Major Australian fund buyers threatened State Street Global Advisors (SSGA) that they would permanently exit its famous ASX 200 fund if the company refused to lower its fees.

Last year, Australia’s biggest ETF providers – BlackRock and Vanguard – introduced generous fee cuts on their flagship ETFs that track the Australian share market.

SSGA was the lone holdout among the big ETF providers. It chose to keep the fees of its Australian shares fund, the SDPR ASX 200 ETF (STW), at 19 basis points, double its competitors, until January this year.

The company’s decision to keep its fees high for so long annoyed many of its clients. Some clients chose to sell out of STW and buy into its cheaper competitors, ETF Stream understands. This resulted in STW losing money in 2019, while its competitors gained money.

Meanwhile, clients that remained loyal to SSGA threatened that they would exit STW if its fees were not brought closer in line with its competitors.

Pat Garrett, chief executive of Six Park, a Melbourne-based robo-advisor that uses STW, said he voiced his concerns directly with State Street.

"State Street lowered its fees after new, competing ASX 200 ETFs entered the market at lower [fees]. We have been monitoring this development, and indeed have been actively engaged with State Street with regard to STW's [fees] and the prospect that in our clients' interests, we might have to make a change to another ETF,” Mr Garrett said.

"Fees are not the only variable that go into our ETF selection process…but as we preach, fees do matter so we are happy that STW has made this change."

While Six Park does not disclose the size of its positions, ETF Stream believes the company holds more than $50M in STW.

SSGA cut STW's fee from 19 to 13 basis points last month. The fund faced a difficult year in 2019, losing its crown as the largest ETF in Australia to Vanguard's VAS and after a hiccup with its franking credits, which also angered its investors.

Australia's ETF fee war has gone too far

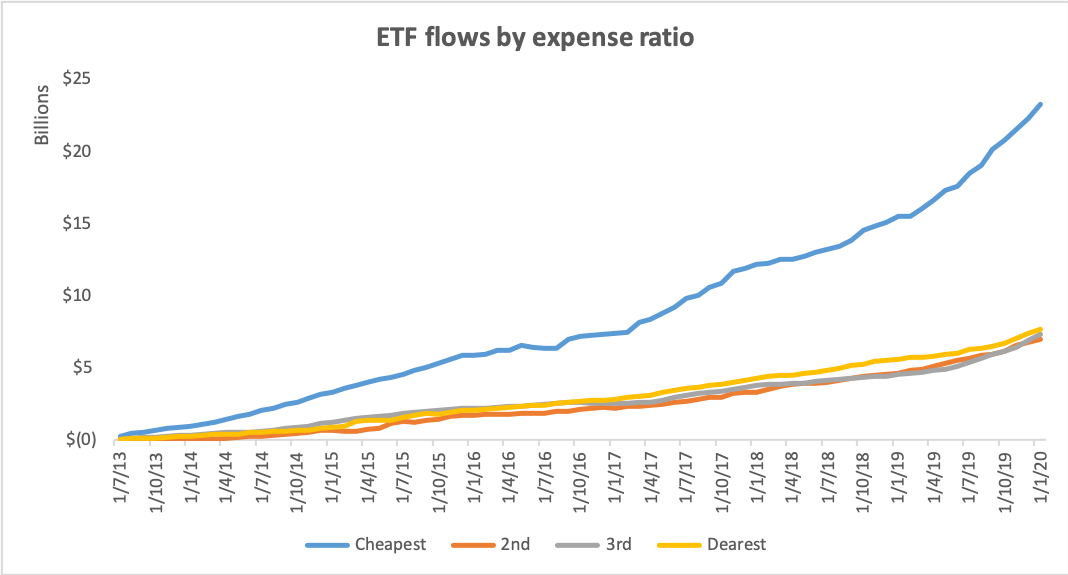

The fee cuts come at a time that ASX data increasingly shows that ETFs with the lowest fees see the greatest inflows.