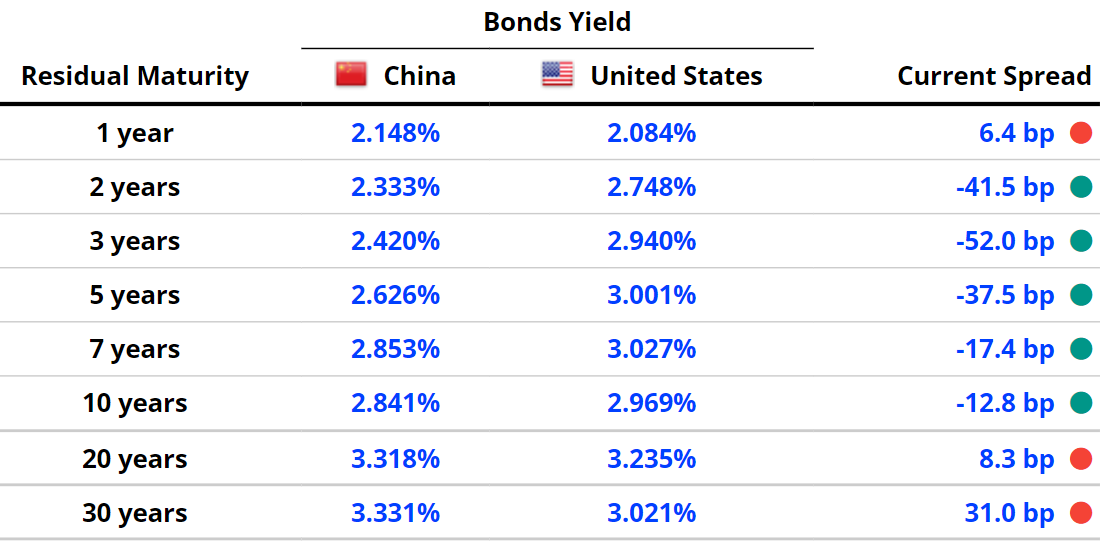

A similar pattern has also been observed across other bond durations, with several China/US sovereign bond spreads now in negative territory.

Source: worldgovernmentbonds.com

Looking ahead, the Fed will look to cut away at its $9trn balance sheet which could involve unwinding its bond holdings at a rate of $95bn per month